Investors Anticipate Cryptocurrency Market Rally by Year-End

Institutional investors expect a crypto rally by year-end; 61% plan to increase investments.

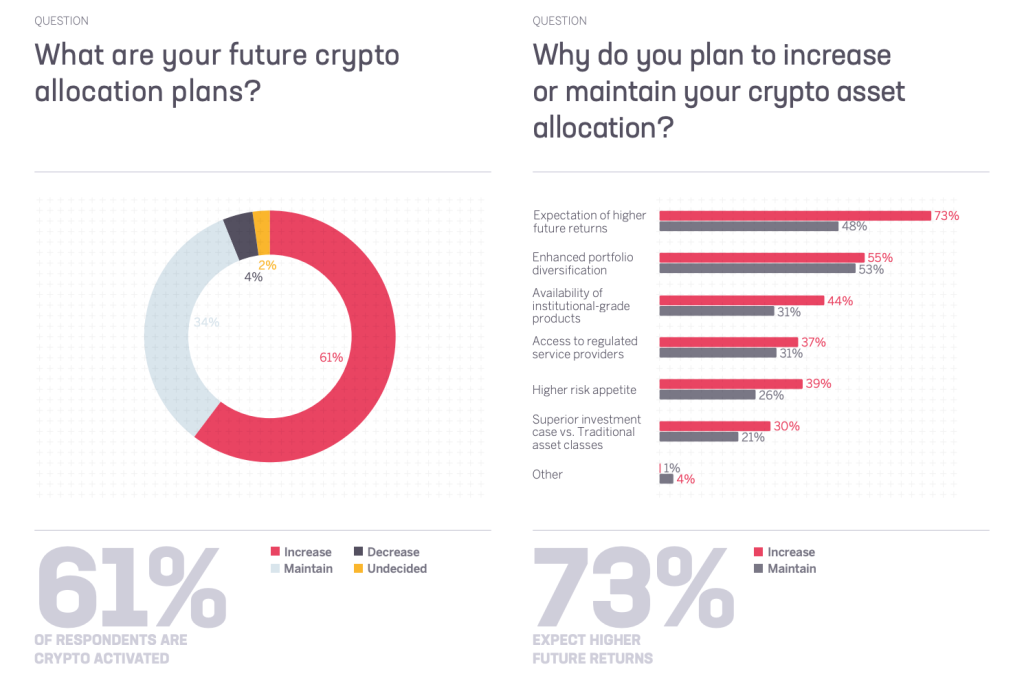

Institutional investors are confident in a cryptocurrency rally by the end of the year. Over 61% of participants in a survey by digital bank Sygnum plan to increase their investments in digital assets.

Most respondents cited market growth expectations as their reason. Key catalysts identified include the launch of exchange-traded funds based on altcoins and the adoption of bills on cryptocurrency market structure. They believe these factors will sustain the bull cycle into 2026.

Some 44% of the study’s participants also pointed to the expanding availability of investment products for institutions. According to Sygnum, 81% of investors are interested in crypto ETFs, with 70% particularly drawn to funds featuring staking.

The greatest interest was shown in Solana-based instruments (54%). At the end of October, two companies—Bitwise and Grayscale—introduced exchange-traded funds based on SOL. According to SoSoValue, they have attracted $342 million since launch.

Some 39% of respondents intend to increase their positions due to a growing appetite for risk.

Only about 4% of survey participants plan to reduce their investments in digital assets, while 34% intend to maintain their portfolios as they are.

The survey was conducted among 1,000 institutional and professional investors from 43 countries.

Most Popular Narratives

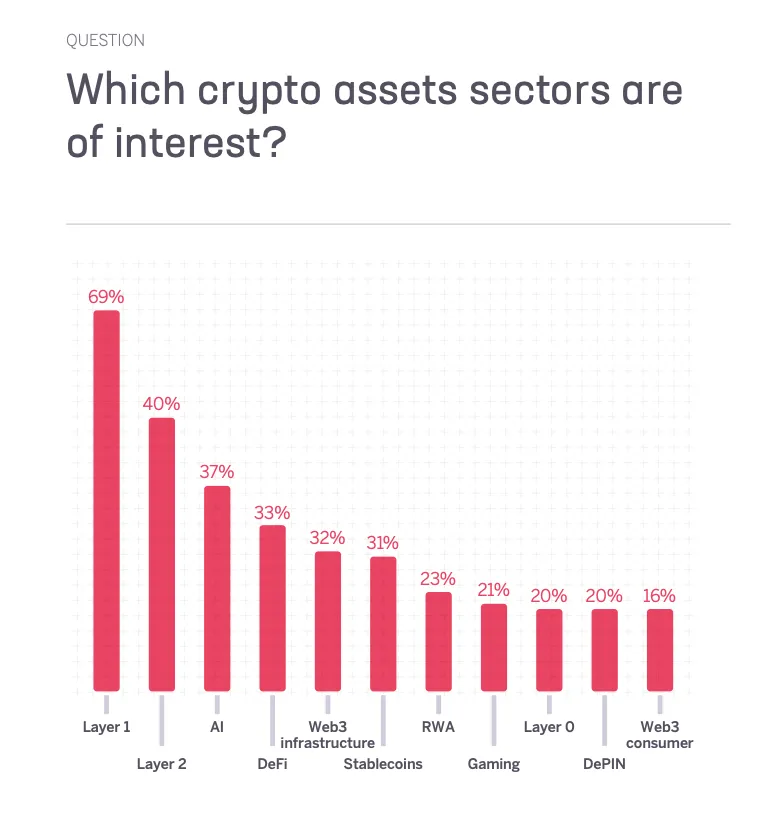

The first-layer blockchain sector remained the most popular, according to the survey authors, supported by the stable position of major projects.

L2 solutions took second place, attributed to the spread of Ethereum-based scaling solutions. However, much of the activity is concentrated in networks without native tokens, such as Base from Coinbase.

“This could complicate direct allocations, even if demand for these solutions is temporarily present,” the experts stated.

AI infrastructure and Web3 showed moderate but steady interest. Institutional investors view these areas “as long-term catalysts alongside the development of artificial intelligence, which will support sector growth.”

A third of respondents highlighted the appeal of DeFi, though this segment remains technically challenging for most. Moderate interest was recorded in the DePIN, gaming, and consumer Web3 sectors.

Key Shift

Experts noted that for the first time, portfolio diversification (57%) surpassed short-term return potential (53%) as the primary reason for investing in digital assets.

“We interpret these findings as evidence that cryptocurrencies are becoming a strategic, long-term asset class with unique value drivers and risk factors,” said Sygnum’s Chief Investment Officer Fabian Dori in a comment to Decrypt.

The study also pointed to the growing acceptance of cryptocurrencies in traditional finance. More than 80% of survey participants stated that Bitcoin is a viable reserve asset for treasuries. 70% believe that holding cash instead of the first cryptocurrency will incur high opportunity costs over the next five years.

Back in September, experts highlighted the increasing use of digital assets as a hedge against inflation.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!