New record high sets bitcoin on course for $150,000, say analysts

Analysts do not rule out a pullback to $108,000–$118,000

On 5 October the first cryptocurrency set a new record high at $125,708. That signalled the start of the next leg higher towards $150,000, according to the analyst known as CrediBULL Crypto.

We blast through it.

Now that we’ve made new ATH’s in an impulsive manner, the next leg to 150k+ has begun imo.

At this stage- it is anyone’s guess how deep of a pullback we may get here at our highs (if any), but just like last time, anything above the lows of the origin of… https://t.co/UXOBiaFetD pic.twitter.com/CKIItoVMCc

— CrediBULL Crypto (@CredibleCrypto) October 5, 2025

He nevertheless allowed for pullbacks to the $108,000–$118,000 area — potential levels for accumulation.

“At this stage, everyone can only guess how deep the pullback will be (if there is one at all), but, as last time, anything above the lows from which this impulse began (at $108,000) is an acceptable scenario,” the expert noted.

Trader Crypto Chase concurred, confirming the start of another bull rally.

A new leg up seems likely. If BTC is truly strong, the pullbacks will be minor at best. Sweeping the 121.4K~ equal lows would accomplish the job of flushing late longs / trailed stops while not providing an easy entry to those on the sideline.

Unfortunately the entirety of… pic.twitter.com/gDaCqsX1W3

— Crypto Chase (@Crypto_Chase) October 5, 2025

“If bitcoin is truly strong, the pullbacks will be, at best, minor,” he stressed.

On 6 October the self-proclaimed “king of perpetuals” James Wynn wrote that the digital gold would set another ATH “in the coming hours”. At the time of writing the first cryptocurrency was trading at $123,900.

What is happening in the crypto market?

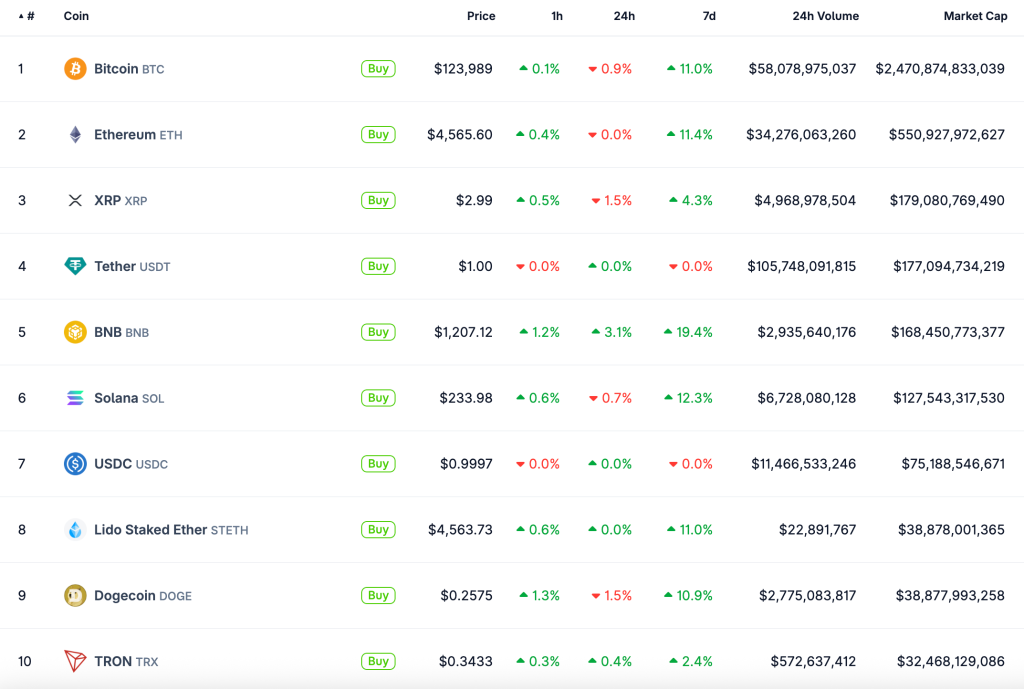

Over the past 24 hours the market value of digital assets fell by 0.6% to $4.3 trillion, according to CoinGecko. Among the top ten cryptocurrencies, BNB posted the best daily performance, with its price exceeding $1,200 for the first time.

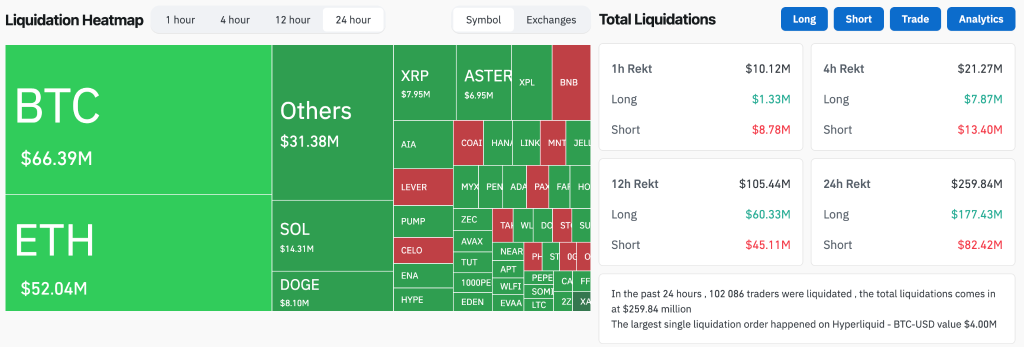

Bitcoin’s new record was not accompanied by significant liquidations.

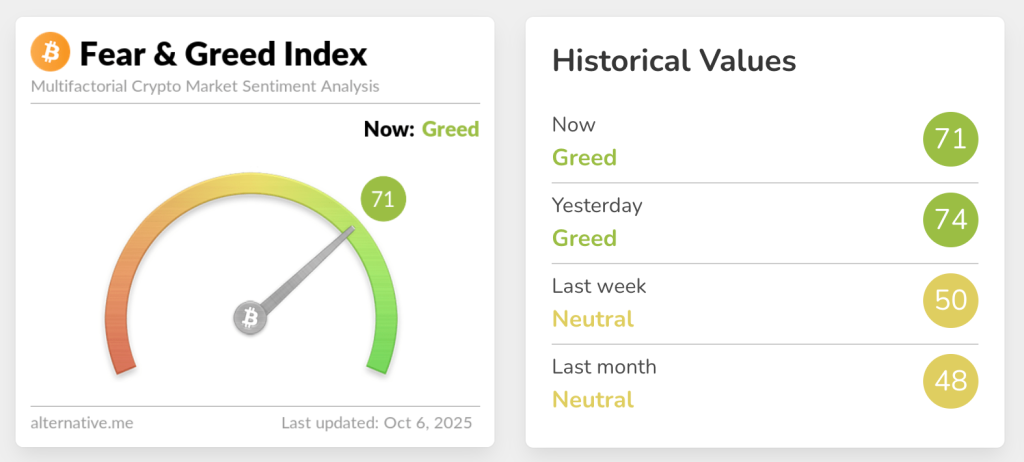

Fear Index is in the “greed” zone, signalling that bullish sentiment prevails.

Drivers of the crypto market

One possible driver of bitcoin’s rise was the US government shutdown, which began on 1 October. Following that event the cryptocurrency’s price jumped above $116,000.

Some community members noted that three of the last five shutdowns led to a pump in the digital gold.

Another traditionally supportive factor is inflows into spot ETF. From 29 September to 3 October, bitcoin-based products took in $3.2bn.

“We may get one last pullback, but the most bullish aspect of this bitcoin move is that it is not being driven by crypto-treasury companies or futures enthusiasts, but by spot ETF buying. This most likely indicates that macro portfolio managers and funds are viewing the cryptocurrency as an asset to rotate into from commodities and small-cap stocks,” noted analyst and trader Will Clemente.

Nate Geraci, president of Nova Dius, called this the second-best showing for ETFs since launch.

Bloomberg ETF analyst Eric Balchunas also said that bitcoin’s ATH followed “a wild week for ETFs with $3.3bn of inflows over a few trading sessions and $24bn year-to-date”.

Seasonality also matters — analysts earlier explained the pattern of rallies in the final three months of the year. According to CoinGlass, the first cryptocurrency has risen in eight of 12 fourth quarters.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!