Investors direct a record $1.47 billion to crypto funds in a week

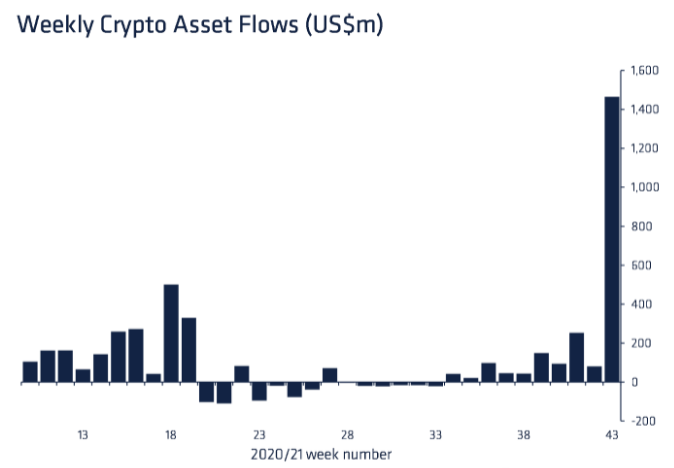

Inflow of funds into digital asset-based products from 16 to 22 October amounted to a record $1.47 billion, with year-to-date total at $8 billion. These figures come from CoinShares’ report.

The previous record was $670 million, set in February. Year-to-date inflows surpassed inflows for all of 2020 ($6.7 billion).

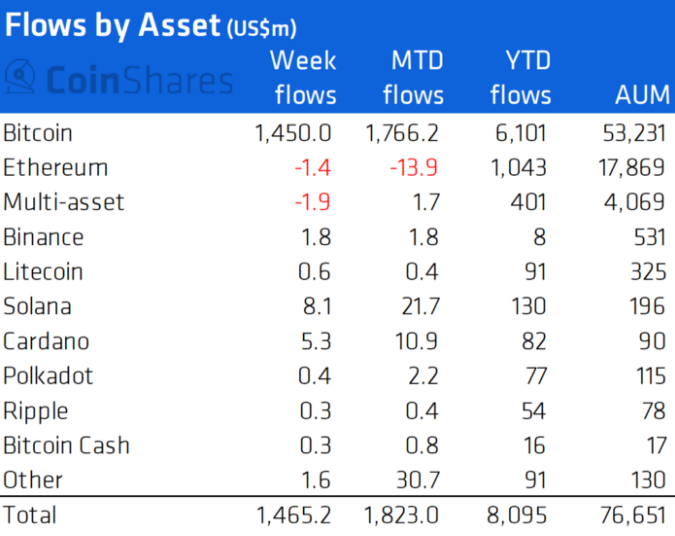

Total assets in cryptocurrency-based products rose to a new high of $76.7 billion. During the week the figure reached $79.2 billion as digital gold pushed to an all-time high above $67,000.

Analysts attributed such dynamics to the successful launch in the United States of two Bitcoin ETF by ProShares and Valkyrie Investments. Investments in these products totalled $1.24 billion.

“In addition to ETFs, other Bitcoin funds attracted assets of $138 million. At the same time, there were signs of profit-taking amid outflows from older products.”, experts noted.

As a result, inflows into Bitcoin-based funds totaled $1.45 billion, into Solana, Cardano, Binance Coin were $8.1 million, $5.3 million and $1.8 million respectively.

Outflows from Ethereum products continued for the third week in a row and amounted to $1.4 million.

Experts consulted by ForkLog noted the potential for continued Bitcoin upside after the launch of ETFs in the United States.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!