K33 Analysts Declare the End of Bitcoin’s Four-Year Cycle

Experts believe the first cryptocurrency is far from its peak.

The historical patterns that once dictated the dynamics of the first cryptocurrency are no longer relevant, according to K33 analysts.

They argue that Bitcoin’s movement now depends on institutional investors and macroeconomic policy, rather than the traditionally halving-related patterns.

“The four-year cycle is dead, long live the new king,” declared Vetle Lunde, head of research at the company.

On October 6, digital gold reached a historic high above $126,000. Since the beginning of the year, the asset’s price has risen by more than 30%, according to TradingView.

The expert emphasized that the current rally fundamentally differs from previous bullish phases. Lunde described it as the antithesis of past peaks.

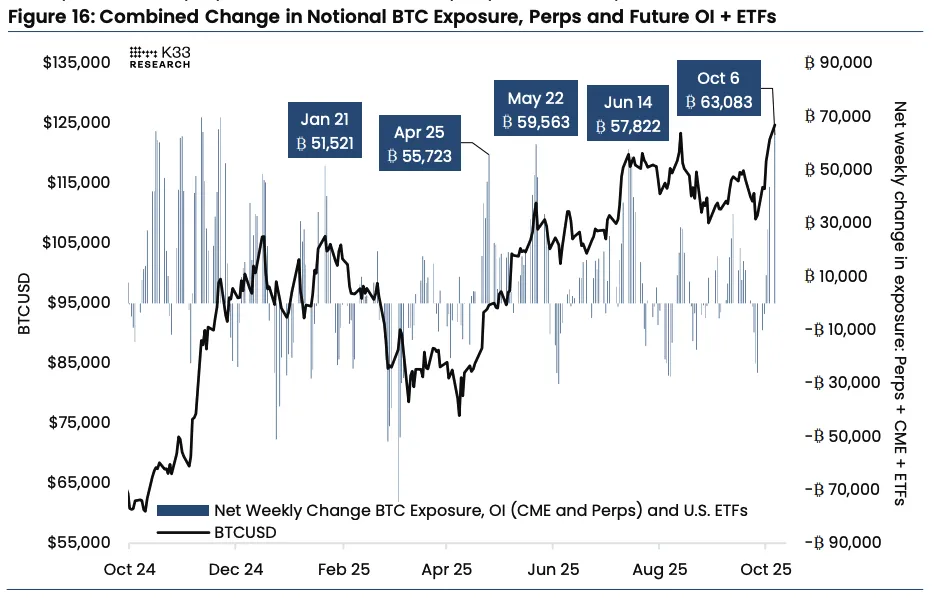

A key point is the scale of institutional involvement. Over the week, spot Bitcoin-ETF absorbed 31,600 BTC, and open interest on CME increased by 15,000 BTC. Against this backdrop, Bitcoin has become a significant part of the global market, noted the analyst.

Lunde acknowledged signs of market overheating. However, he expects only a short-term consolidation rather than a structural reversal.

“If in 2021 the peak coincided with monetary tightening and post-COVID caution, now [Donald Trump] is likely to replace [Jerome Powell] with his appointee who will lower rates—it’s like pouring gasoline on the fire even without expansionist policy. On the horizon is an era of liquidity abundance, not austerity. This scenario favours scarce assets like Bitcoin,” explained the analyst.

In the past 24 hours, the first cryptocurrency corrected by 2%. At the time of writing, digital gold is trading around $122,600.

Swissblock analysts recorded an increase in selling pressure from short-term holders and described the price decline as a “healthy correction.”

BTC Net Realized Profit/Loss shows short-term selling pressure emerging after Bitcoin’s new ATH near $126K.

Investors are taking profits, but unlike past tops, this wave looks controlled, not panic-driven.

Conviction remains strong.This has the signs of being a healthy cooling… pic.twitter.com/HE09JUh6eQ

— Swissblock (@swissblock__) October 8, 2025

“Unlike the panic-driven profit-taking at past peaks, the current wave appears orderly, indicating sustained investor confidence. […] A key signal will be the easing of sales while maintaining a price above $120,000-121,000—this will confirm a controlled market reset, laying the foundation for a new growth phase,” the experts emphasized.

October Peak?

Currently, fractal analysis shows similarities between Bitcoin’s current movement and past cycles: 1,051 days from the November 2022 low compared to 1,060 days in previous bullish trends. However, Lunde considers such parallels superficial.

“Fractals are a simplified approach to situation analysis,” he noted.

Instead of historical analogies, K33 relies on a system evaluating six key parameters, including:

- funding rates;

- RSI index;

- digital gold dominance;

- the ratio of futures to spot market volumes;

- social trends;

- cryptocurrency supply dynamics.

Only two of these indicate risks of approaching the cycle’s peak: the ratio of futures to spot market volumes and RSI overbought conditions. According to Lunde, this is insufficient to enter the “danger zone” typical of a peak.

“Bitcoin’s price dynamics remain healthy, and we see no prerequisites for a repeat of the infamous four-year cycle,” concluded the analyst.

Back in September, the death of the first cryptocurrency’s cycles was confirmed by Bitwise’s Chief Investment Officer Matt Hougan. The same opinion is held by CryptoQuant CEO Ki Young Ju.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!