Ninety-five percent of bitcoin’s supply has been mined

Bitcoin’s supply is now 95% mined.

On November 17 the number of coins mined surpassed 19.95 million BTC—95% of the Satoshi Nakamoto-programmed cap of 21 million BTC.

The World’s Bitcoin Supply Is Now 95% Mined

— Documenting ₿itcoin 📄 (@DocumentingBTC) November 17, 2025

Bitcoin’s issuance slows with each halving—miners have less than 1.05 million BTC left to extract. The event occurs roughly every four years and cuts the block reward in half.

After the latest in April 2024, it fell from 6.25 BTC to 3.125 BTC. Miners now produce about 450 BTC a day, down from 900 BTC.

The next reduction is expected in April 2028.

Though most coins are already in circulation, the final 5% will be mined slowly—over about 115 years, until 2140.

This reflects not only the mathematical schedule but also the long-term security architecture of the digital-gold network. As the block subsidy trends to zero, bitcoin gradually shifts to an economy in which user fees play the central role, incentivising miners to maintain hash rate and, in turn, the blockchain’s resilience against attacks.

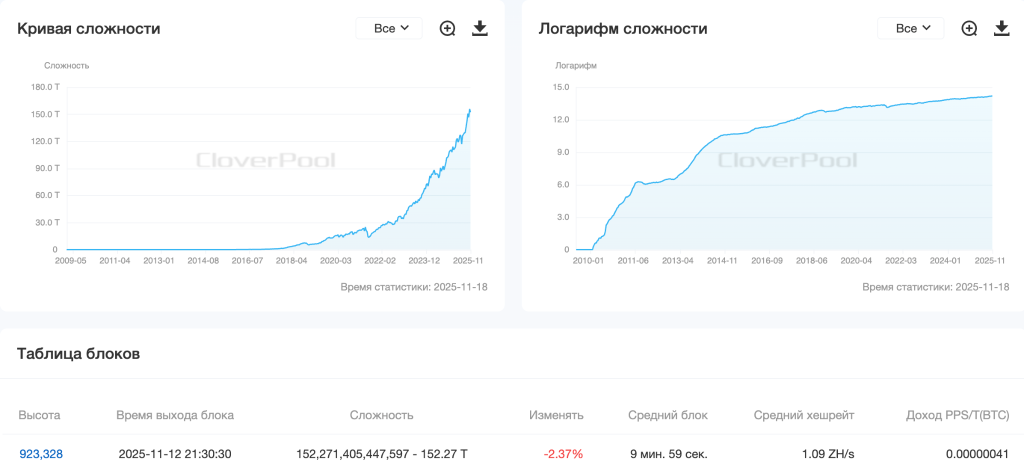

The structural shift is already visible in mining metrics. Network difficulty sits near record highs. At the latest adjustment the metric reached 152.27 T.

Rising computing power is intensifying pressure on the industry: miners must refresh hardware, optimise costs and expand into adjacent lines of business.

In particular, many hosting providers and mining firms are pivoting to servicing infrastructure for artificial intelligence.

Long-term resilience

Reaching the 95% milestone invites reflection on bitcoin’s future. On one hand, the network is “ageing” as issuance slows sharply. On the other, that programmed scarcity is the cornerstone of bitcoin’s value.

EVEDEX’s CMO Mike Lvov argues that the current stage only reinforces the digital-gold model. The rising share of mined coins does not diminish the asset’s relevance, he says; rather, it highlights its finitude amid historically rising demand.

“Blockchain technologies keep advancing; second-layer solutions are emerging atop Bitcoin, new projects are appearing, and the network itself continues to evolve. The asset’s resilience depends on demand for it, and I am sure that demand will only grow,” he added in a comment to ForkLog.

Kraken’s global economist Thomas Perfumo concurs. He stressed that predictable issuance and programmed scarcity distinguish the first cryptocurrency from traditional monetary systems.

“This unique combination of the functionality of a global settlement protocol with the reliability of scarcity makes bitcoin a diversification tool, a natural hedge against fiat-money debasement and a structural component of modern portfolios,” the expert explained in a conversation with The Block.

He also said the current level of issuance underscores the network’s resilience and its ability to preserve value over the long term.

Marcin Kazmierczak of RedStone saw the 95% milestone as a sign of the digital-gold blockchain’s maturity:

“We are moving from a growth asset to a class with fixed long-term scarcity. This matters for institutional adoption and scaling infrastructure. The key is not the 95% figure but the network’s ability to bear future loads and sustain the economic model.”

Price impact

It is often assumed that diminishing new supply should lift the value of each coin as demand grows while issuance shrinks. Yet experts view the event as more symbolic than a direct catalyst for bitcoin’s price.

Nansen senior analyst Jake Kennis questioned its market impact. In his view, reaching a new historical threshold merely reaffirms bitcoin’s status as digital gold.

“It highlights the cryptocurrency’s scarcity, but the remaining 5% will be mined over more than 100 years because of halvings. While increasing scarcity supports prices psychologically, this milestone is more important for the broader narrative than as a direct driver,” the expert explained.

Lvov added that halving cycles play a bigger role in shaping price patterns than the sheer percentage of coins mined:

“The less there is left to mine, the higher the potential long-term price, but halving cycles continue to adjust the price.”

Kazmierczak voiced a similar view. As the block reward shrinks, miners rely more on fees, which pressures less efficient operators and spurs industry optimisation. In his words, this is a long-term shift from subsidy to fees, not an “instant price driver”.

At press time bitcoin trades around $90,100, down 5.1% over the past 24 hours, according to CoinGecko.

In November, MARA CEO Fred Thiel predicted tough times for miners. He called cryptocurrency mining a “zero-sum game”.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!