Morgan Stanley’s Bitcoin ETF Investments Reach $272 Million

Morgan Stanley’s investments in spot bitcoin ETFs have surpassed $272 million, equivalent to 0.02% of the bank’s AUM of $1.2 trillion.

The investment bank has observed significant client interest in these products following their approval by the SEC.

Morgan Stanley made these exchange-traded products available in August this year.

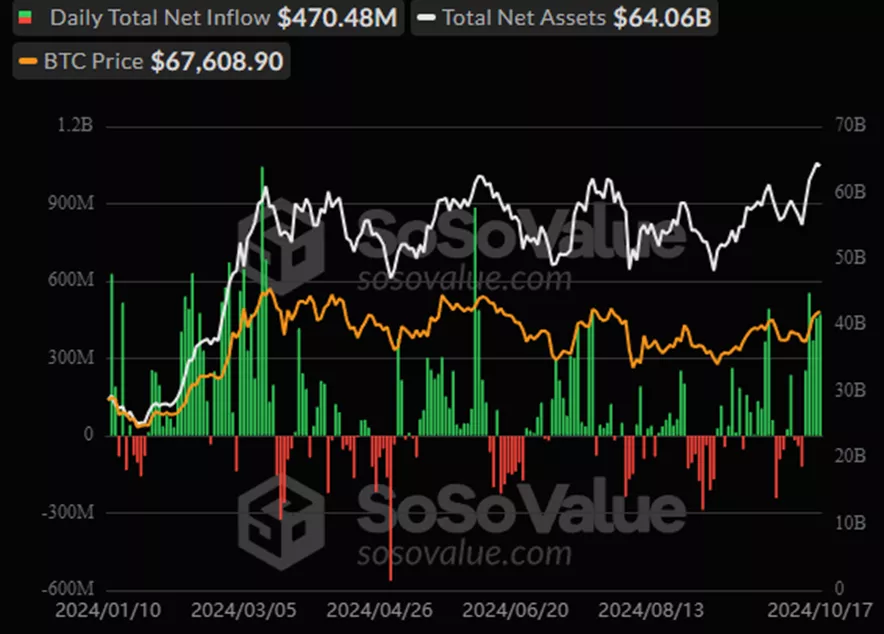

Total inflows into BTC-ETFs since trading began in January have risen to $20.7 billion.

On October 17, the inflow amounted to $470.5 million, with $2.11 billion over the past five days.

The head of global research at Morgan Stanley highlighted bitcoin mining stocks as a promising investment direction.

Morgan Stanley’s Global Head of Research is Pitching #Bitcoin Mining Stocks to CIOs ? pic.twitter.com/cVcRWdPfKJ

— matthew sigel, recovering CFA (@matthew_sigel) October 14, 2024

The expert noted the preparation of regulations that will require data centers to increase capacity. This could stimulate demand for energy-intensive industries such as bitcoin mining.

JPMorgan has pointed to the potential return of Donald Trump to the U.S. presidency and the need for a hedge against economic instability as drivers for cryptocurrency growth by the end of the year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!