McKinsey Projects Tokenized Asset Market to Reach $1.9 Trillion by 2030

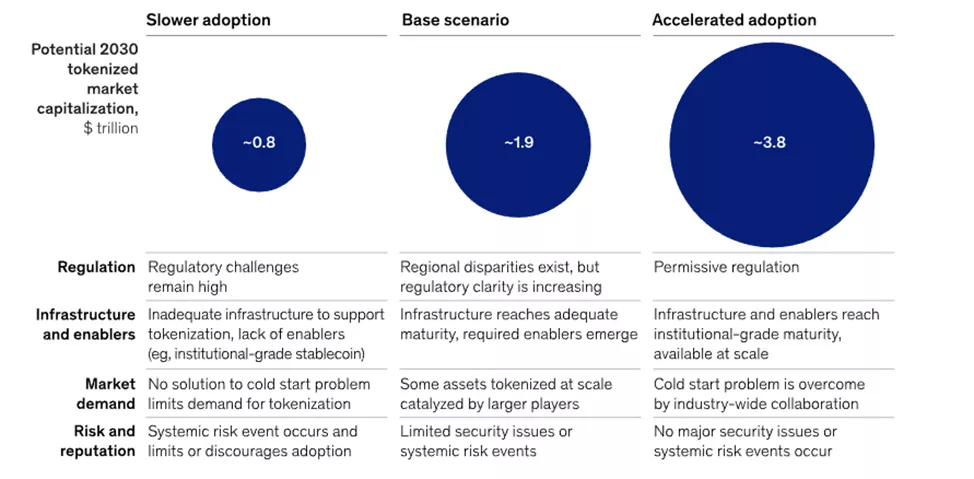

The volume of tokenized assets is projected to reach $1.9 trillion by 2030, despite a “cold start,” according to McKinsey.

In a more optimistic scenario, this figure could double, though analysts have become more skeptical about its likelihood. A pessimistic outlook suggests growth to $0.8 trillion.

Experts noted that tokenization has gained “significant momentum,” but widespread adoption of the technology is not yet underway.

They added that modernizing existing financial infrastructure is “complex, especially in a heavily regulated industry like financial services.”

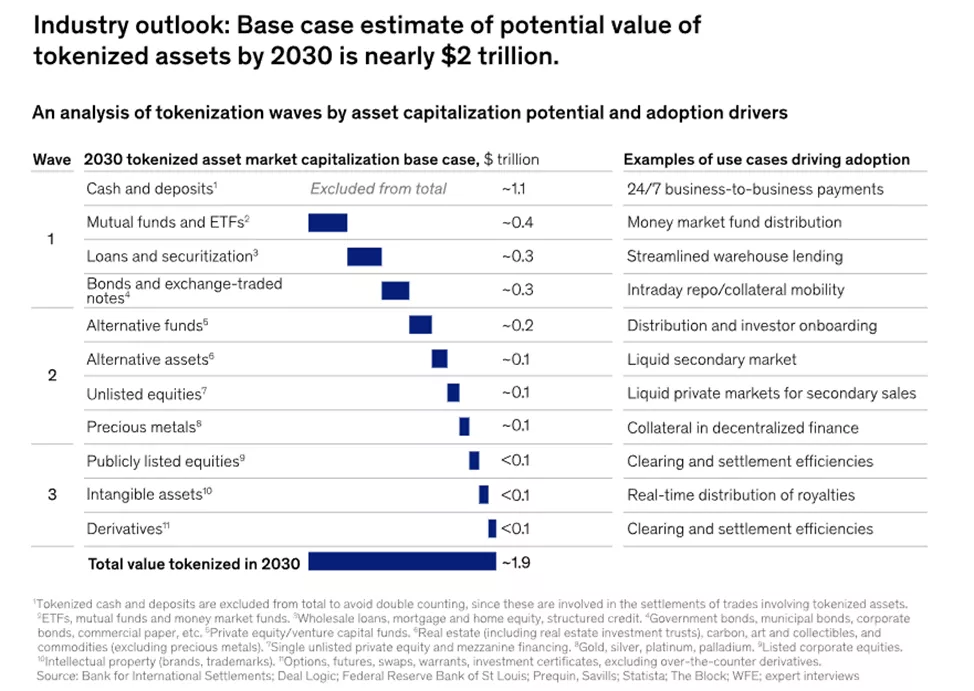

Analysts estimate that the following asset categories will surpass the $100 billion mark:

- mutual and exchange-traded funds;

- loans and securitization;

- bonds and ETN;

- alternative asset funds.

Stablecoins, deposit tokens, and CBDCs were excluded from the calculations.

McKinsey noted that tokenization faces the typical “cold start problem,” requiring initial investments from users.

The technology struggles with limited liquidity, hindering the spread of instruments. Due to fears of losing market share, issuers may release tokenized assets while simultaneously utilizing TradFi infrastructure.

Analysts added that use cases are needed where there are advantages over traditional financial systems. They cited bond tokenization as an example.

Currently, the market for such instruments has reached billions of dollars. Their advantages over traditional issuances are minimal, and secondary trading remains “sparse.”

To change the situation, experts suggested developing a use case where the digital representation of collateral provides greater mobility, faster settlements, and increased liquidity.

According to specialists, early adopters who “catch the wave” of tokenization can secure a large market share, enhance their reputation, and play a key role in setting standards. Many institutions are currently in a wait-and-see position.

“There are indicators suggesting that tokenization has reached a tipping point. These include blockchain capable of processing trillions of dollars, seamless connectivity between networks, and the development of a regulatory framework providing clear guidelines on data access and security,” the experts concluded.

Over the past year, Fortune 100 companies have increased the number of supported blockchain initiatives by 39% to a “record level,” according to Coinbase. Corporations are also focusing on the tokenization of RWA.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!