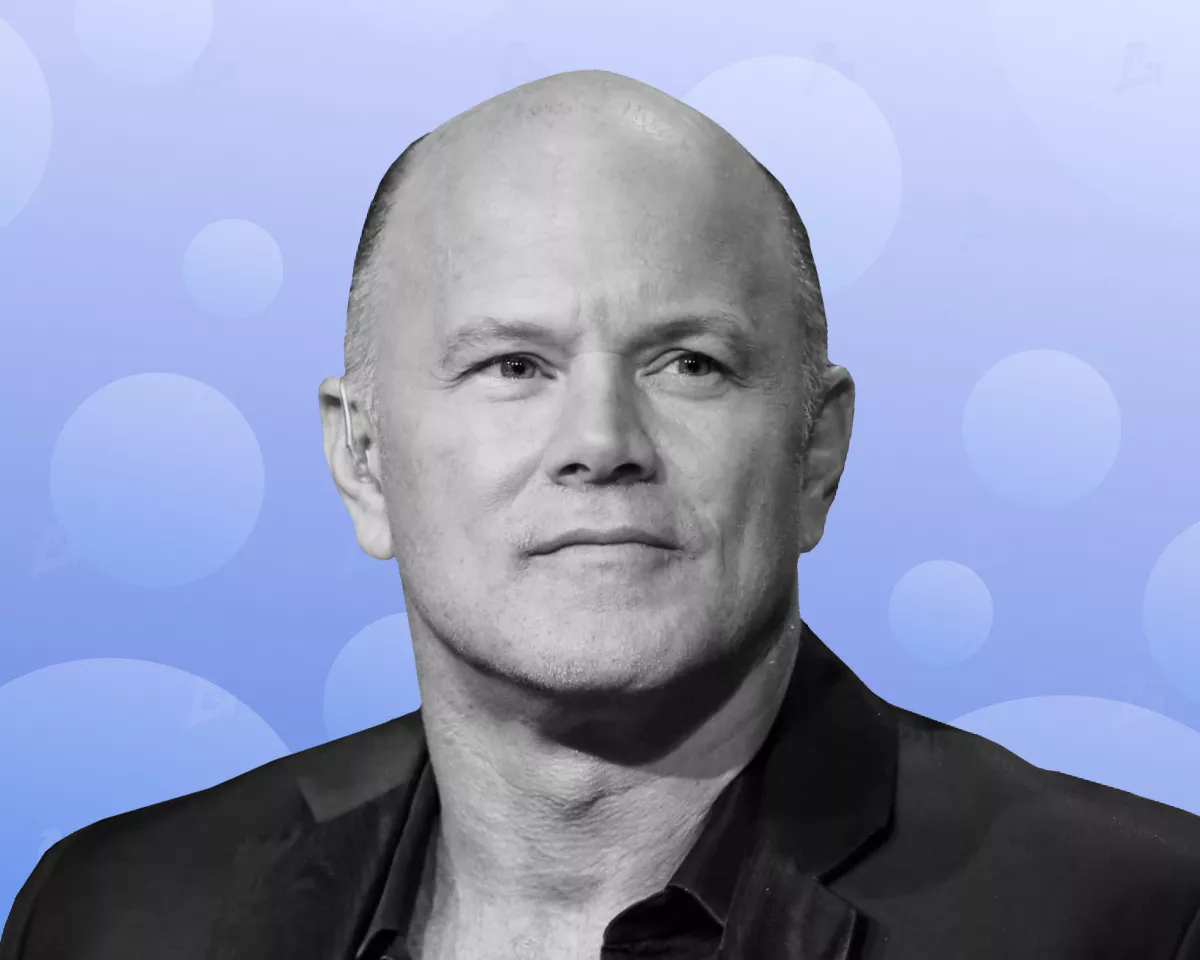

Bitcoin will lead a new rally in the cryptocurrency market once the U.S. Federal Reserve stops raising the federal funds rate, said Galaxy Digital CEO Mike Novogratz in an interview with CNBC.

“Bitcoin will lead the markets when the Fed retreats. As soon as the regulator wavers, prices will surge,” said Novogratz.

Following the June 14-15 meeting, the Fed raised the target range for the federal funds rate by 75 basis points — to 1.5-1.75%. Fed Chair Jerome Powell also said that in July the rate could be raised by another 0.5%-0.75%.

Bitcoin prices reacted with a brief uptick, but the next day the price retraced. At press time, the leading cryptocurrency was trading near $21,217.

According to Novogratz, the Fed’s decision sparked certain fears about an impending recession, but investors will not rush to place money in high-risk assets like Bitcoin.

“Many of the guys I’ve talked to expect they will start acting when they sense the Fed is about to pause. As long as the regulator remains hawkish, any risk asset will struggle to deliver truly good results,” he added.

The Galaxy Digital chief also acknowledged that, despite portfolio diversification, the current crypto-market crisis has been more painful than previous bear cycles. In his view, this is driven by the higher price of digital assets.

Led by Novogratz, Galaxy Digital became one of the investors in Terraform Labs, which is developing the Terra ecosystem. The top executive also counts himself among the so-called ‘LUNAtics’, backing this with a tattoo on his left arm.

After the collapse of TerraUSD and Luna, he called the project ‘the biggest idea that failed’.

In June 2022, Novogratz said that Bitcoin will not fall below the $20 000 level, while Ethereum prices would stay above $1,000.

As reported in April, Novogratz had already voiced the thesis that the Bitcoin rally would resume following the Fed’s monetary policy easing.

Follow ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.