Investors record the heaviest losses since the FTX collapse

Bitcoin losses hit FTX-era levels as liquidations top $2bn and price hovers near $82,000.

Realised losses on the leading cryptocurrency have surged to levels last seen during the collapse of the FTX exchange, according to Glassnode analysts.

$BTC realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown.… pic.twitter.com/hAmZPOM5XZ

— glassnode (@glassnode) November 21, 2025

The spike points to widespread selling by investors who bought at higher prices. Analysts call this capitulation—a cleansing of the market’s “weak hands”.

The speed and scale indicate a contraction in marginal demand—as prices fell, recent buyers closed out positions. Most loss-making sales came from short-term holders.

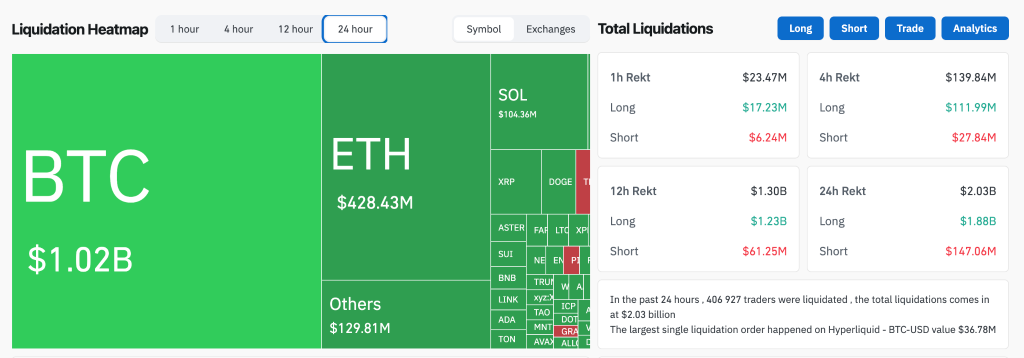

Liquidations of $2bn

Amid bitcoin’s slide to a multi-month low of $82,000, 24-hour liquidations exceeded $2bn.

Longs bore the brunt—$1.8bn. Shorts lost $147m.

In the past 24 hours, 406,925 traders were hit. The largest single liquidation occurred on the decentralised exchange Hyperliquid in the BTC/USD pair, at $36.7m.

At the time of writing, bitcoin trades around $82,000, down 10.6% over the past day.

Glassnode earlier noted that bitcoin had pierced the average cost basis of active investors. The next target is $81,900.

“Digital gold is now in a capitulation zone, and the market is trading on forced liquidations rather than rational pricing. Holders are taking losses, which has historically preceded sharp rebounds,” — commented BRN’s head of research, Timothy Misir.

But the timing of any recovery depends on the return of institutional capital, he added.

The sell-off was preceded by substantial outflows from spot bitcoin ETFs, which shed $903m—the second-worst result since the instruments launched in January 2024.

Macro backdrop

Stronger US macro data added pressure on cryptocurrencies, damping enthusiasm for further rate cuts by the Fed.

According to the media, the White House’s nominee for Fed chair, Kevin Hassett, said that pausing monetary easing would be “a very unfortunate decision”.

“I believe the headwinds for the economy in the fourth quarter are really significant. […] I’m not sure we fully appreciate how destructive a pause would be for fourth-quarter GDP,” he said in an interview with Yahoo Finance.

On November 21st Japan also approved a record $135bn stimulus package, writes Reuters. That supported global markets, but it was not enough to offset the de-leveraging wave already under way in digital assets.

“The macro backdrop is constructive, but the crypto market is trading almost entirely on internal flows and liquidation pressure,” Misir stressed.

Where is the bottom?

Andre Dragosch, Bitwise’s head of research in Europe, said bitcoin is approaching a “maximum pain” zone—a price band concentrated around the average entry levels of the largest institutional investors.

FWIW —

Think max max pain is reached the moment we tag either the IBIT cost basis at 84k or MSTR cost basis at 73k.

Very likely we’ll see a final bottom somewhere in between.

But these will be fire sale prices and akin to a full cycle reset imo.

— André Dragosch, PhD⚡ (@Andre_Dragosch) November 19, 2025

He pointed to two key levels:

- $84,000 — the entry price of BlackRock’s IBIT, the largest bitcoin ETF;

- $73,000 — the entry price of Strategy.

In his view, a tag of one of these levels—or a bottom formed within that range—would fit a typical consolidation phase. At that stage, capitulation is likely to end and a sustained recovery to begin.

Earlier, Jeffrey Kendrick, Standard Chartered’s head of digital-assets research, said that bitcoin’s correction had “run its course”. He expects the cryptocurrency to rise into year-end.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!