Kraken Leads in Ethereum Withdrawals From Deposit Contract After Shapella

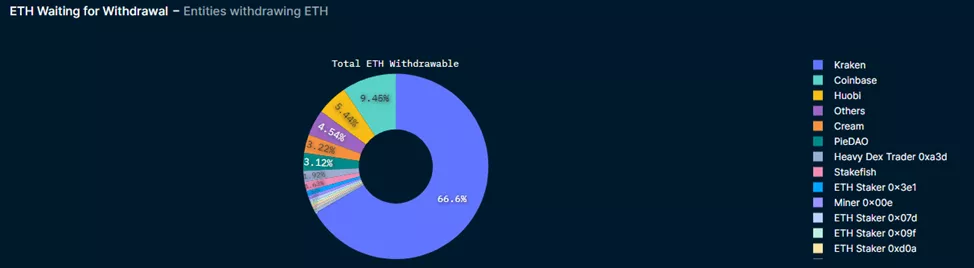

Kraken accounts for 86.6% of the total ETH queued for withdrawal from the deposit contract after the successful activation of Shapella. The data are in a dedicated dashboard Rated Network.

Nansen analysts assessed this metric at 66.6%.

Shapella activated EIP-4895 — the ability for users to withdraw funds from staking. The hard fork occurred at epoch #194 048.

On February 10, 2023, Kraken agreed to pay a $30 million fine and shut down its staking program after claims by the SEC that it was not properly registered.

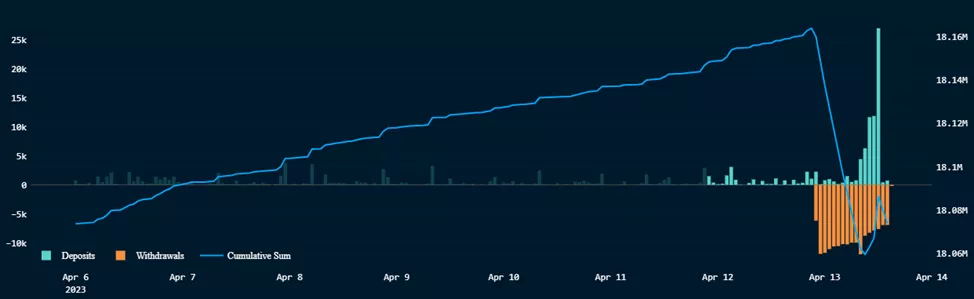

According to Parsec Finance, 17 654 validators await withdrawals from the deposit contract.

The queue for ETH withdrawals from the deposit contract reached 890 980 ETH ($1.78 billion), according to Token Unlocks.

At the time of writing, the daily withdrawal pace stood at 84 092 ETH (data from Nansen).

From 15:00 to 16:00 (Kyiv/Moscow) 27 008 ETH were directed into staking, equating to 25.9% of the net reduction in staker balances over the previous 14 hours after Shapella activation (104 291 ETH).

Andrew Turman, an analyst at Nansen, explained that in most cases users withdraw their rewards rather than the entire available balance. He suggested that the volume of blocked Ethereum will gradually decline, while inflows of coins will continue.

Notably, the majority of withdrawals are addys withdrawing their rewards, not their rewards + full stake. At current pace, it’s reasonable to assume the total amnt of staked ETH willtrend down, but there remains strong inflows as well, with over 15k ETH staked on a 24 hour basis pic.twitter.com/kQNPme56cy

— Andrew T (@Blockanalia) April 13, 2023

Earlier, Glassnode estimated potential sales after Shapella at 170 000 ETH ($323 million) in the next seven days after the update’s activation. This amount accounts for less than 1% of the 18 million ETH locked in staking 18 million ETH ($33.92 billion, 15% of circulating supply).

Experts questioned whether Kraken and Celsius, which is undergoing bankruptcy, would immediately start selling coins withdrawn from the deposit contract.

Analysts noted that Coinbase said it would be ready to accept Ethereum withdrawals within 24 hours after Shapella. Lido will implement this option in May. Kraken has yet to set a date.

On April 13, Binance announced that it would open Ethereum withdrawals from staking on April 19, at 5:00 (Kyiv/Moscow).

Analysts at JPMorgan Chase and Fidelity Investments differed in their assessments of the potential impact of Shapella on the price of the second-largest cryptocurrency.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!