Michael Saylor Proposes Bitcoin Strategy for Microsoft

Transitioning to Bitcoin could add $5 trillion to Microsoft’s market capitalization, according to MicroStrategy founder Michael Saylor in a presentation to the tech giant’s board of directors.

Saylor suggested the company convert its reserves, cash flows, and debts into Bitcoin. He believes this would boost MSFT’s stock growth:

“If you do this, you will add hundreds of dollars to the stock price. You can create trillions of dollars in enterprise value. You can de-risk your shareholders.”

Microsoft should invest $100 billion in Bitcoin annually, added the head of MicroStrategy.

“What if you could buy a $100 billion company growing faster than Microsoft? What if you could do this every year?” Saylor noted.

In his presentation, he calculated that such a move would add $584 to the stock price over the next ten years if Bitcoin reaches $1.7 million by 2034. The company’s market cap should increase by $4.9 trillion.

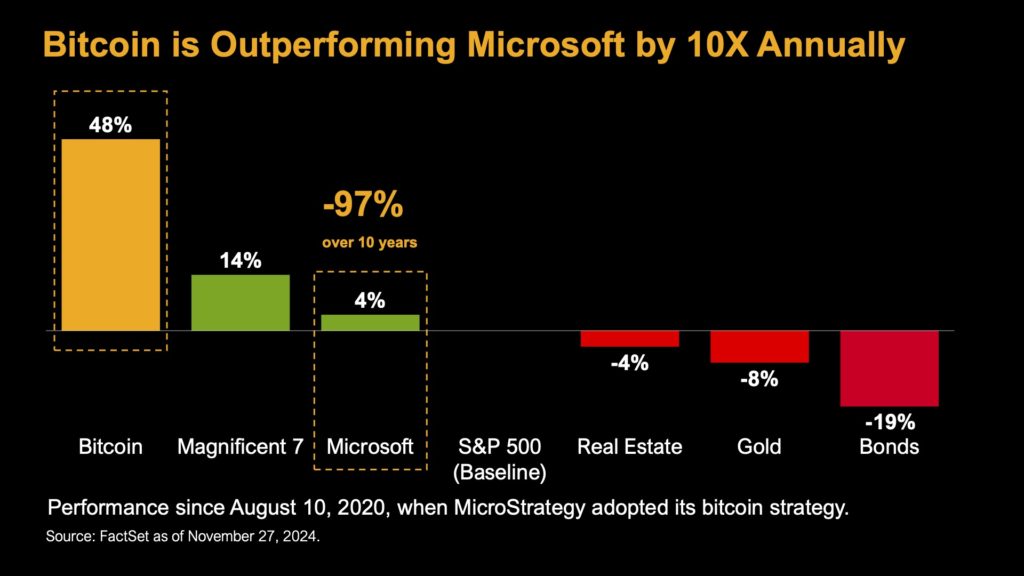

He also compared the growth rates of Microsoft, Bitcoin, and traditional financial instruments relative to the S&P 500 index.

According to calculations, the first cryptocurrency is growing ten times faster than Microsoft, while traditional investments like real estate, gold, and bonds are declining.

Saylor emphasized that buying Bitcoin is more logical than repurchasing one’s own shares, and holding digital gold is more rational than traditional bonds:

“If you are going to outperform the market, you will need Bitcoin.”

The head of MicroStrategy noted that with the change of government in the US and the excitement around the idea of a national Bitcoin reserve among state authorities in many countries, the investment appeal of the first cryptocurrency has only increased.

“Bitcoin is the best asset you could own,” Saylor is convinced.

At the time of writing, MSFT shares are trading at $423. The company’s market capitalization is $3.15 billion.

Back in November, analysts suggested that by the end of 2033, MicroStrategy could absorb up to 4% of the total Bitcoin supply.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!