MicroStrategy Acquires Additional 122 BTC

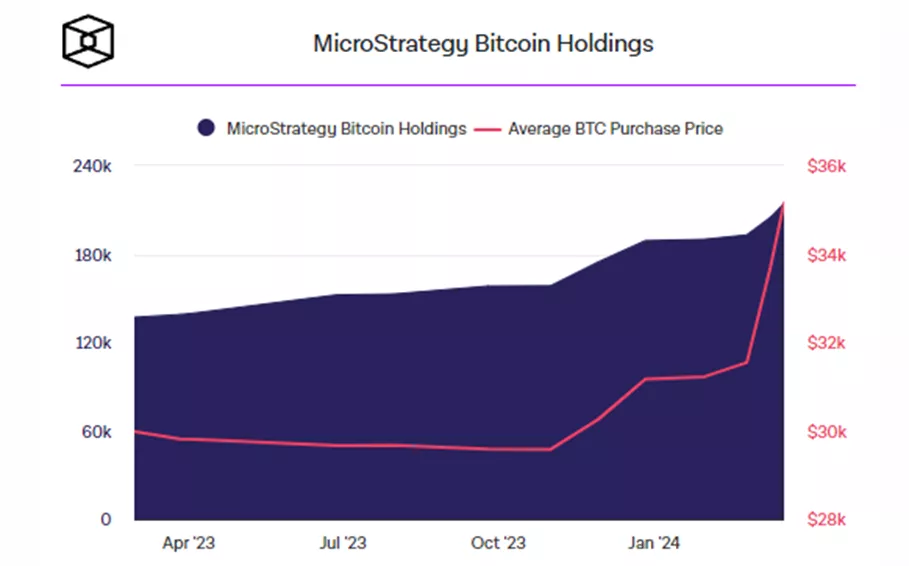

In April, MicroStrategy acquired an additional 122 BTC ($7.8 million), bringing its bitcoin reserves to 214,400 BTC (~$13.5 billion), according to the latest report.

The company allocated a total of $7.54 billion for the purchase of crypto assets at an average price of $35,180 per coin.

At the end of the first quarter, MicroStrategy held 214,278 BTC. An additional 122 BTC were purchased after the reporting date, according to its founder Michael Saylor.

In April, @MicroStrategy acquired an additional 122 BTC for $7.8 million and now holds 214,400 BTC. Please join us at 5pm ET as we discuss our Q1 2024 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/h40yyrgEb0

— Michael Saylor⚡️ (@saylor) April 29, 2024

Since December 31, the company has acquired 25,250 BTC for $1.65 billion — at $65,232 per BTC. The corporation has continued its trend of increasing reserves in digital gold for 14 consecutive quarters.

“In the first quarter, we raised over $1.5 billion through capital market strategies, including two successful convertible debt offerings,” noted CFO Andrew Kang.

On March 19, MicroStrategy added 9,245 BTC to its balance, spending $623 million. The company’s cryptocurrency reserves reached 214,246 BTC — over 1% of the total digital gold supply.

Earlier, its founder Michael Saylor stated that the firm does not intend to sell its holdings of the first cryptocurrency in the near or long term.

MicroStrategy plans to transition into a “developer of bitcoin and products based on it.” Since its inception, it has focused on creating and supporting analytical software.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!