Market Shifts Focus from Meme Coins to DeFi Tokens

Leading meme coins have lost their growth momentum, while DeFi tokens are showing stronger gains. This is reflected in the dynamics of the respective indices, reports The Block.

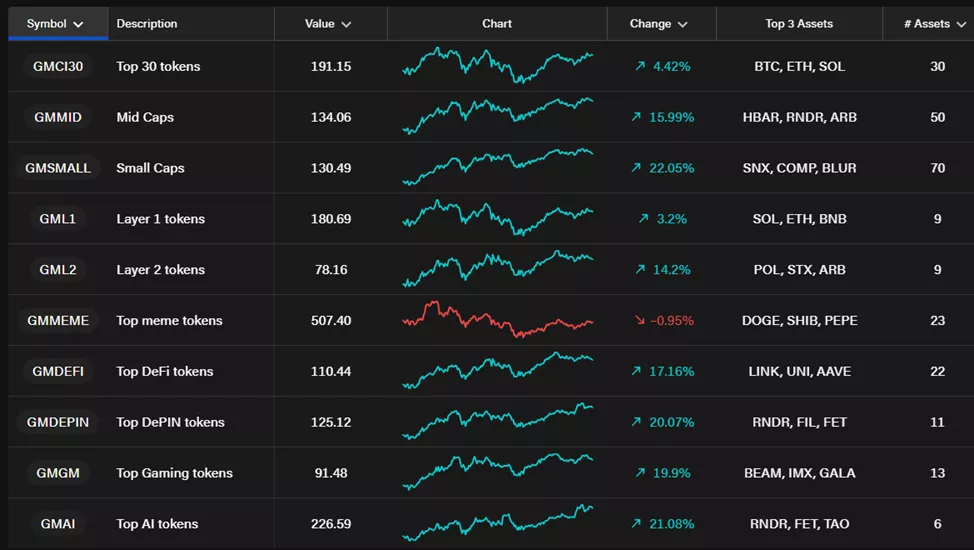

Over the past week, the GMMEME indicator, which tracks the top 30 meme coins, decreased by 0.95%.

For the last two weeks, the index has fluctuated between 470 and 535 points, with an unsuccessful attempt to break upwards on November 23, when it reached an ATH of 571.87 points.

Min Chong of Presto Research pointed to an “overheating” of the sector.

“Exchange listings led to a spike in token prices in mid-November, followed by growing investor fatigue over controversies, including Pump.fun,” explained the specialist.

Chong noted a capital rotation into small-cap tokens and AI projects.

Arthur Cheong, founder, CEO, and CIO of Defiance Capital, pointed to a renewed interest in ETH and DeFi protocols. Inflows into the segment may come from closing positions in meme coins, the expert suggested.

The catalyst was Donald Trump’s victory and rising hopes for an improved regulatory environment.

Chong described the current trend as a “broader shift” towards fundamental indicators. Interest in DeFi, the analyst linked to an anticipated rate-cutting cycle in TradFi.

Christopher Giancarlo, a candidate for the position of “crypto czar,” reminded that providing citizens with the assurance of owning their own wallets and the adoption of new rules and regulations by the CFTC and SEC are among Trump’s goals.

Earlier, the monthly turnover of DEX on Solana exceeded $100 billion amid record monthly fees from Pump.fun.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!