Monetising entertainment: how GameFi is changing the gaming paradigm

In 2021 the GameFi sector was one of the main drivers of growth in the cryptocurrency market. 1.4 million wallets were connected to decentralised applications in this space, the volume of in-game NFT trades exceeded $4.5 billion, and venture capitalists pumped more than $4 billion into the segment.

GameFi is reshaping the industry’s paradigm: the Play-to-Earn (P2E) business model allows financial rewards not only for developers but also for gamers and content creators. Some users see this as a means of supplementary earnings; others see an alternative to full-time work.

- Gamers have long earned money from in-game activities. However, P2E projects remove intermediaries in the monetisation chain in the form of streaming services, third-party marketplaces and esports organisations.

- Blockchain games can generate income, but the amount earned depends on market conditions, user investments, developers’ actions and a number of other factors.

- The entry barrier into GameFi is fairly high, so guilds sponsoring participants in exchange for a share of the earnings are gaining popularity.

- The companies behind P2E are pursuing a sustainable economic model. This is a young field, and existing projects have tokenomics issues.

Gamifying income

Gamers have long learned to monetise in-game activity, and quite successfully. One obvious method is streaming. The Twitch data leak in October 2021 showed that popular streamers earn hundreds of thousands of dollars a month.

Here’s a more comprehensive list of leaked Twitch payouts (I will keep updating this thread as more things come out). pic.twitter.com/15JItvp6l4

— KnowSomething (@KnowS0mething) October 6, 2021

Among other options are selling skins (in-game items) on third-party marketplaces, account trading and boosting. Esports should not be overlooked either — the size of this market exceeded $1 billion.

However some of these practices, for example account trading, game publishers consider illegal, and the chances of breaking into the pro scene or becoming a popular streamer are slim for ordinary players.

The P2E model uses blockchain to give players rights to exclusive ownership of digital items. Users do not need “crutches” to monetise their activity. All that is required is to play and generate value, which can then be realised at will.

Examples such as Axie Infinity have shown that you can earn money even from home by playing. However, the amount of this income varies greatly depending on the game’s tokenomics, user actions and market conditions.

«An Axie Infinity player from the Philippines bought two houses with his earnings from the popular crypto-powered play-to-earnings game.»

Congrats John! So amazing to see the impact Axie is having on people’s lives 🙌🔥https://t.co/l7ZsWeQlYu

— Axie Infinity🦇🔊 (@AxieInfinity) July 29, 2021

Can you earn in P2E games?

The short answer is yes. But calculating exact earnings is difficult.

Earnings depend on the overall market picture, the player’s efficiency and luck, and the time they are prepared to devote to the process. Rewards and restrictions set by developers also matter.

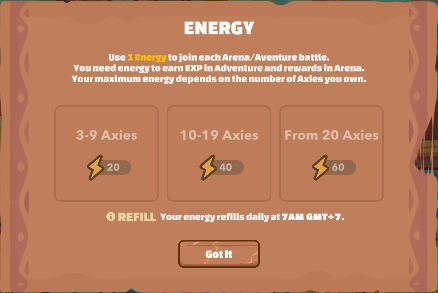

For example, in Axie Infinity a player’s actions are limited by “energy” — a resource expended for each PvP or PvE battle and fully recharged at the start of a new day. The amount of energy depends on the size of the collection of Axies.

Similar constraints exist in most P2E games. For instance, in Splinterlands the barrier is the daily DEC token pool size.

Gamers earn Smooth Love Potion (SLP) and the governance token Axie Infinity Shards (AXS). They can earn:

- ~2,250 SLP per month for completing daily quests;

- up to 39,000 SLP per month from PvP arena battles (at high ratings, assuming 100% wins).

At the current SLP price (~$0.01), a successful gamer can earn up to $412, not including income from staking AXS staking and selling NFTs.

But the described situation is an example of an “ideal storm.” To achieve the stated income, a user would need to win every single battle for a month, which is practically impossible for obvious reasons.

It is telling that in May 2021 a player could earn more than $650 in a month simply from daily quests. In January 2022, this activity would yield just over $22 as the SLP price fell by 96%.

Also noteworthy are the arena leaderboard prizes. The prize pool is set by the developers — in the latest 19th season they allocated 3,000 AXS, in season 18 — 5,000 AXS.

In season 19 the player who took first place in the ranking obtained 135 AXS (~$7,060 at the current rate). Yet the developers themselves determine the season’s duration, and securing prize places is extremely difficult.

Another income source in Axie Infinity is trading Axies — combatants that make up a player’s team — as well as land and cosmetic items. All are NFT-based.

Players can breed Axies, spending SLP and AXS. To prevent “pumping” the activity, developers imposed a limit — a creature can pass its genes only seven times, and each new iteration costs more than the previous one. Axies obtained can be kept or listed on the marketplace.

Earnings in P2E projects also depend on the investments of gamers directly. Rare combat creatures in Axie Infinity or ships and high-level gear in Star Atlas increase the owner’s income, but they cost a lot. This raises the entry barrier for novices.

One option for beginner players is to join a guild — an organisation that sponsors participants in exchange for a portion of their earnings.

A lone gamer is no match

A guild is an organised group of people united around similar economic interests and seeking common goals. In traditional games, guilds are usually formed by players with various character archetypes to accomplish tasks like conquering dungeons.

In blockchain games, guilds can be broadly divided into two categories: game-oriented and GameFi.

Game-oriented guilds resemble traditional ones. Their main task is to achieve specific in-game goals such as farming rare equipment, expanding territories and completing quests.

GameFi guilds are focused on maximise profits from P2E projects. They can be likened to esports organisations that hire a pool of skilled players and provide them with everything needed to participate in events in exchange for a share of the prizes.

Entry barriers in some P2E projects remain high. For Axie Infinity one must assemble a team of three Axies. The price of these creatures depends heavily on their characteristics and rarity. At the time of writing the minimum cost of an Axie is $29.

Thus a gamer hoping to join a project must have at least about $87 in starting capital. It may seem modest, but that refers to buying an Axie with low stats that may not fit the metagame. Such creatures make it hard for the player to win battles and thus earn SLP.

The cost of Axies also depends on market conditions — during a bull run assembling a team is more expensive.

GameFi guilds generally hold substantial capital — by the end of 2021, Yield Guild Games (YGG)’s assets under management (AUM) exceeded $824 million. This enables them to provide participants with NFTs and other resources needed to play. In return they take a percentage of earned tokens.

YGG members among Axie Infinity players contribute 30% of their earnings to the guild. In other organisations the percentage can differ. For example, Blackpool charges 40%.

Crypto Gaming United (CGU) co-founder Sergey Sergienko told ForkLog that the percentage can vary with market conditions. He said that if a standard offer implies a 50% take, on a falling market the guild gives players all the income.

“Right now [in Axie Infinity] we give all the income to the player, as the SLP price is at rock bottom and we are supporting our players to the extent that they do not scatter,” he noted.

To form a guild it is not necessary to establish a DAO. However, a decentralised structure helps preserve community coherence as the organisation scales. Hence some large teams, such as Merit Circle and YGG, adopt such architecture.

How will the YGG DAO work? Find out more in our latest article! https://t.co/HTkBPxVgaf

— Yield Guild Games (@YieldGuild) July 9, 2021

The polar view argues that a DAO structure, by contrast, can become a barrier to scaling. Konstantin Sinev, Liberty Gaming Guild’s marketing director, says that for long-term growth the guild needs investor backing:

“For this, alas, the influence of the player community is not enough — large profits imply issuing a token of its own and maintaining activity around it. The guild becomes like an ETF for those who want to invest in GameFi. And that comes with consequences — when it comes to financial management, you have to curb the influence of the DAO concept.”

Fragile tokenomics

P2E projects are not just games in which you can earn money. The most successful sector players rely on complex economic models that determine how resources will be allocated.

The studios behind blockchain games are focused on profitability. Moreover, sustained fund inflows are needed for their development. Developers are in constant search of a balance between engaging gameplay and a system of incentives that encourages users to invest time and money in the product.

According to Cara Wu, a crypto-products analyst at Andreessen Horowitz, behavioural economics posits four driving forces that shape the basic architecture of human motivation:

- the drive to acquire (tokens, NFTs);

- the drive to social bonds (friends, guilds, DAOs);

- the drive to invent (content creation);

- the drive to defend (territories, ideology, battles).

She emphasised that the ability to realise in these directions matters not only for gameplay but also for the game’s economy.

Building many ways to win along this 4 dimensional achievement space is not just good for gameplay, but also existential to the macroeconomy. Players who value the drive to bond, invent, or defend most highly supply liquidity and subsidize players who value the drive to acquire.

— carra.eth (@WuCarra) October 7, 2021

“Players who value social bonds, invention and defence the most provide liquidity and subsidise users oriented toward acquisition,” Wu wrote.

In addition to retaining users, developers must build an economic model that will not collapse as the project scales.

According to Konstantin Sinev, even in closed-economy projects specialists constantly monitor inflation of in-game currencies, carry out additional issuance or, conversely, reduce it. He stressed that teams behind games like Axie Infinity need to do the same.

“The economy of any game is an endless calibration. You cannot release something and simply attend to user support. … The risk of an economy collapse exists, but only if developers fail to learn from the experience of the “older” firms in time, of course adapting it to the realities of GameFi,” Sinev said.

Jonathan Lai of Andreessen Horowitz noted that developers can influence the economy via “tokenised resources.” He said the crafting system for equipment and other in-game items allows the studio to perform the role of a monetary regulator.

16/ By changing the formula for inputs that go into finished goods, a game designer can balance the economy through a layer of abstraction. It’s similar to a central bank changing interest rates to control inflation vs directly setting prices 🏦

— jonathanylai.eth (@Tocelot) September 19, 2021

“By changing the formula for resources that go into production of finished goods, a game designer can balance the economy. It’s akin to how the central bank changes interest rates to curb inflation rather than directly setting prices,” Lai wrote.

Tokenisation of resources also helps address another problem that could harm a project’s economy: a shortage of in-game stock for the cryptocurrencies.

A limited number of use cases for tokens inside the game prompts players to sell assets on external markets, which inevitably drives their prices down. Developers therefore seek to broaden the list of “economic sinks.”

Some themes for 2022:

• Launch new gameplay content

• Add needed economic sinks

• Supercharge our community

• Educate millions of new Web 3 usersWhat are yours? pic.twitter.com/0OgHEBtUNm

— Axie Infinity🦇🔊 (@AxieInfinity) January 11, 2022

Investment remains the same

GameFi tokens are extremely volatile — their value depends heavily on the overall market and network effects, which, if mismanaged by the project team, can bite on the downside as well. As a result, the potential return on investment can suddenly shrink, and recouping even initial outlays may take considerable time.

This is a relatively young sector, with no truly large AAA projects. Since these are games, they must be engaging first and foremost. The existing P2E products are niche.

Even in the metaverse segment, which some regard as the precursor to GameFi, the mass market tends to favour projects that do not rely on distributed ledger technology and the P2E model.

“As the next generation increasingly spends more time online, many investors (and speculators) are hoping to become real estate tycoons in the metaverse.”https://t.co/a5nypt9Xqh$RBLX https://t.co/laxdrKL7Q2 pic.twitter.com/rBmQr8VRni

— Martijn Kleinbussink (@BiasedRational) January 24, 2022

High entry barriers also weigh on the outlook. Moreover, users not focused on the gaming aspect of P2E turn to DeFi services, which can offer even higher yields.

According to Sergey Sergienko, the arrival of more sophisticated and engaging games will also affect venture capital appetite, which is already funding projects in the space.

“There is currently quite strong venture-capital interest in these stories — both in the games themselves and in the guilds. I think the industry will see further inflows, especially when projects are more compelling than simple games,” Sergienko said.

Developers are seeking a sustainable economic model, and in time the situation may improve. But for now P2E faces significant challenges, and projects in this space should be treated as investments. Blockchain games can generate income, but one must not overlook the accompanying risks.

Follow ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!