Messari: Compound lending volume up 57%

Against a backdrop of rising liquidity in the Compound lending protocol, the volume of loans issued in Q3 2021 rose by 57%, while users’ interest income fell by 19%, according to Messari analysts.

Excited to share our Q3 2021 Compound Quarterly Report.

This is one of the most comprehensive protocol-level analyses you will read, and we hope this can become the standard for DAO reporting moving forward.

Some insights below.

— Ryan Watkins (@RyanWatkins_) October 21, 2021

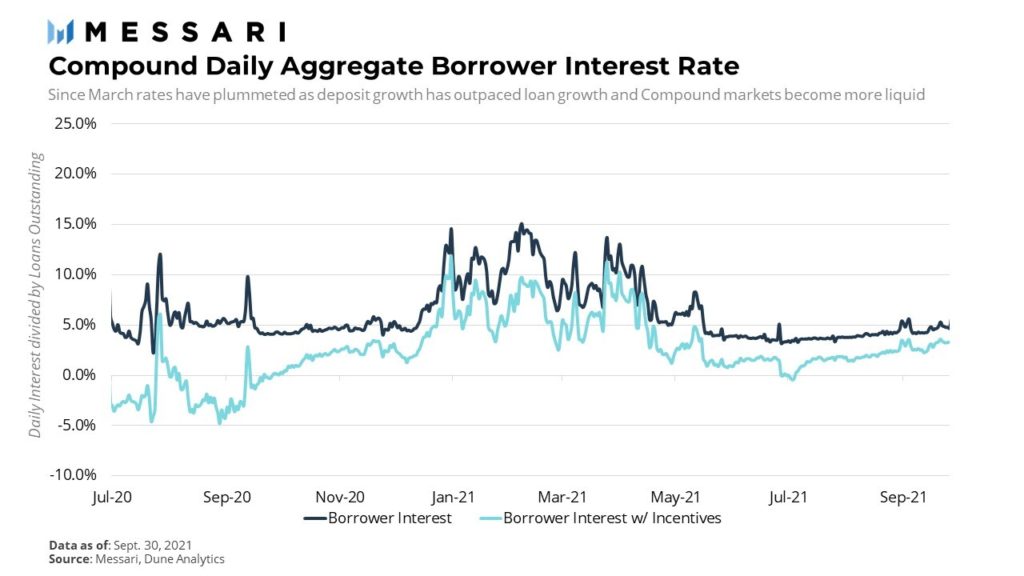

According to experts, liquidity growth pushed borrowing rates down to historically low levels. Yet as demand from borrowers for USD Coin (USDC) and Dai (DAI) markets grew toward quarter’s end, rates began to rise.

Messari attributes the uptick in borrower activity to favorable market conditions and attractive borrowing costs.

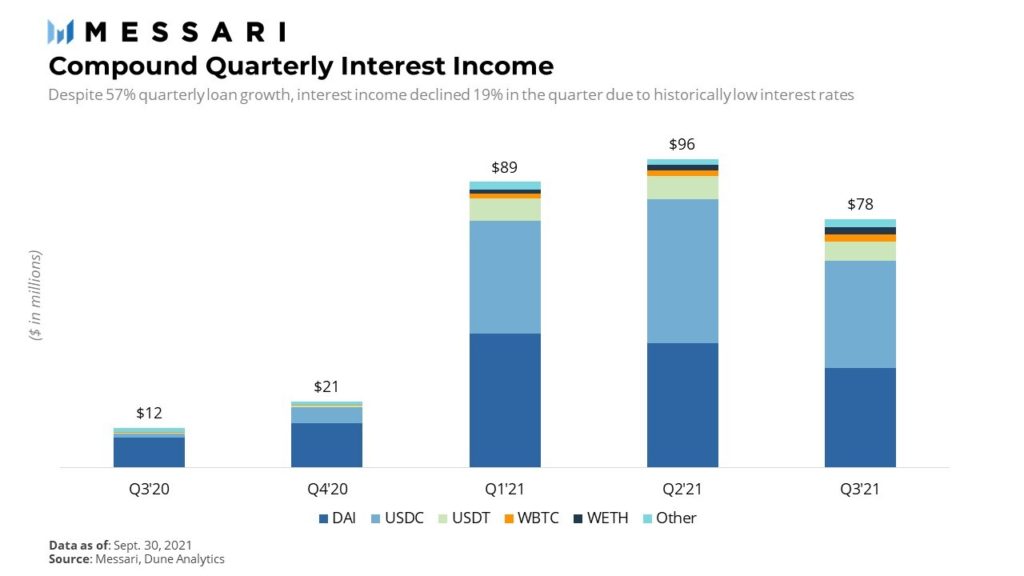

Despite the growth in lending volumes, total interest income for liquidity providers declined by 19%, from $96m in Q2 to $78m. This reflected lower borrowing rates on DAI and USDC, the most popular tokens.

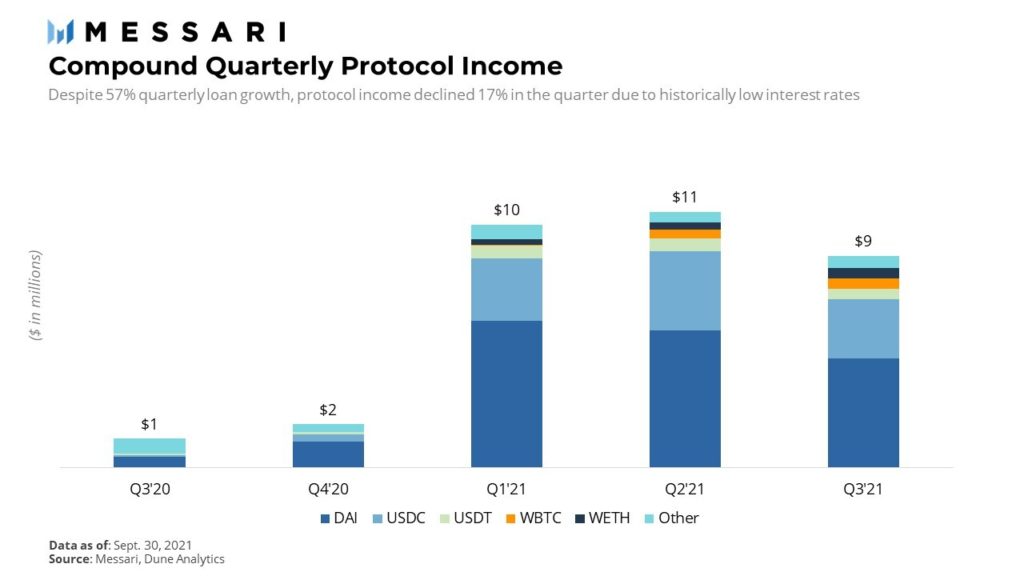

Although the protocol does not levy maintenance fees on users, developers introduced the concept of a reserve factor. It determines what portion of the interest paid by the borrower the governance may allocate to project development or use as a safeguard in the event of defaults to shield liquidity providers.

Individual reserve factors are set for different assets. The highest is for DAI (15%). Owing to the drop in interest rates, the protocol’s income from reserve factors declined for the first time this year, by 17%, from $11 million to $9 million.

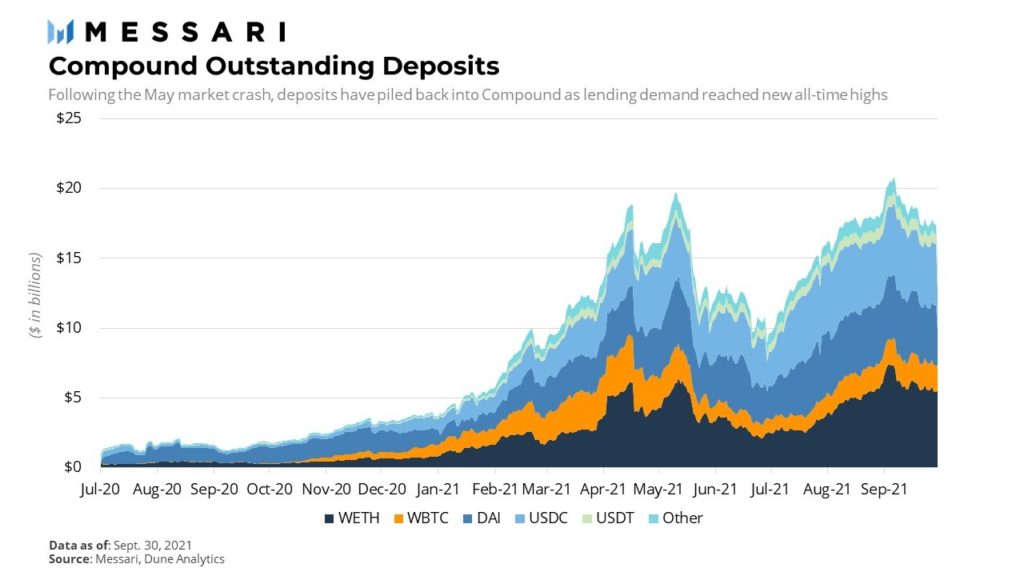

Against the backdrop of rising token prices and users seeking higher yields, deposits on the platform also increased by 48%.

According to DeFi Llama, the total value locked (TVL) in Compound stands at $11.9 billion. At its peak in September 2021, the figure was estimated at $12.97 billion.

Earlier in the protocol, an update containing a critical vulnerability was activated. Due to an error in the distribution process of the COMP governance tokens, the project lost $82 million.

In October, unknown actors again exploited the bug to withdraw assets from the Compound smart contract. This time, more than $160 million was at risk.

Community members unanimously approved activating RFP-064, intended to close the vulnerability.

Subscribe to ForkLog news on VK.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!