Luna Foundation Guard and Terraform Labs Invest $200 Million in AVAX

The non-profit Luna Foundation Guard (LFG) is investing $100 million in AVAX tokens from the Avalanche project to expand reserves and bolster the stability of the algorithmic stablecoin UST.

1/ Thrilled to reveal the blossoming collaboration between @avalancheavax and Terra will also be further solidified with a $100 million Treasury Swap between TFL and the Avalanche Foundation of $LUNA <> $AVAX to strategically align ecosystem incentives!https://t.co/z9A86CWZDs

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) April 7, 2022

LFG will acquire the tokens from the Avalanche Foundation for UST in an over-the-counter trade. Unlike the organization’s Bitcoin reserves, AVAX will be held on the asset’s native blockchain.

«The LFG deal to acquire $100 million in AVAX for the UST reserve […] marks the emergence of a diversified and uncorrelated pool of assets supporting the peg of the stablecoin», — the statement said.

The Terra-backed company Terraform Labs (TFL) will also swap LUNA for AVAX. The swap amount will be $100 million. It was explained as necessary to “demonstrate commitment to Avalanche”.

Following the two deals, the Avalanche Foundation’s balance will hold $100 million in UST and $100 million in LUNA.

According to Do Kwon, head of Terraform Labs, the AVAX purchased with stablecoins will bolster the stability of UST’s peg to the US dollar. The same model as used for Bitcoin is employed.

6/ This means that as $UST adoption grows on Avalanche, $AVAX becomes more scarce — aligning the growth of the stablecoin with the L1’s developers and users.

— Do Kwon 🌕 (@stablekwon) April 8, 2022

LFG began purchasing digital gold at the end of March. Do Kwon explained at that time that with the formation of the UST reserve UST would become a ‘hybrid’ stablecoin — if the asset’s price falls below $1, the reserve pool will ‘operationally’ provide the liquidity necessary to maintain price stability.

This pool operates similarly to the on-chain mechanism for issuing UST. However, instead of burning LUNA, it involves supplying and holding wrapped BTC. In the case of AVAX, only the reserve asset changes.

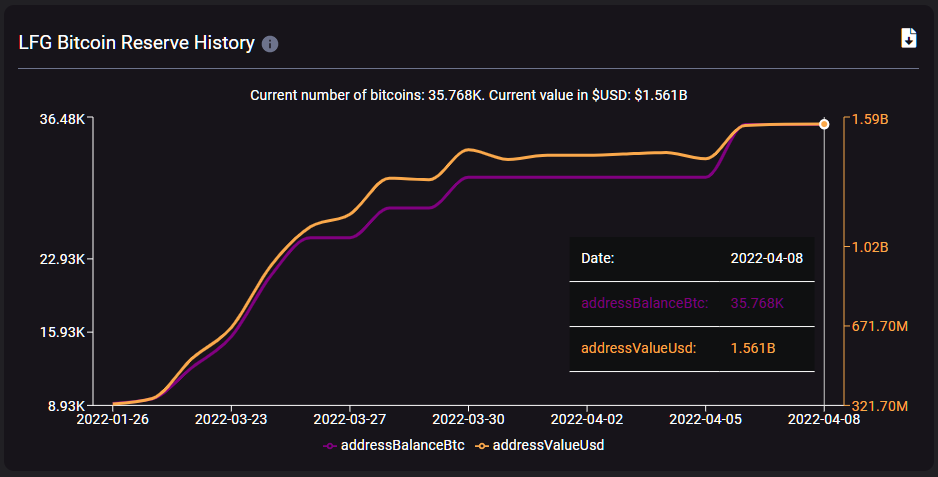

According to Smart Stake, at the time of writing LFG holds 35,768 BTC worth more than $1.55 billion.

The partnership will enable users to swap AVAX for UST directly. The Avalanche ecosystem will also host more Terra-native protocols. Specifically, Anchor has been operating in the network since March, with Nebula Protocol set to launch in the near future.

8/ TFL will also put boots on the ground to grow Avalanche — @anchor_protocol has touched ground recently, and @nebula_protocol will create a cluster of top assets in the Avalanhce eco etc.

— Do Kwon 🌕 (@stablekwon) April 8, 2022

«Terraform Capital покроет первоначальные затраты на бутстрэппинг для отдельных проектов, использующих UST в экосистеме AVAX. В консорциуме с нашими различными партнерами по безопасности будут покрываться расходы на аудит», — написал Квон.

Основатель Avalanche Эмин Гюн Сирер назвал сделку «началом объединения экосистем Avalanche и Terra». По его словам, партнерство позволит создать новые классы активов и более эффективные сценарии их использования.

3/ Terra has developed an innovative approach to stablecoin design, and Avalanche is the perfect chain for $UST to expand its use across DeFi applications.

— Emin Gün Sirer🔺 (@el33th4xor) April 7, 2022

«Terra и Avalanche создадут новую игровую подсеть. Пока я не могу раскрыть какие-либо подробности, но я в восторге от того, что нас ждёт в будущем», — добавил он.

As reported in March, the price of LUNA hit a historic high amid news of the creation of a bitcoin reserve for UST.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!