NFTs as a New Class of Virtual Assets: A First Look (Part Two)

ForkLog publishes a series by Dmitry Bondar on non-fungible tokens (NFTs) as a new class of virtual assets. The first article introduces the NFT market; the second article discusses the close kinship between cryptocurrencies and collectibles; and the third article examines NFT prospects.

NFT Market 2019

According to Nonfungible, in 2019, compared with 2018, NFT turnover in dollar terms fell by 4% ($152.8 million versus $159.3 million). Active addresses rose by 1% (113,287 versus 111,640), the market capitalization of the NFT market rose by 16.81% ($210.5 million versus $180.2 million), and the share of NFTs taking part in turnover hardly changed (12.39% versus 12.30%).

Interestingly, large turnover or capitalization does not necessarily accompany a large and thriving user community. In the lead by turnover were the trading card game Gods Unchained, the RPG MyCryptoHeroes, the virtual world Decentraland and Ethereum Name Service domain names. More than 50% of users belonged to three projects: CryptoKitties, 0xUniverse and MyCryptoHeroes. Overall, in 2019 tokenized art and games, collectible cards and RPGs performed best.

Top-5 most expensive NFTs sold in 2019, sold led by the racing car “1-1-1” from the game F1 Delta Time, sold for 415.9 ETH.

NFT Market 2020

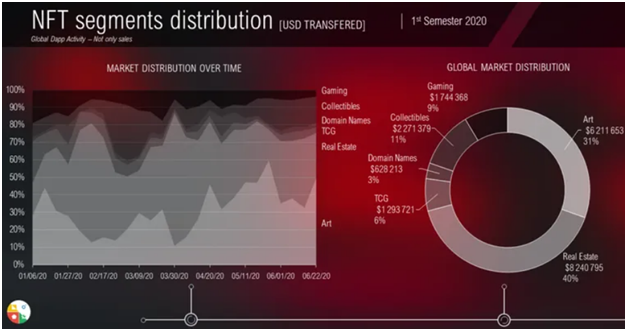

In 2020 the NFT market revived. In the first half of 2020, the total NFT turnover in USD stood at $232.5 million, up 294.29% on the first half of 2019. The tokenized art segment captured 31% of total NFT turnover, with land in virtual worlds coming closest to the leader, accounting for 40% of turnover.

Data: Nonfungible.

In the autumn, amid a growing wave of NFT-related DeFi coverage, market growth continued. One of the largest NFT collections, backed by the WHALE token, rose in September by 40%. A symbolic moment was the appearance of the tokenized painting “Block 21” at Christie’s auction and its sale at a price ten times the estimate.

Despite the growth, the aggregate NFT market turnover, as with turnover on individual NFT marketplaces, remains far from the cryptocurrency market. As the experience of the Rarible marketplace showed, the mighty farming (yield farming) can do something about this.

RARI Farming

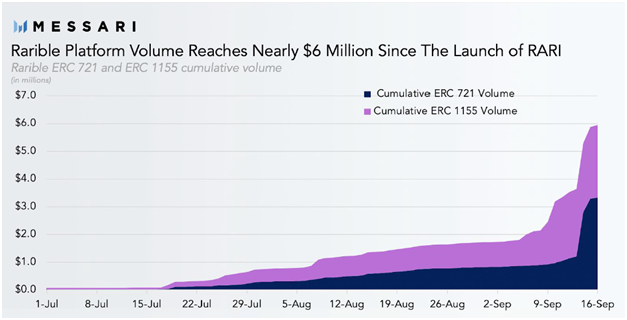

On 15 July 2020, the NFT creation-and-trade platform Rarible began rewarding its sellers and buyers with the RARE token, the governance token of the Rarible DAO. As a result, Rarible’s trading volume over two months grew from thousands to millions of dollars.

Data: Messari.

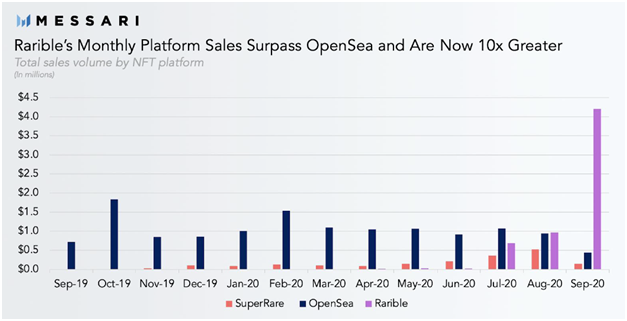

The explosive growth proved controversial: to maximize rewards in RARI, traders began buying NFTs from themselves, washing volumes. Nevertheless, farming RARE helped Rarible overtake OpenSea in trading volumes within two months—the oldest and largest NFT marketplace.

Data: Messari.

So far RARI is the only governance-token farming case for NFT marketplaces. Whether OpenSea will answer, as Uniswap did for liquidity vampires, remains to be seen. Governance-token farming for NFT projects is not the only way to combine NFTs and farming. In a forthcoming piece on NFT prospects we will examine more closely what might happen if farming and NFTs are joined together.

These were the largest NFT marketplaces, and now the largest buyers and sellers of NFTs and their main asset.

Digital Land

According to Nonfungible, in 2019 the 10 largest NFT buyers spent $1.4 million, of which almost 50% was spent on LAND tokens — NFTs controlling parcels of digital land in the virtual world Decentraland. The top-10 sellers sold NFTs for $1.56 million — Decentraland land accounted for 60% of these sales. The profit of the top-10 addresses who bought and sold NFTs stood at $0.53 million. 65% of this profit was earned from selling Decentraland land.

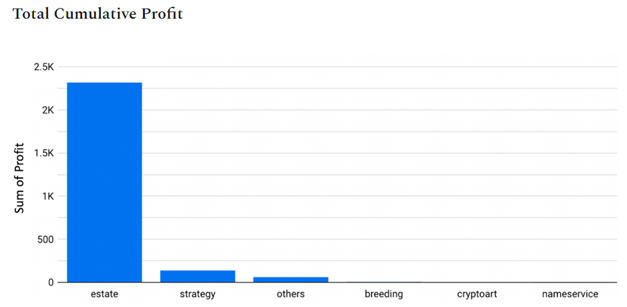

NFTbank data on the 10 most successful NFT traders from January 2018 through August 2020 indicate the same: large traders earned on virtual land. Their total profit from NFT resales amounted to 2540.6 ETH, and 91% of this profit came from NFTs in the “Real Estate” category.

Data: Zima Red.

Back in the virtual world Second Life, created in 2003, six years before Bitcoin, which we mentioned in the first part of this article, there already existed a market for virtual land and land-use fees, but no NFT. Today the market for tokenized virtual land exists not only in traditional virtual worlds like Decentraland, Cryptovoxels, The Sandbox and Somnium Space, but also, for example, in Axie Infinity.

Although in 2020 competitors became more visible, Decentraland remains the leader in this segment. Not surprisingly, in the DAI collateral portfolio there is only one token related to NFT in general and to virtual worlds in particular — MANA, the currency of the Decentraland virtual world.

Sales of LAND on the primary market occur by auction and only for MANA, which are then burned. Decisions on new land auctions and LAND parameters are taken by the Decentraland DAO. All MANA and LAND holders have voting rights in this DAO: the more of these assets you hold, the greater your voting weight.

Why is land needed in virtual worlds? For the same reason as in the real world: all our existence takes place on land owned by someone, with all the consequences. Yet unlike real land, the area of virtual land can be expanded. For example, the Decentraland DAO can vote to increase the area of the Decentraland virtual world and mint a new batch of LAND for these new lands.

Have you ever dreamed of a career as a cyber-lord of the land: owning digital land and living off the income from that land? As the market for virtual-land rentals grows, this could become a reality. If virtual land begins to generate real income, it ceases to be a toy and becomes a real asset. The transformation, from seemingly useless collectibles into real assets, and the transformation of real assets into collectibles, has a long history. Today this story receives a rather unexpected continuation, to which the second article of this cycle is devoted, “Bitcoin and Collectibles.”

Dmitry Bondar

Subscribe to ForkLog’s news on Telegram: ForkLog Feed — the full stream of news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!