Matrixport analysts warn of altcoin crash amid FTX asset sales

By year-end, Ethereum could fall to as low as $1,000, and downside targets for Solana (SOL) sit at $15 and $10 due to overhang of supply from FTX. Such forecasts представили Matrixport Technologies analysts.

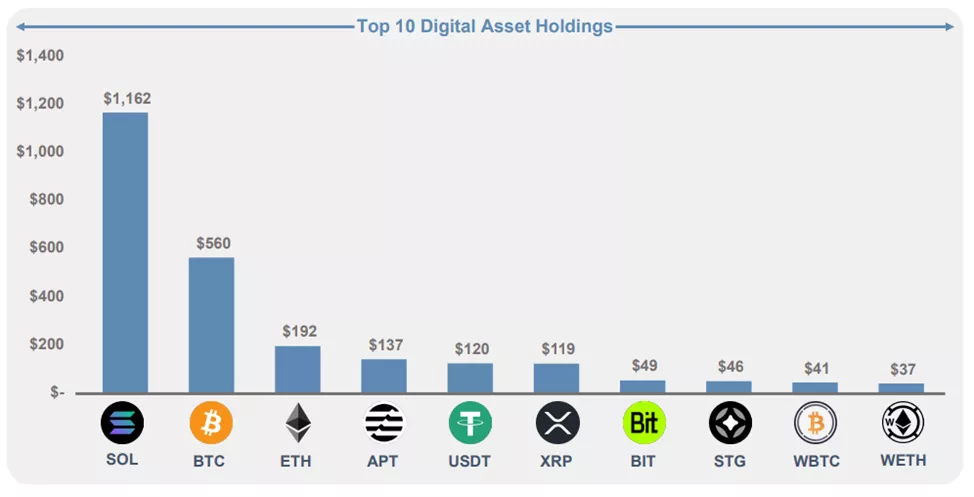

Experts drew attention to решение суда, which allowed creditors bankrupt exchange to begin the process of selling digital assets worth $3.4 billion. This amount includes $560 million in Bitcoin, $192 million in Ethereum and $1.16 billion in SOL (the largest holder of the tokens). The sales will begin this week.

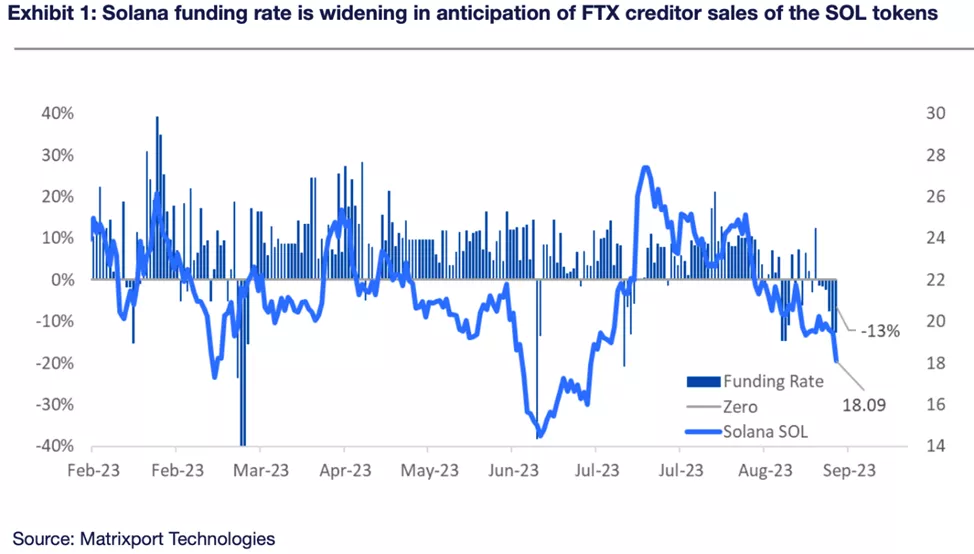

In the run-up to the process, the funding rate on Solana perpetual contracts fell to -13% per year.

According to the analysts, unfavourable prospects also loom for ApeCoin (APE) due to unlock events that will increase the token supply by 11%.

For Ethereum, the key support is at $1,600; a break below could open the potential for further declines.

“A drop below $1,500 could revive the notion that the price will fall to $1,000 — a level that seems justified, based on the ecosystem’s revenue forecast,” the analysts said.

Analysts noted positive funding rates for Bitcoin and Ethereum, but did not interpret them as bullish in light of negative readings of such metrics for altcoins.

The court ruling also states that since the start of the restructuring process, creditors have accumulated $2.6 billion in cash.

Lawyers identified 38 properties owned by the group of companies in the Bahamas valued at $199 million.

The court found that 50 insiders of the organisations, including Sam Bankman-Fried and Caroline Ellison, received assets in the form of cash, cryptocurrencies, shares and real estate totaling $2.2 billion.

In June, the current FTX management team said it had returned liquid assets amounting to about $7 billion.

A month earlier, the exchange filed a suit against Genesis demanding the return of $3.9 billion. Subsequently, the amount of claims was reduced to $2 billion. Ultimately, the companies agreed to pay $175 million to Alameda Research.

In September, the court approved Robinhood’s repurchase of its 55 million shares worth $605.7 million, which had previously belonged to the exchange’s founder, Sam Bankman-Fried.

In the same month, FTX filed a suit against LayerZero Labs, the developer behind the omnichain protocol, seeking the return of $86 million.

On August 24, FTX informed the court of plans to ‘sell, staking and hedging’ its cryptocurrencies — for this the exchange will hire Galaxy Digital’s Mike Novogratz.

Earlier in September, a transfer from an FTX-linked wallet of about $10.2 million sparked concerns aboutdump of altcoins.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!