Kaiko highlights problems with USDT peg

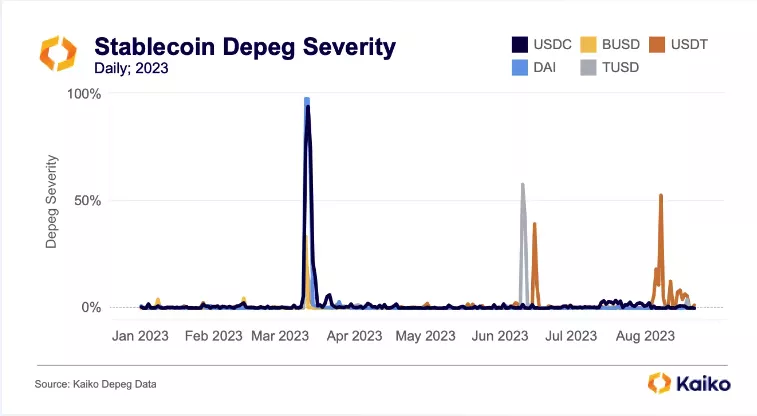

Throughout August there was a small but persistent deviation of the USDT price from the US dollar, which was a ’cause for concern’. Analysts Kaiko noted this.

According to their observations, for other stablecoins such as TUSD, BUSD, DAI and USDC over the past year there were also episodes of depegging, but their deviations were less pronounced, and overall quotes of rivals remained more stable.

The most serious incident with USDT this year occurred on August 7, when the discount reached 2% on nearly every trading platform. The situation came amid reports of token sales totaling around $500 million on Binance, Huobi, Uniswap and other exchanges.

“USDT has a problem with peg stability. The fixed redemption fee means holders often rationally sell the token on the market rather than redeem it for fiat with the issuer. As liquidity has declined, the market is no longer able to absorb significant USDT selling,” analysts explained.

Kaiko believes that sustained depegging could seriously undermine trust.

As a remedy, analysts suggested that Tether consider scrapping the redemption fee and abandoning minimum requirements. In their view, this would not have a material impact on financial results. They noted that concerns about a potential reduction in token supply are preventing the company from taking such a step.

Currently, Tether charges 0.1% to convert USDT to fiat for amounts above roughly $100,000. Applicants must also pay $150 for a KYC check.

Earlier, Tether reported $850 million in net profit in the second quarter. According to the document, 85% of USDT’s collateral consists of cash and cash equivalents. The company invested $72.5 billion in US Treasuries.

In May, Tether’s chief technology officer Paolo Ardoino said that the issuer’s high profitability provides the opportunity to consider new business directions.

Later it emerged that Tether invested $1 billion in a Bitcoin mining project in El Salvador.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!