K33 Analysts Predict Bitcoin Bull Run Peak Date

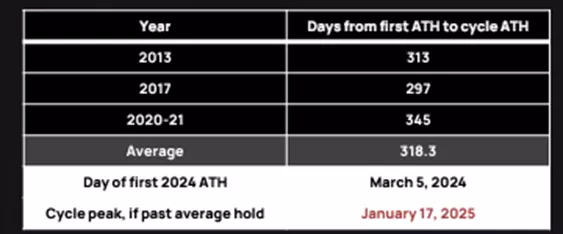

The average duration between the first and last ATH of a Bitcoin cycle is 318 days. If this pattern repeats, the next global peak will be reached on January 17, according to K33 Research.

The average duration between the first and last all-time high of a cycle is 318 days.

If that repeats in this cycle, we could face a global top on January 17, close to the election (and also close to where MSTR is on track to deplete its ATM). pic.twitter.com/eOBE8NaqQY

— Vetle Lunde (@VetleLunde) December 19, 2024

Experts noted that this date is close to the inauguration of the elected U.S. President Donald Trump and the moment when MicroStrategy exhausts its “ATM.”

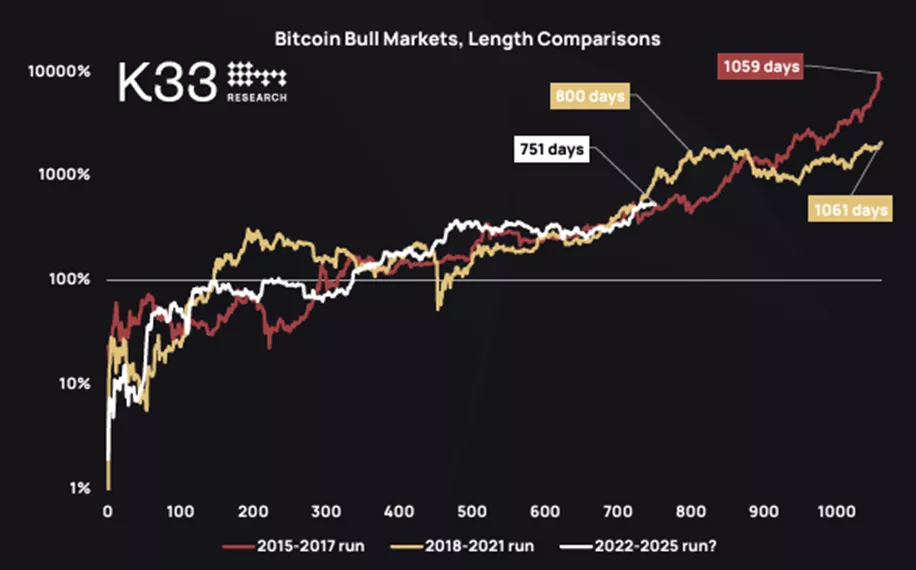

Experts are confident that the launch of a BTC-ETF, a pro-cryptocurrency U.S. president, and increasing global tension with coin reserves will disrupt the four-year halving cycles.

K33 highlighted that during the current bull run, the market reached a new ATH before the halving, and the 2022 low was below the 2017 high.

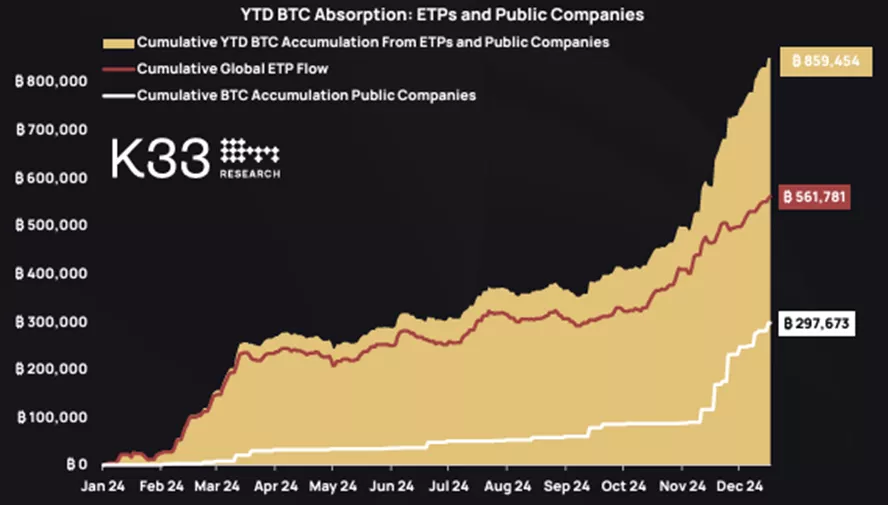

According to analysts’ calculations, in 2024, BTC-ETF issuers and public companies acquired 859,454 BTC. This accounts for 4.3% of the available supply and is equivalent to the next eight years of coin mining by miners.

K33 noted the hodling strategy of public companies and the resilience of flows into exchange-traded funds, expecting the trend to continue in 2025.

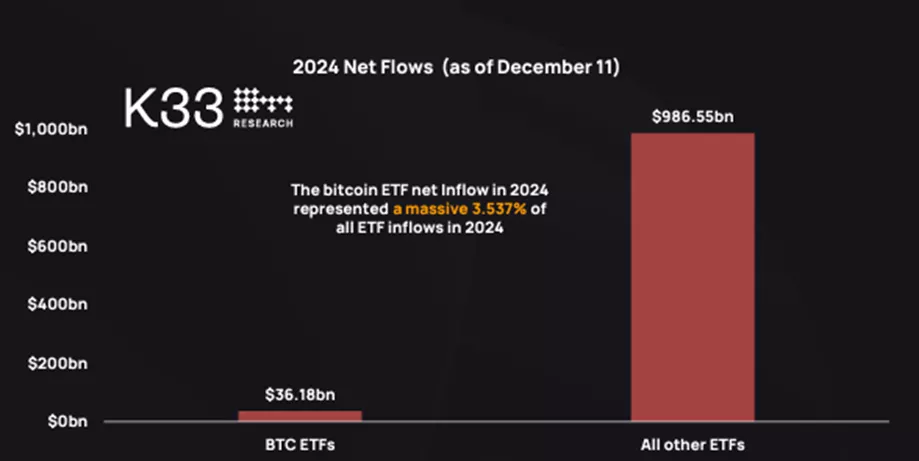

In 2024, inflows into BTC-ETF ($36.18 billion) accounted for 3.54% of the total for all U.S. ETFs during this period ($986.55 billion). Notably, investment rates in BTC-ETF were 4.5 times higher than in inflation-adjusted “gold” ETFs.

The dynamics of the first cryptocurrency closely correlated with inflows into exchange-traded products, experts indicated.

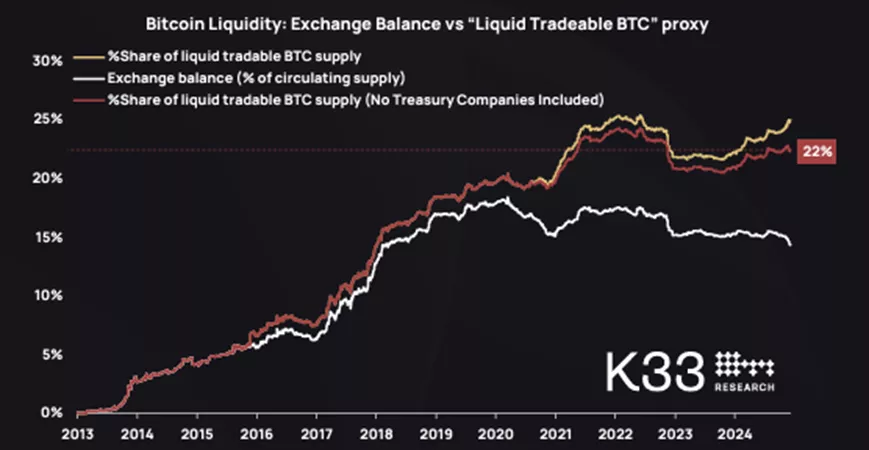

Analysts noted the increase in available market coins to a maximum since 2021 (22% of supply). This is explained by inflows from Mt. Gox, government sales, and purchases by ETF issuers.

Including the digital gold owned by public companies in the calculation, the asset “will be more liquid than ever.”

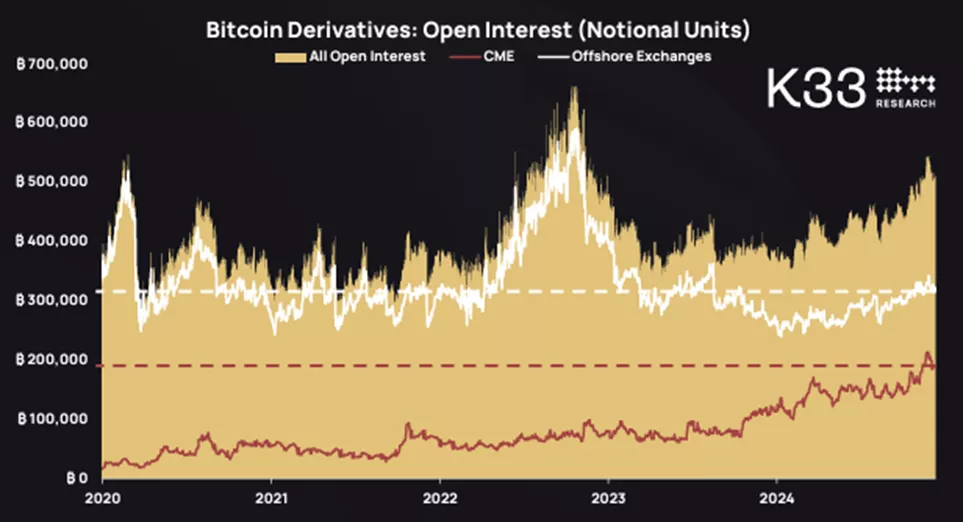

Open interest (OI) in Bitcoin derivatives approached ATH, driven by activity on the CME, indicating the “institutionalization” of the asset.

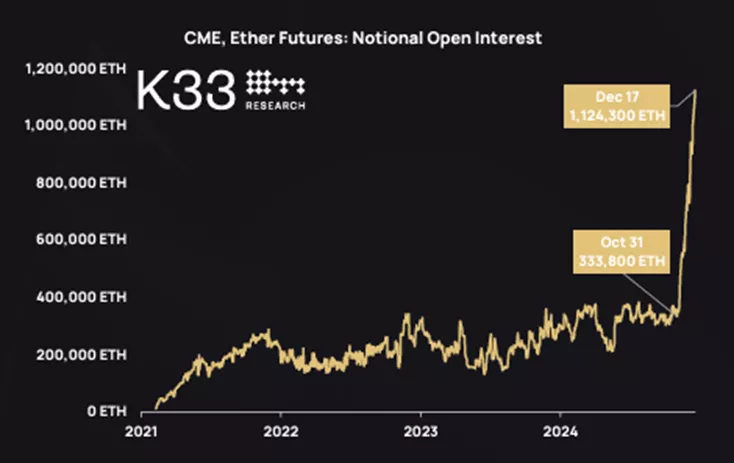

Since the U.S. presidential election, OI in Ethereum futures on CME has shown an “absolutely vertical trend.” Since October 31, the figure has jumped by 700,000 ETH, exceeding 1 million ETH.

According to Sygnum’s calculations, each $1 billion inflow into BTC-ETF pushes Bitcoin up by 3-6%.

Earlier, in its 2025 forecast, BlackRock called digital gold a “promising diversifier.”

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!