K33 Research: Ethereum Continues to Lag Bitcoin

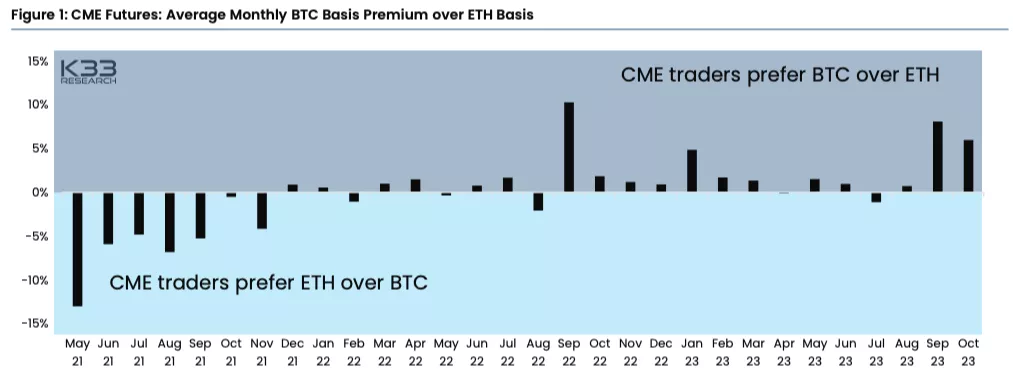

Traders still prefer Bitcoin due to higher futures premia amid expectations of approval for the spot ETF. This conclusion was reached by K33 Research.

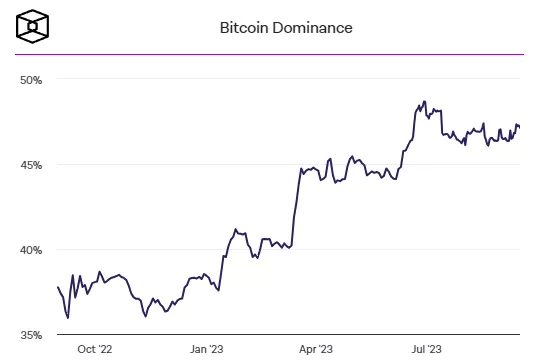

The lack of hype around the launch of Ethereum futures ETFs led to a drop in the ETH/BTC ratio to 0.057, a 14-month low. Bitcoin’s dominance rose toward two-year highs.

“The divergence in premium sizes between assets may lie in the fact that Bitcoin, with the potential for the rapid appearance of spot ETFs, is more attractive than Ethereum, which is tied to DeFi and NFT. Preferring digital gold until there are clear signs of a spark in the second-largest cryptocurrency probably represents the safest tactic at the moment,” — they noted.

Analysts said they do not expect the U.S. Securities and Exchange Commission to appeal the ruling in the SEC decision on Grayscale’s case until the deadline of 13 October. In that event, the court would likely order the regulator to reconsider the company’s application to convert GBTC into a spot Bitcoin ETF.

Experts say that developments around Grayscale could trigger a strong market reaction in the short term. After that, focus will shift to the upcoming deadlines for spot Bitcoin ETF applications from BlackRock, Fidelity, VanEck and Invesco.

Analysts noted rising optimism in the derivatives market. In particular, premiums on the CME for the next month and funding rates have risen, and the steepening of the volatility curve in six-month Bitcoin options points to sustained demand for calls. However, overall sentiment was described as cautious.

“Five-day Bitcoin futures volatility stood at 9.4% — the second-highest reading in 2023 — accompanied by changes in CME premia. Higher activity did not lead to any meaningful directional impulse,” — the analysts explained.

A week ago, K33 Research recommended investors redirect capital from the second-largest to the largest cryptocurrency.

Analyst Jeffrey Kendrick of Standard Chartered projected Ethereum to $8,000 by the end of 2026.

Former BlackRock director Steven Shonfield suggested that the SEC would approve the instrument within three to six months.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!