Market makers hedge against bitcoin dropping below $20,000

On July 18, the Deribit cryptocurrency derivatives exchange saw two trades of 500 bitcoin put options expiring on December 31, with strikes at $20,000 and $22,000.

💥Monster prints from early this morning on Paradigm

31Dec 22k Puts trading 500x (500 BTC)

31Dec 20k Puts trading 500x (500 BTC)cleared on @DeribitExchange

Impossible to get liquidity on demand for this kind of size directly on the order-book! pic.twitter.com/vgMEWO78Jq

— Paradigm (@tradeparadigm) July 18, 2021

The trades were executed via Paradigm’s over‑the‑counter platform for institutional investors.

“It is impossible to obtain liquidity on demand for such an amount directly in the order book!”, the message said.

QCP Capital CEO Darius Sit, in an interview with CoinDesk, said there was also considerable interest in selling September puts.

The piece suggests that large investors were likely buyers of the contracts. Through such actions they hedged long positions on the spot or futures markets.

A put option gives the holder the right to sell the underlying asset at a fixed price. The price may be above the market price at expiration, which is advantageous to the trader.

The holder takes a bearish position, but may also use it as insurance to offset losses if their primary bet on the spot/futures market does not pay off.

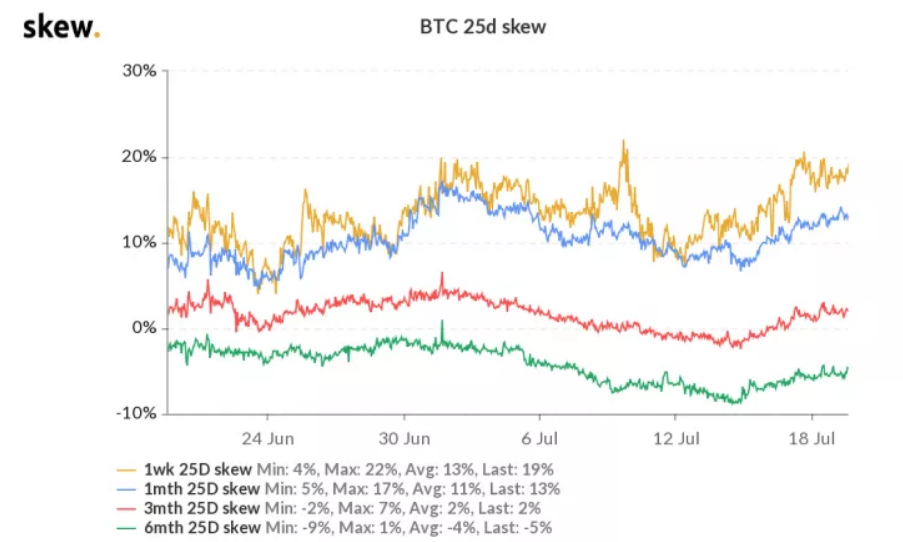

According to skew, in the long run bullish sentiment dominates the options market. The put/call ratio for six-month contracts remains negative.

However, over horizons of one week, one month and three months, the opposite trend is observed. This points to dominance of bearish bets.

As noted, on July 20 the price of bitcoin fell below $30,000.

Earlier, the “Bond King” Jeffrey Gundlach called the chart of the first cryptocurrency scary and predicted a drop to $23,000.

Prior to that, JPMorgan analysts did not rule out a fall to $25,000.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!