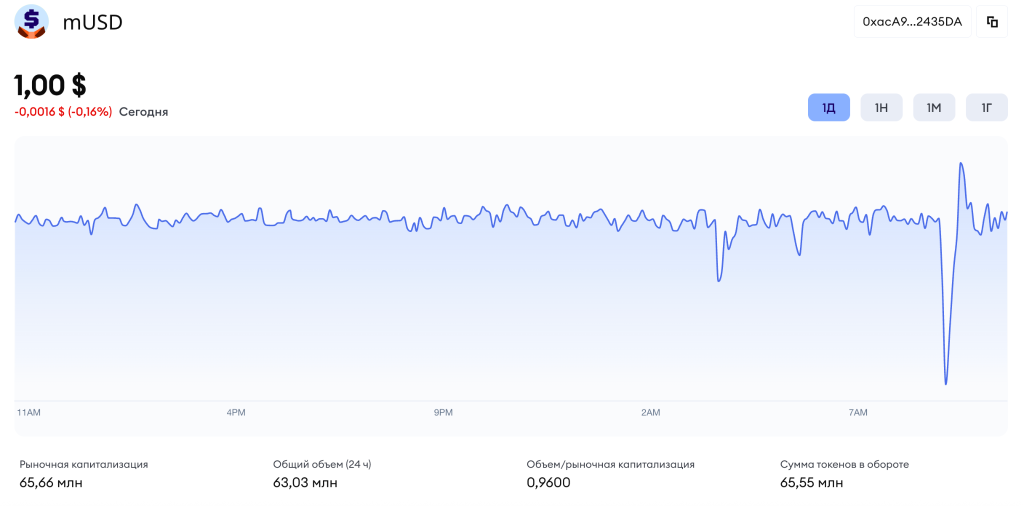

MetaMask’s Stablecoin Issuance Surpasses $65 Million

The majority of the stablecoin's issuance is on the Linea network.

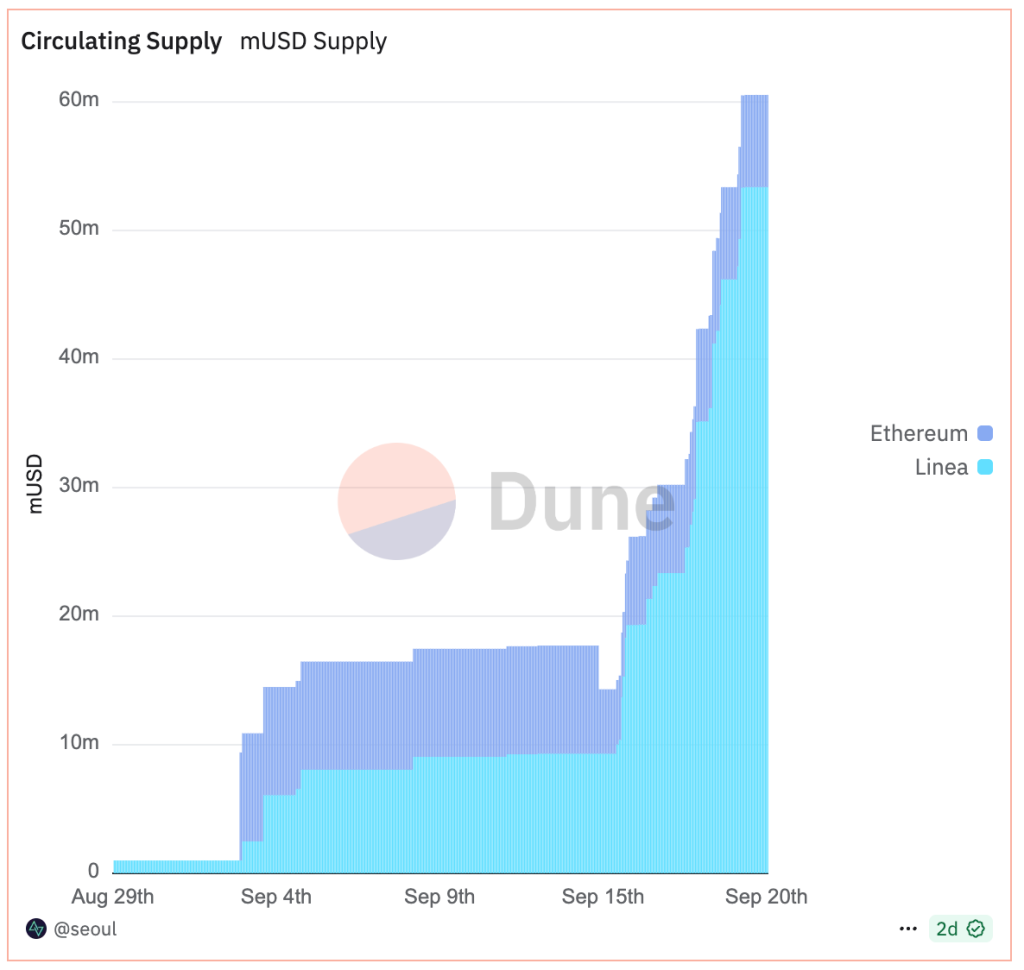

The supply of MetaMask’s stablecoin, mUSD, surged from $15 million to $65 million within a week of its launch, according to data from the Web3 wallet’s website.

The majority of the stablecoin’s issuance is on the Linea network—88.2%. The remaining 11.8% is on Ethereum.

The MetaMask team announced the launch of mUSD at the end of August, with the release occurring on September 15.

MetaMask USD ($mUSD) is now live. 🦊

The best way in and out of crypto is here. pic.twitter.com/h6zSUao7Ka

— MetaMask.eth 🦊 (@MetaMask) September 15, 2025

mUSD is issued via Stripe’s Bridge platform using the decentralized M0 infrastructure. The stablecoin is fully backed by liquid dollar equivalents—cash and short-term treasury bonds—at a 1:1 ratio.

On September 19, Ethereum co-founder and ConsenSys CEO Joseph Lubin stated that MetaMask is also preparing to launch a native token in the near future.

The Stablecoin Market Landscape

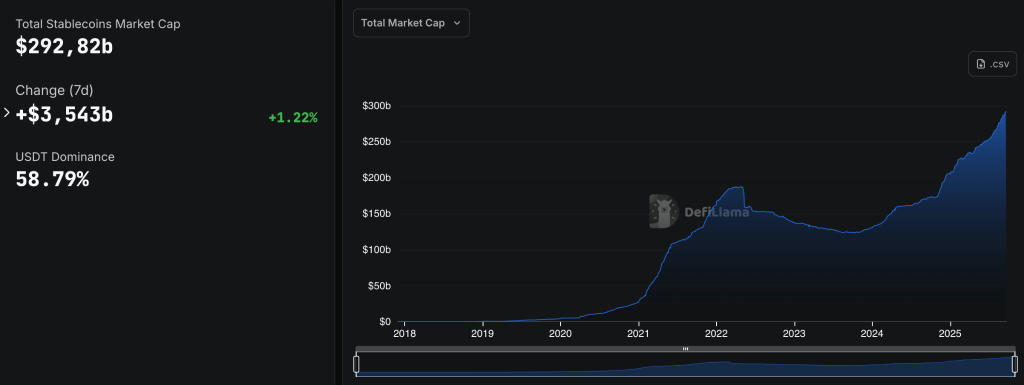

The increase in mUSD issuance coincided with a general rise in the supply of dollar-pegged stablecoins, reaching $279.8 billion. USDT from Tether remains the leader, accounting for $172.3 billion.

On September 21, the market capitalization of the stablecoin sector exceeded $292.8 billion for the first time.

On September 22, it was announced that blockchain platform Kaia and LINE NEXT, the Web3 division of South Korean messenger LINE, have partnered. The parties announced the launch of a stablecoin-focused “super app” called Project Unify.

Asia’s waking up to the trillion-dollar stablecoin puzzle

Every day, millions of people across this continent move money the same way their grandparents did, through systems built decades before the internet existed.

But something is different. Let us tell you what’s really…

— Kaia (@KaiaChain) September 22, 2025

The new service will integrate payments, transfers, and fiat gateways into a single interface. Users will be able to:

- earn rewards for holding stablecoins;

- transfer funds via the messenger;

- make global purchases with cashback.

Developers will also introduce an SDK for integrating stablecoins into third-party applications. The platform will support stablecoins pegged to the US dollar, Japanese yen, Thai baht, and other Asian currencies.

The beta version of Unify is scheduled for launch by the end of the year.

Analysts at JPMorgan described the issue as a “stablecoin race.” They noted that the anticipated wave of stablecoin launches in the US could turn into a zero-sum competition.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!