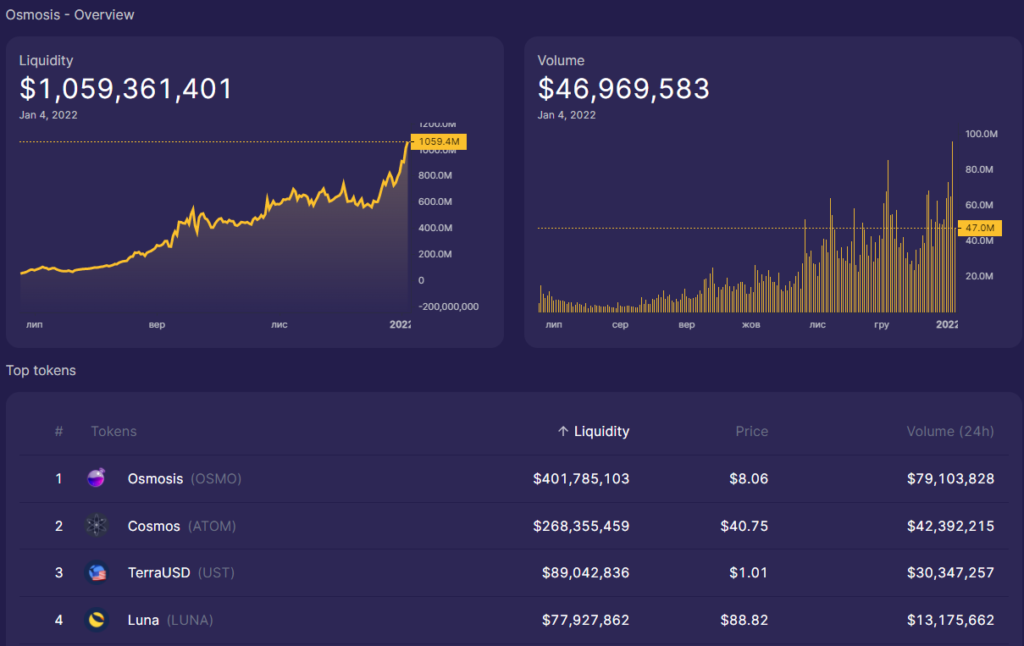

Liquidity in Osmosis DeFi ecosystem surpasses $1 billion

The Osmosis decentralized platform on Cosmos reached TVL of $1 billion.

On January 3, trading volume on the DEX reached $95 million. The price of the native token OSMO over the last 24 hours rose by 8.8%, according to CoinGecko.

In the screenshot above, besides OSMO and ATOM, the algorithmic stablecoin UST and LUNA (Terra’s native token) are gaining significant popularity.

The growth in TVL of the ecosystem was evidently aided by Osmosis’s integration with cross-chain bridge Terra Bridge.

1/ As some of you #LUNAtics may have noticed over the holidays, outbound IBC transfers from Terra to @osmosiszone have been added directly to the Terra Bridge UI. https://t.co/iOK7YyrgUZ pic.twitter.com/vmEXlRNjlu

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) January 3, 2022

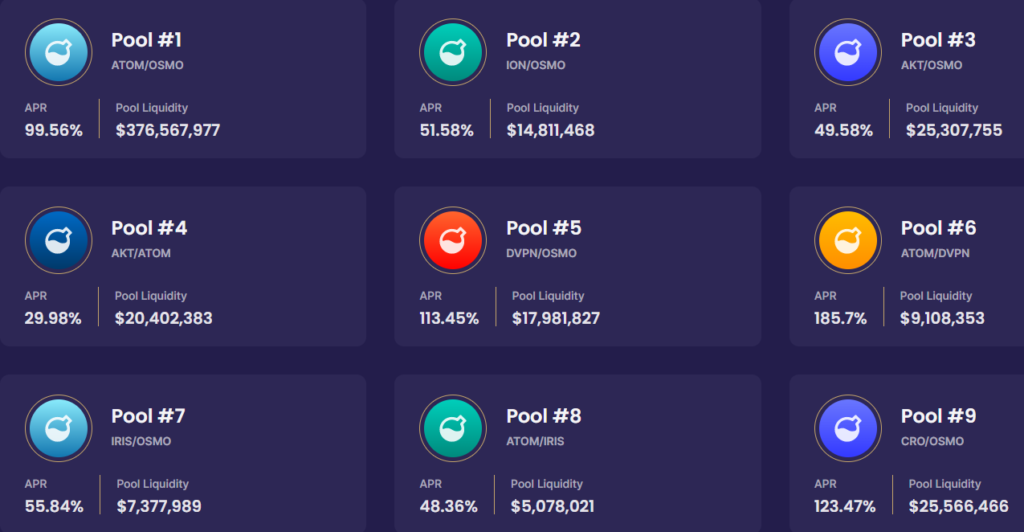

Capital inflows may also be driven by high pool yields. APR of many of them exceeds 100%.

In addition, Osmosis offers an innovative approach to staking (“liquid staking”). Users place funds in pools with the OSMO token. In addition to rewards for providing liquidity, there is the possibility of earning staking income.

Suppose that the yield on ATOM-OSMO pool funds, as well as from OSMO staking, is 100%. Placing $1000 in the pool would yield a daily income of $2.70 (at a rate of 0.27%). In addition, users would receive $1.35 per day on the $500 invested in OSMO staking. Thus, total daily income would be $4.05.

As of writing, the Osmosis protocol ranks 15th by TVL on DeFi Llama.

In December, the DeFi ecosystem Terra surpassed Binance Smart Chain in total value locked.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!