NFTs as a new class of digital assets: Bitcoin and collectibles

ForkLog publishes the third installment in Dmitry Bondar’s series on non-fungible tokens (NFTs) as a new class of digital assets. First part is an introduction to the NFT market, the second—about the close kinship between cryptocurrencies and collectibles, the third—about NFT prospects.

What is a collectible?

Utility—or, in other words, consumptive value—of NFTs can vary widely, but by the community’s consensus, the usefulness of early NFTs such as CryptoPunks or CryptoKitties is that they are collectibles. It sounds grand, but it is not sufficiently precise.

If you open the ‘Collectibles’ tab (Collectibles) on OpenSea, the oldest NFT marketplace, you will see that NFTs in this category are heterogeneous. There are various game characters, digital art and collectible cards, Aavegotchi lottery tickets, stamps from the Austrian Post and even postcards from Binance.

How to determine whether an NFT is a collectible or not? On the OpenSea site there is a whole “NFT Bible” (NFT Bible), but there is no answer to the question “What are collectibles?” There is no such answer on other NFT-focused sites either. There exists an opinion that the distinction between collectibles and other NFT categories is that they are useless, but that approach does not work and here is why.

Not all collectibles are equally useless

Creating a useless token is not that easy. It’s not enough to simply declare that the token has zero financial value or to put in the site’s header Don’t buy this token. If a token has functionality, if it, like YFI, is used to interact with a DeFi application, or, like MEME, to obtain rewards promised by its issuer, then it is not useless.

If a collector pays for an item, it is not useless to him; it satisfies his need. The thing, becoming a collectible, gains additional usefulness, and by itself, not being a collectible, can be either useful (for example, a gold coin) or useless (for example, an autograph).

Jean Baudrillard contrasts two motives for acquiring things: ordinary things are needed for their functionality, and collectibles for the pure possession of them. Nevertheless, when something becomes a collectible, its functionality does not disappear; it simply recedes into the background. A useful thing does not become useless because it is collected.

Whether something is a collectible or not is determined not by the producer, but by the collector. The item becomes a collectible thanks to the collector, who devises the concept of the collection and thereby endows the item with additional usefulness.

NFTs take the collecting of digital objects to a new level, but you can collect anything, including any tokens, both fungible and non-fungible.

Any object dreams of becoming a collectible, but that is not the end of its career. Some collectibles can become money.

Turning collectibles into money

Dror Goldberg is one of the few scholars who notes that primitive means of exchange, such as the island’s stone money and shell money, were not useless: they had aesthetic and symbolic value and were sacred objects. These items, with some caveat, can be read as specific collectibles.

Nick Szabo in his study of the nature of money, published in 2002, develops the idea of money originating from collectibles, but for obvious reasons he did not apply it to Bitcoin. This was done by Conrad Graf in 2013.

Bitcoin as a collectible: yesterday and today

Originally, Bitcoin was indeed more of a collectible than money — it was an experimental toy of a small circle of cryptopunks, in no way connected to real economics or to the economics of any game. It is also notable that Mt. Gox, the first exchange where Bitcoin traded, specialised in trading ‘Magic: The Gathering’ cards — a collectible card game.

Today, Bitcoin is no longer simply a collectible with symbolic value, but a recognised financial asset that, to some extent, performs the functions of money. Nevertheless, today Bitcoin means more to collectors than in 2009. It is no longer merely the sole, but the first in history cryptocurrency, the supply of which, as befits a collectible, is capped. Dmitry Starodubtsev goes further and says that today Bitcoin, technically, is no more than a collectible antique.

Strictly speaking, bitcoins are not fully fungible: each coin has its own unique provenance. Reputable exchanges try not to deal with dirty bitcoins, while clean bitcoins trade at a premium. For bitcoins sent by Satoshi Nakamoto to Hal Finney, collectors would probably pay even more than for the cleanest freshly minted bitcoins.

Dirty and clean bitcoins, as with fiat currencies, are fungible in that they share the same functionality; they can be divided and merged without loss of properties. Indivisible NFTs, existing in a single instance, are hard to use as money. Hard, but possible.

Turning NFTs into money

You can wrap NFTs into divisible and fungible ERC-20 tokens — thus the shard market emerged. The limit of shards is that even top NFTs typically cost under $100,000. To create an NFT-backed currency with a supply of at least $1 million, you need to tokenize not a single NFT but a basket of NFTs.

The Whale token is the first project of a currency backed by a basket of NFTs. Central banks print money against promises to pay — against this backdrop, money backed by digital artworks, collectible cards and virtual-world assets does not seem so absurd. The supply of such a currency is no longer limited by the price of a single NFT but by the market capitalization of liquid NFTs. Unfortunately, it remains relatively small, so printing a lot of money from NFTs is not yet feasible.

If something dreams of becoming a collectible and a collectible becomes money, what do money dream of? Of course, to become collectible.

Turning money into collectibles

No, we won’t discuss banknotes that have fallen out of circulation and have value only for numismatists. We won’t discuss special collector coins issued by modern central banks, nor rare examples of the current national currency sought by collectors. All of this has happened. There have also been collectors of cryptocurrencies joining numismatists and banknote collectors.

Something truly new is “live” fungible financial assets that turn into NFTs. No, not insurance policies like yinsurenft; that would be too easy.

Enjin

The Enjin project offers users to turn Enjin Coin (ENJ) tokens into various in-game items. To create a game asset on the Enjin platform, you must deposit a certain amount of ENJ. As a result you obtain, for example, a unique in-game sword backed by ENJ, which can be used in the gaming multiverse, i.e., across more than one game.

Meet a new class of digital assets — a game item backed by cryptocurrency. The holder of this game item can redeem it for ENJ at any time: the item melts, the NFT is burned, and the user receives ENJ that backed it. The price of such game items will be influenced not only by the state of the game-asset market but also by the market for the cryptocurrencies that back these items. If a sword backed by ENJ can be sold for more than the ENJ backing it, there is no need to melt it. If the sword cannot be sold and money is needed, you can melt it and sell ENJ on an exchange.

Enjin’s solution is limited by the fact that the backing for a game asset can be only ENJ. This is because ENJ was sold in an ICO, and the project team needed to invent a utility for its token. A game asset backed by more liquid crypto assets looks more impressive. The Aavegotchi project has taken a step in this direction.

Aavegotchi

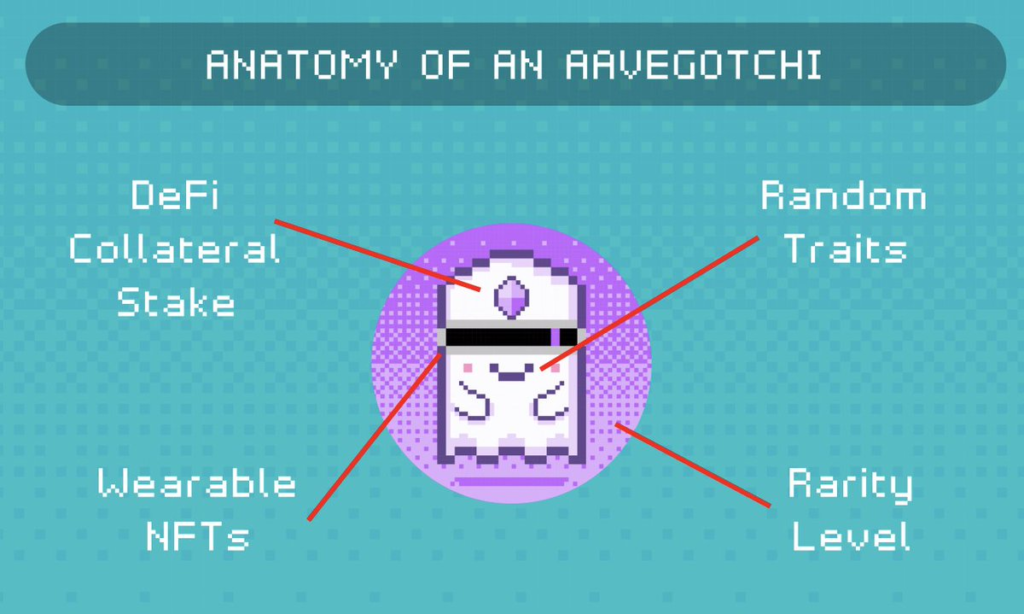

Aavegotchi is a game reminiscent of Axie Infinity, but with game characters backed by deposit certificates. The Aavegotchi character is an ERC-998 NFT that owns a deposit in a DeFi application. In the first stage, the backing will be only aTokens—the Aave deposit certificates. In the second stage, holders of GHST, the governance token of the AavegotchiDAO, will be able to vote to add other tokens.

To create an Aavegotchi character, you must deposit aTokens in addition to GHST: the rarer the character you want, the more you must deposit. To release your assets, you won’t melt the character but destroy it. A character around which a whole game world with its own digital land, duels where you can win your opponent’s accumulated interest, and various items to change the degree of its uniqueness will be built.

Psychologically this is more complex, but the economic logic is the same as with game items: if you can sell an Aavegotchi for more than the certificates backing it, there is no need to destroy it. Otherwise, the scenario where a person needs money but must destroy their beloved Aavegotchi to obtain it borders on a Black Mirror episode.

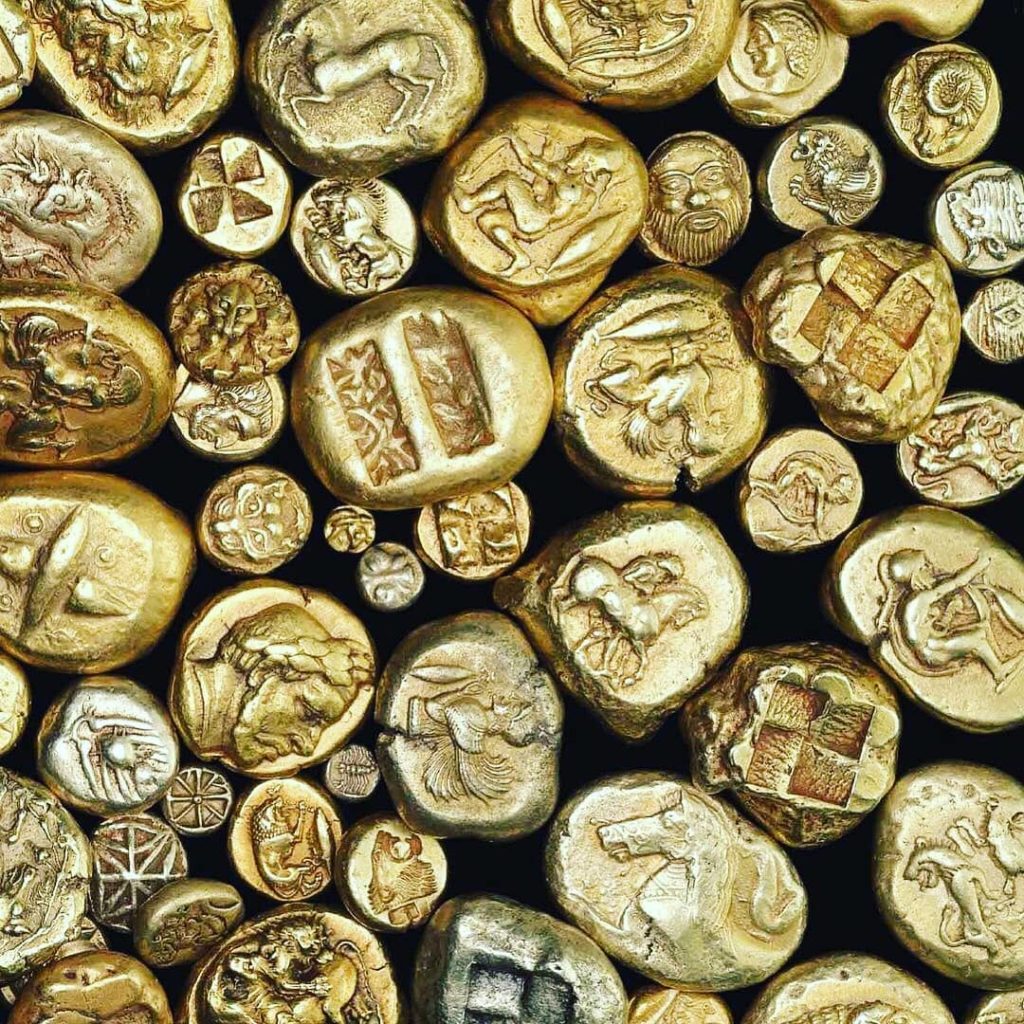

By the way, numismatists collect not pieces of gold, but gold coins—certain objects made of gold rather than gold itself. The price a collector pays for an ancient gold coin is not determined by its weight. At the same time, like Enjin game items or Aavegotchi characters, an ancient gold coin can be melted, and then the gold will be released at the price of destroying the collectible item.

The holder who wants to release a financial asset from the collectible pays a penalty. When a financial asset becomes a collectible, it gains additional value. When the financial asset sheds its collectible wrapper, it loses that additional value.

It’s only the beginning

The ERC-998 standard allows wrapping financial assets not only into game items and characters. You can, for example, create an ERC-998 token that owns a digital painting and cryptocurrencies, devise a concept grounding this token as a work of contemporary art, and sell it at auction through an art marketplace. At the same time, unlike Enjin or Aavegotchi, you can arrange for the cryptocurrencies to become permanently part of the artwork: they cannot be detached from the NFT and used as a regular medium of exchange. In short, not only regulators and appraisers but also contemporary artists have something to think about.

Even more food for thought in the third part, “NFTs as a new class of digital assets: prospects.”

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news stream, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!