Nansen Attributes Ethereum Decline to Market Sentiment Shift

The waning optimism among Ethereum investors has played a more significant role than the outflow from ETFs linked to the second-largest cryptocurrency by market capitalization. This conclusion was reached by Nansen, reports Cointelegraph.

Analysts associated the reduced risk appetite of market participants with the release of macroeconomic statistics.

According to experts’ calculations, since the start of ETF trading on July 23, investors have withdrawn $420.5 million from them. During this period, the price of Ethereum fell by 26%.

“Bitcoin corrected downward by 14%. In our opinion, this is ‘fatigue’ from risk appetite, unrelated to the ETF launch. […] The first sell-off in March led to realized losses. […] Then in July-August, a second one occurred, correlating with stocks. This happened against the backdrop of still confident but slowing U.S. economic growth and overvalued TradFi,” explained the specialists.

Nansen noted that the direction will depend on upcoming decisions by the Fed.

“It is unclear whether we are taking a pause in consolidation or if prices have peaked. If the Fed can proceed with cuts while maintaining GDP growth, the bull market for cryptocurrencies and stocks is likely to continue. However, if the [economic] growth slows sharply, risk assets will have fewer opportunities for price increases,” commented the analysts.

ETH-ETF

From August 12 to 16, the spot Ethereum-ETF segment recorded an outflow of $14.16 million compared to an inflow of $104.8 million the previous week, according to SoSoValue.

In total, $420.1 million was withdrawn from the products during the entire period.

The cumulative outflow from Grayscale Ethereum Trust (ETHE) increased to $2.41 billion. On August 16, the figure rose by $27.7 million.

Inflows into ETHA from BlackRock rose to $977.6 million, including $10.3 million on the last reporting day.

FETH from Fidelity attracted a total of $367.5 million, ETHW from Bitwise — $305.2 million, ETH from Grayscale — $222.9 million.

Inflows into other products ranged from $10.8 million to $60.1 million.

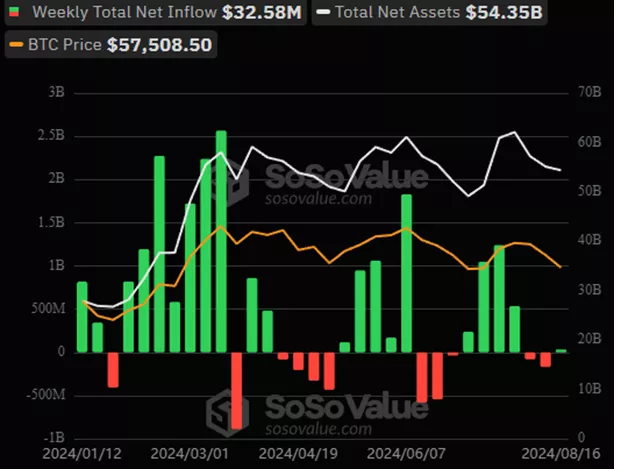

BTC-ETF

The negative trend in spot bitcoin-ETFs was interrupted. Over the calendar week, inflows amounted to $32.6 million.

The cumulative inflow since the approval of BTC-ETF in January increased to $17.37 billion.

Clients withdrew $19.7 billion from GBTC by Grayscale. Inflows into IBIT from BlackRock reached $20.39 billion, into FBTC from Fidelity — $9.8 billion, into ARKB from ARK Invest and 21Shares — $2.45 billion, into BITB from Bitwise — $2.04 billion. Inflows into other products ranged from $208.6 million to $582 million.

Bloomberg has forecasted the launch of options on BTC-ETF in the fourth quarter.

Earlier, the NYSE approached the SEC with a proposal to amend rules allowing it to list and offer trading options based on spot Ethereum-ETFs from Bitwise and Grayscale.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!