MicroStrategy Shares Poised for Surge Amid Nasdaq 100 Inclusion

The momentum for MicroStrategy (MSTR) is expected to continue, with potential inclusion in the Nasdaq 100 index this month and increased focus on cryptocurrencies in the United States. This was stated by Bernstein experts, as reported by The Block.

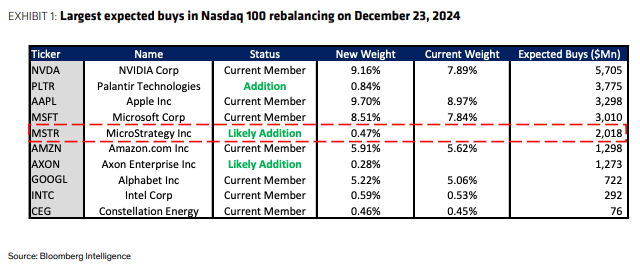

On December 10, Bloomberg analyst James Seyffart suggested that the announcement of MSTR’s inclusion in one of the largest American stock indices would be made on December 23. According to his calculations, the volume of the company’s securities purchases through ETFs will amount to at least $2.1 billion.

The ever so dashing @JSeyff spilling the beans on what we already know — MSTR is coming to the Nasdaq on Friday. Then S&P500 once FASB rules change on #Bitcoin and they can show profit end of Q1. How will $2.1 Billion of immediate stock buying affect MSTR’s share price? Are we… pic.twitter.com/e8w6Sv0JGN

— BRITISH HODL ❤️??❤️? (@BritishHodl) December 10, 2024

“Joining the S&P 500 will be more challenging due to the lack of income. However, changes in rules related to Bitcoin valuation could give MicroStrategy a chance for inclusion,” he added.

Another Bloomberg analyst, Eric Balchunas, confirmed his colleague’s assumptions. He expects an announcement from Nasdaq as early as December 12-13.

$MSTR is likely to be added to $QQQ on 12/23 (w/ announcement coming 12/13). Moderna likely to get boot (symbolic). Below is best guess of adds/drops via @JSeyff. Likely a 0.47% weight (40th biggest holding). There’s $550b of ETFs tracking the index. S&P 500 add next yr prob. pic.twitter.com/rmTavtvWQL

— Eric Balchunas (@EricBalchunas) December 10, 2024

Balchunas suggested the exclusion of Moderna Inc (MRNA) shares from the index due to a loss of market capitalization share. In contrast, MSTR’s weight increased to 0.46%—the 40th largest asset in the stock market.

“Many investors may have doubts about MicroStrategy’s premium to NAV and its Bitcoin purchasing program, which depends on the ability to issue shares and convertible debt with this premium,” noted Bernstein.

However, analysts emphasized that this could continue for a long time. The company has already used about $15 billion of the planned $42 billion to purchase the first cryptocurrency and shows no signs of slowing down. Moreover, as digital gold accumulates, the premium in shares will normalize, experts indicated.

At the time of writing, MSTR is trading at $400.75, having risen 6.2% since the opening of today’s session.

Earlier, on December 9, MicroStrategy founder Michael Saylor announced the purchase of an additional 21,550 BTC for $2.1 billion. The firm holds 423,650 BTC at an average price of $60,324 per coin.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!