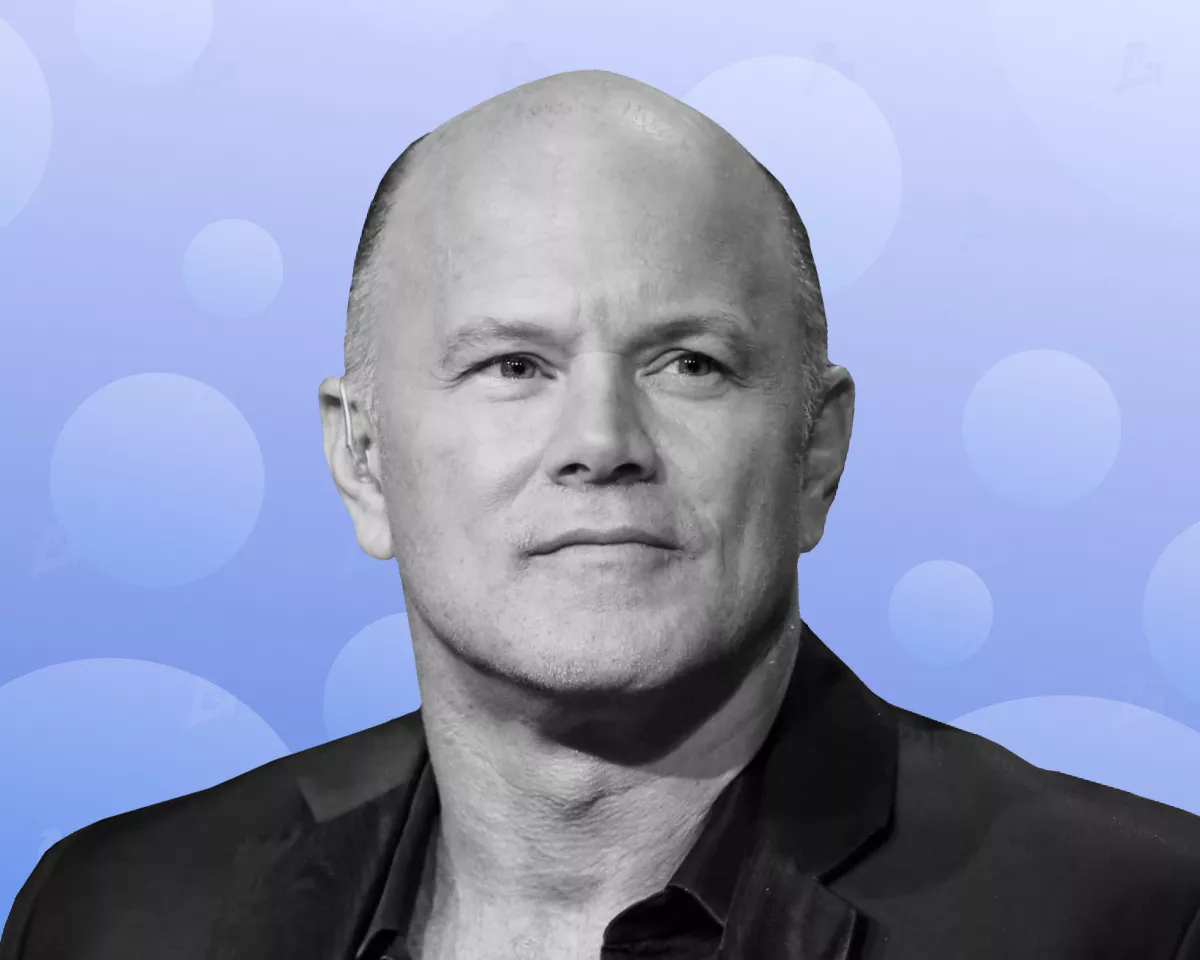

The collapse of the Terra ecosystem undermined trust in the DeFi sector and the broader crypto market, even as the idea of creating an algorithmic stablecoin looked promising. This was stated by Galaxy Digital founder Mike Novogratz.

After much thought, it’s time to talk about last week and, more importantly, the weeks ahead. https://t.co/m2pnzpe9Lu

— Mike Novogratz (@novogratz) May 18, 2022

Led by Novogratz, Galaxy Digital became one of the investors in Terraform Labs, which is developing the Terra ecosystem. And the executive himself identified as one of the so-called ‘LUNATICS’, backing it with a tattoo on his left arm.

I’m officially a Lunatic!!! Thanks @stablekwon And thank you my friends at Smith Street Tattoos. pic.twitter.com/2wfc00loDs

— Mike Novogratz (@novogratz) January 5, 2022

In a letter to the firm’s employees, Novogratz said the company’s interests would not be harmed. The crypto bank has a cushion of liquidity and capital, he added. Novogratz attributed Terra’s fiasco to macroeconomic factors.

According to the Galaxy Digital CEO, the low rates in traditional markets spurred speculative demand for UST in the Anchor protocol, with a yield of 18%, which displaced other Terra use cases. Going forward, pressure on reserve assets combined with the withdrawal of stablecoins created stress akin to a bank run.

There were not enough reserves to prevent the collapse of UST. Looking back, things always look clearer. My tattoo will be a constant reminder that venture investing requires humility, Novogratz admitted.

For the executive, the Terra USD collapse was yet another reminder of the need to adhere to the following investment principles:

- portfolio diversification;

- partial profit-taking;

- a risk-management framework;

- an understanding of the macroeconomic backdrop.

Many private investors could have avoided ‘heart-wrenching losses’ if they had invested no more than 1–5% of their savings in the asset. Novogratz stressed that only the funds one is psychologically prepared to lose should be used.

The executive forecast that conditions in the cryptocurrency market would remain challenging in the near term. That does not change his expectations of favourable prospects going forward.

As a reminder, the CEO of Galaxy Digital warned about threats to support levels at $30 000 for Bitcoin and $2000 for Ethereum.

Earlier in Forbes назвали крах UST и LUNA «пятой перезагрузкой» крипторынка.

Подписывайтесь на новости ForkLog в Telegram: ForkLog Feed — вся лента новостей, ForkLog — самые важные новости, инфографика и мнения