JPMorgan Affirms Bitcoin’s Growth Forecast Amid Trump and MicroStrategy Influence

JPMorgan experts express confidence in the “positive outcomes” for both the leading cryptocurrency and gold during Donald Trump’s presidency in the United States, reports The Block.

The report by analysts mentions a hedging strategy against devaluation, likely “supported by tariffs, geopolitical tensions, and expansionary fiscal policy.”

“We do not view the initial negative reaction of gold as a rejection of the hedging strategy against currency weakening in the event of Trump’s victory. Ultimately, bitcoin, as a key element of this approach, has shown growth,” noted researcher Nikolaos Panigirtzoglou.

Will the Rally Continue?

According to JPMorgan analysts, the dynamics of central banks’ gold purchases will have a crucial impact on the future trajectory of its prices.

Experts highlighted that monetary regulators in many countries significantly increased their reserves of the precious metal in 2022 following the onset of the armed conflict in Ukraine and the imposition of anti-Russian sanctions. They believe the trend towards further diversification of central bank reserves with a focus on gold will continue, with the People’s Bank of China playing a key role in this process.

JPMorgan is confident that retail investors will also show high demand for both assets, including through ETFs. The trend, fueled by Trump’s policies, will continue into 2025.

The MicroStrategy Effect

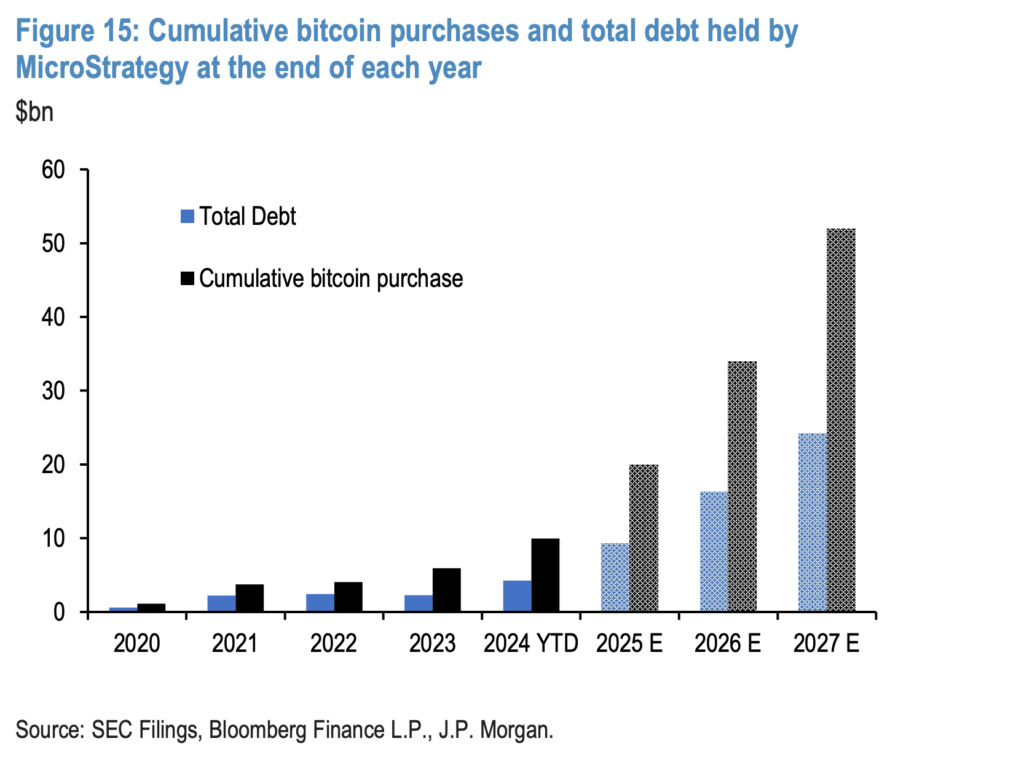

Another driver of digital gold’s growth will be the “Plan 21/21,” aimed at attracting $42 billion for MicroStrategy over the next three years. It is assumed that the funds, obtained equally through shares and debt securities, will be used to further increase bitcoin holdings.

“In 2025 alone, MicroStrategy will invest $10 billion in the leading cryptocurrency, roughly matching its cumulative purchases since mid-2020!” analysts emphasized.

The chart below shows the projected dynamics of debt growth and bitcoin reserves for the company founded by Michael Saylor:

On November 6, amid the US elections, the leading cryptocurrency’s prices reached a new all-time high above $75,000.

Previously, Bitwise’s investment director Matt Hougan suggested that the price of digital gold could rise to $200,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!