JPMorgan: SEC to approve many spot bitcoin ETFs within months

Optimism around the registration of the SEC for many spot bitcoin-ETF funds has risen, with a positive decision expected within months. Analysts at JPMorgan arrived at this conclusion, The Block reports.

Analysts drew attention toabsence of an appeal by the Commission againstthe court’s decision in the Grayscale case. The regulator was ordered not to obstructthe transformation of the bitcoin-trust into an exchange-traded fund.

“The timelines for approval remain unclear, but this is likely to occur by January 10, 2024 — the final deadline for the application ARK Invest and 21 Co.” — the earliest of the various final deadlines to which the SEC must respond, the document states.

Experts stressed that the Commission could satisfy all proposals at once in the interests of fair competition.

Analysts forecast a reduction in the management fee for GBTC and the neutralisation of the product’s discount to NAV after its conversion into an ETF. They estimated the total impact of the latter at $2 billion.

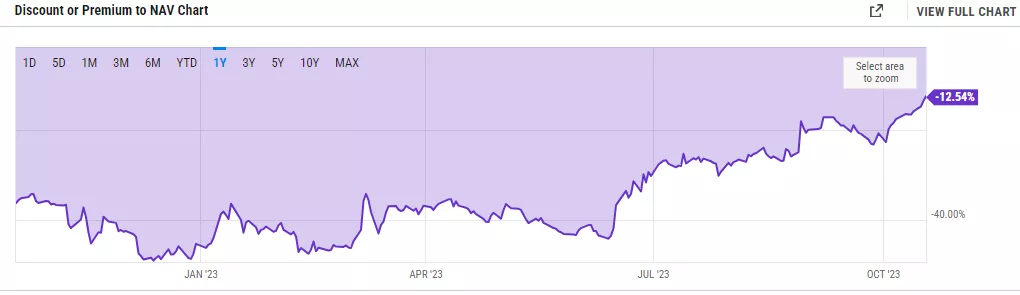

On October 19, the Grayscale Bitcoin Trust’s discount to NAV narrowed to 12.54%, the lowest since November 2021.

At the start of the year the figure stood at 48.31%. The situation in July was sharply changed by the filing of BlackRock’s application to launch a Bitcoin ETF. After that, Grayscale’s GBTC rose by 57%, the discount narrowed from 41.7% to 29.3%. The momentum in recent days has been aided by the SEC’s lack of an appeal against the Grayscale decision.

Earlier, JPMorgan doubted that the product launch would change the game for the crypto market due to low demand for ETFs in those jurisdictions where they have been approved.

Earlier, Matrixport analysts forecast a rise in digital gold to $42 000-56 000. CryptoQuant reported values in $50 000-73 000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!