Investors Seize Ethereum Dip Amid $513 Million Outflow

Cryptocurrency investment products saw a $513 million outflow amid Binance liquidity issues.

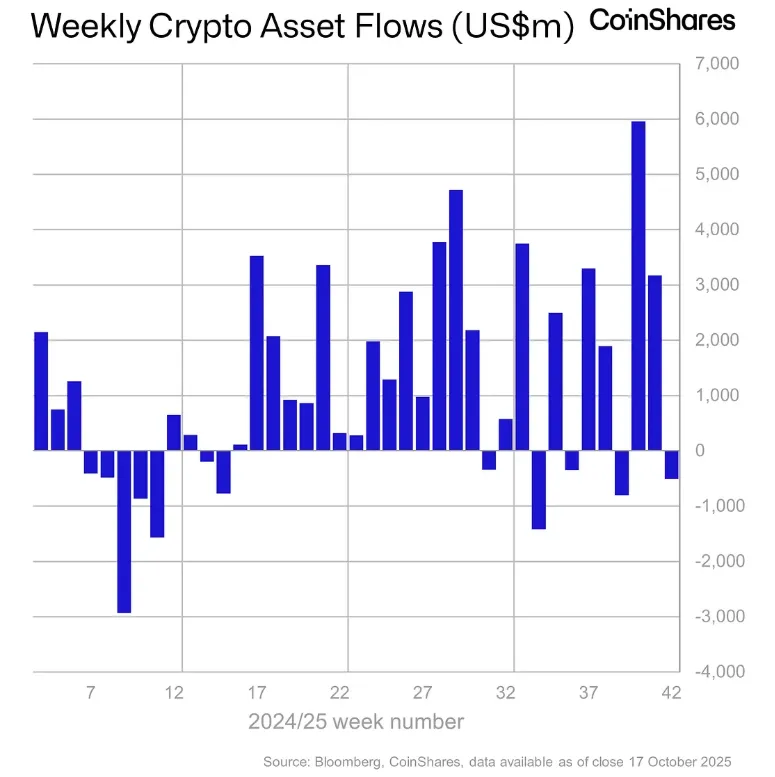

Between October 10 and 17, cryptocurrency investment products experienced an outflow of $513 million. This followed liquidity issues at Binance on October 10, according to a report by CoinShares.

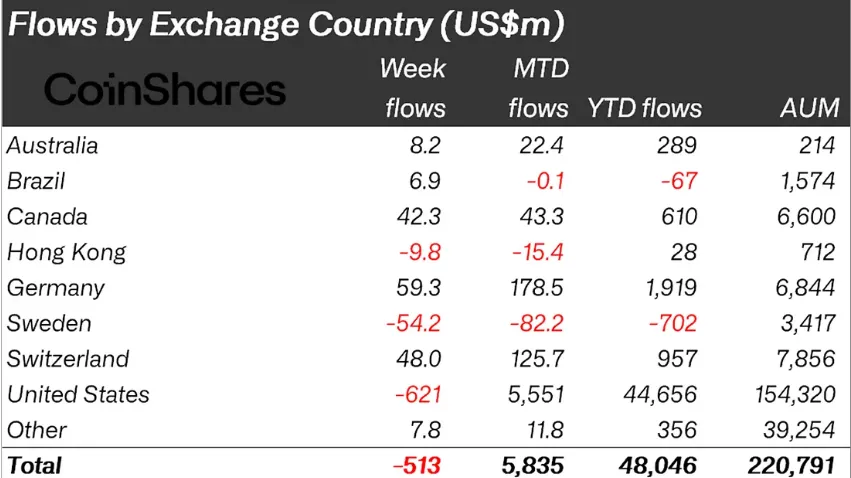

The majority of the capital outflow was from the United States, where investors withdrew $621 million. Meanwhile, market participants in Germany, Switzerland, and Canada viewed the price decline as a buying opportunity, with inflows of $54.2 million, $48 million, and $42.4 million, respectively.

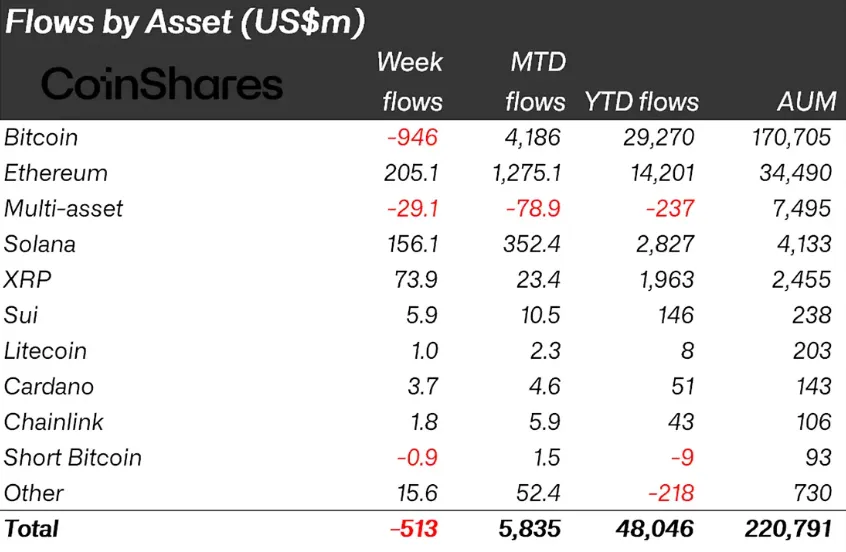

Bitcoin was the only major asset to record a net outflow of funds. Over the week, $946 million was withdrawn from Bitcoin-based products. Since the beginning of the year, inflows into Bitcoin products have totaled $29.3 billion, falling short of the $41.7 billion seen in 2024.

Amid falling prices, investors increased their investments in altcoins. Inflows into Ethereum-based products amounted to $205 million.

Anticipation of the launch of exchange-traded products (ETP) based on Solana and XRP bolstered demand for these assets. Investors poured $156 million and $73.9 million into products based on these assets, respectively. The total trading volume of ETPs remained high over the week, reaching $51 billion.

Earlier, from October 4 to 10, investors invested $3.17 billion in crypto products.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!