Major Solana holder backs tokenomics shift

DFDV backs Solana’s SIMD-0411 to speed disinflation and shift tokenomics.

DeFi Development Corp. (DFDV) has backed SIMD-0411 to accelerate disinflation in Solana. The firm is the first among large treasuries to publicly endorse changes to the network’s monetary policy.

— DeFi Dev Corp. (DFDV) (@defidevcorp) November 24, 2025

Developers at Helius Labs introduced the initiative on 22 November. The document proposes doubling the pace at which the annual inflation rate declines from 15% to 30%, allowing the terminal rate of 1.5% to be reached in three years rather than six. Over that period, issuance would be reduced by 22m SOL (about $3bn at the time of writing).

DFDV argues that Solana has “outgrown” the startup phase and no longer needs to entice validators with high yields. The company pointed to gains in key network metrics:

- protocol revenue: rose from $29m in 2023 to $1.42bn in 2024;

- trading volume on DEX: increased from $55bn in 2023 to $694bn in 2024;

- user activity: in 2025 the network processed about 68.6bn transactions, roughly 50 times Ethereum’s count.

Supporters of the proposal say lower inflation will bolster SOL’s status as an institutional‑grade asset and increase its appeal to ETF issuers. A smaller issuance would also ease selling pressure from holders needing to meet tax liabilities.

A lower base staking rate should spur activity in DeFi, making lending and liquidity provision more competitive.

Risks and drawbacks

DFDV acknowledges the change carries risks. Lower rewards will strain validator economics and could lead some nodes to switch off. Staking product yields may also fall, and the market could see temporary volatility.

Even so, the firm believes the long‑term benefits outweigh the potential drawbacks.

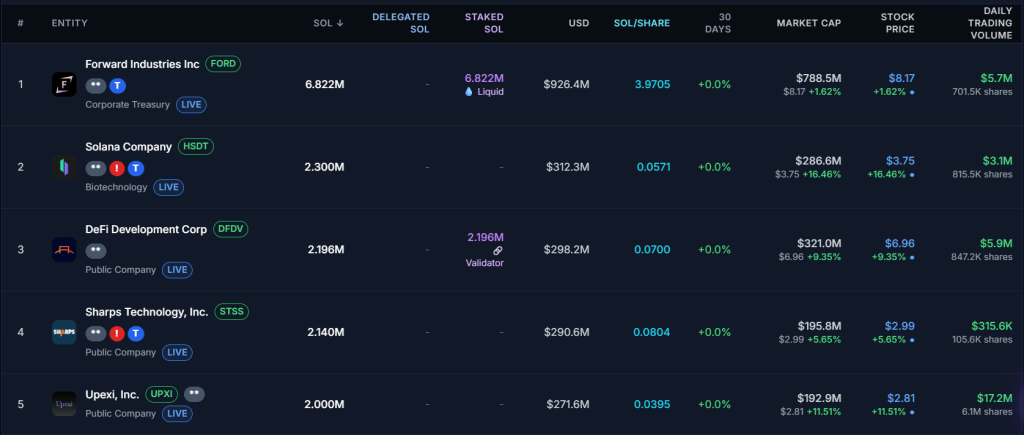

DFDV holds 2.19m SOL (about $298m).

The firm ranks third among corporate holders of the token, with 0.35% of total supply.

Market correction

Over the past month SOL has fallen 31.7% to $135.61.

The largest corporate holder, Forward Industries, is sitting on unrealised losses of $647.3m.

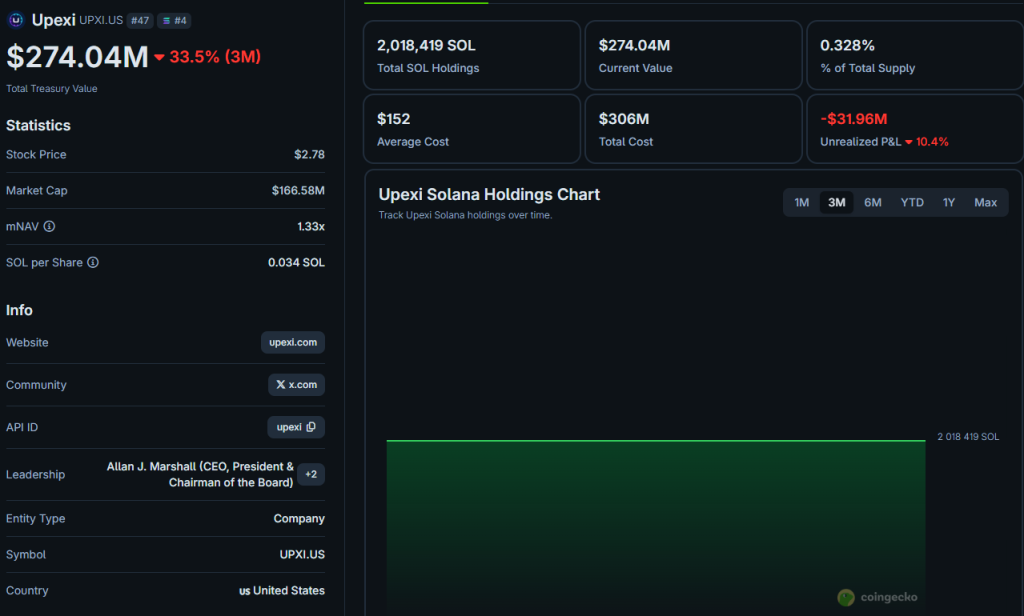

Upexi is also in the red by $31.9m.

DFDV still holds about $61.64m in unrealised gains.

On 18 November, trading began in spot exchange‑traded funds based on Solana from Fidelity and Canary Capital on NYSE Arca and Nasdaq, respectively.

On 24 November, US spot SOL ETFs recorded net inflows for the 20th consecutive day.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!