MicroStrategy Rebrands as Strategy Amid $670.8 Million Loss

- MicroStrategy removed Micro from its name, emphasizing its commitment to acquiring digital gold.

- Net loss in Q4 amounted to $670.8 million; the company will adopt new digital asset accounting standards.

- In 2025, management aims to earn $10 billion from the revaluation of the leading cryptocurrency.

MicroStrategy has rebranded, changing its name to Strategy. The corporation explained the decision as a move to reflect its stance on the leading cryptocurrency.

The primary color of its branding has shifted from red to orange, symbolizing “energy, intelligence, and bitcoin.” The new logo features a stylized letter B, representing the strategy of buying and holding digital gold.

CEO Phong Le emphasized that Strategy is engaged in “innovations in the two most advanced technologies of the 21st century — bitcoin and AI.” The name “powerfully and simply conveys the universal and global appeal of the company.”

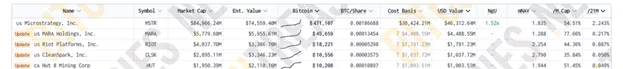

The organization holds 471,107 BTC, making it the largest corporate holder of the leading cryptocurrency.

Since August 2020, Strategy has spent approximately $30.4 billion to build its bitcoin reserves, averaging $64,511 per coin. Currently, the position is valued at $46.3 billion.

According to the plan adopted in October 2024, “Plan 21/21,” Strategy intends to raise $42 billion in equity and debt over three years.

The funds are intended to finance further bitcoin purchases. By early February, the company had raised about $20 billion, including $584 million since the beginning of the year, “significantly ahead of initial timelines.”

In December, Strategy’s management increased the volume of shares offered for sale under the initiative by more than $10 billion.

Net Profit Target — $10 Billion

For the October-December period, the organization reported a net loss of $670.8 million on revenue of $120.7 million. The corporation made a negative revaluation of digital assets amounting to $1.006 billion, compared to $39.2 million a year ago.

CFO Andrew Kang promised to switch to fair value accounting for coins under the new FASB methodology, which “will make treasury operations profitability more transparent.”

In 2025, Strategy plans to achieve a net profit of $10 billion from its bitcoin position. The goal is formalized as a new KPI called “BTC Gain in $” (also added “BTC Gain”).

Previously, management approved the metric “Year-to-Date Investment Return.” In 2024, the metric reached 74.3%, and since the start of the new year — 2.9% (target – 15%).

In the fourth quarter, Strategy acquired 18,887 BTC for $20.5 billion.

Earlier, the corporation’s founder, Michael Saylor, stated his intention to transform it into a bitcoin bank with a capitalization of $1 trillion.

By the end of 2033, MicroStrategy is expected to own 4% of the total supply of digital gold — 830,000 BTC at a price of $1 million, according to Bernstein.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!