Open Interest in Futures and Options Reaches New Highs as Bitcoin Rises Above $16,000

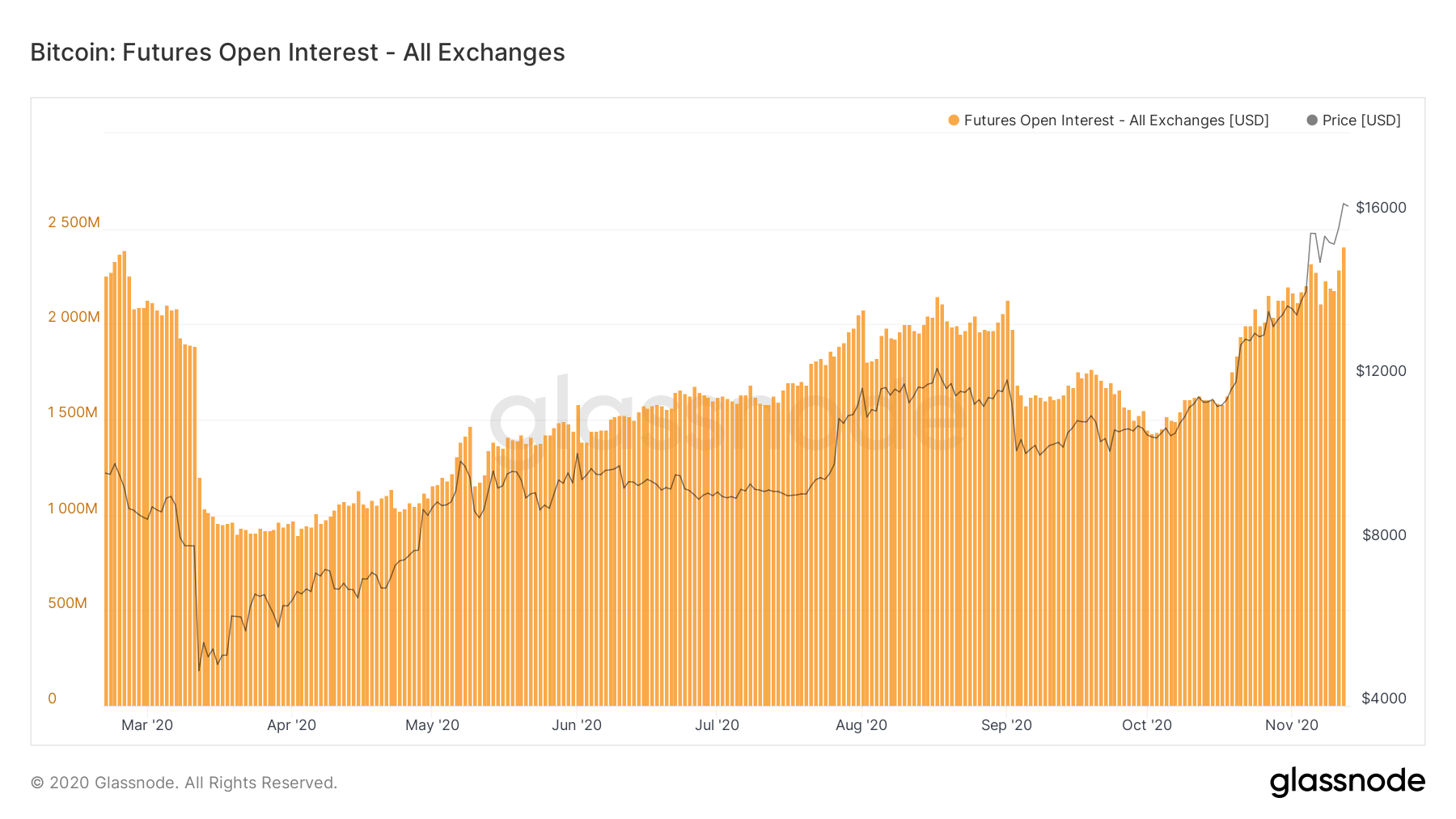

The number of open positions on futures and options markets has reached record highs as Bitcoin rallied above $16,000. This is evidenced by data from analytics service Glassnode.

Aggregate open interest (OI) across Bitcoin futures on exchanges Binance, Bitfinex, BitMEX, Deribit, FTX and Huobi at the time of writing exceeds $2.4 billion.

Source: Glassnode.

“During periods of strong price movement amid high open interest on the Bitcoin futures market, volatility spikes are characteristic,” stated journalist Joseph Young.

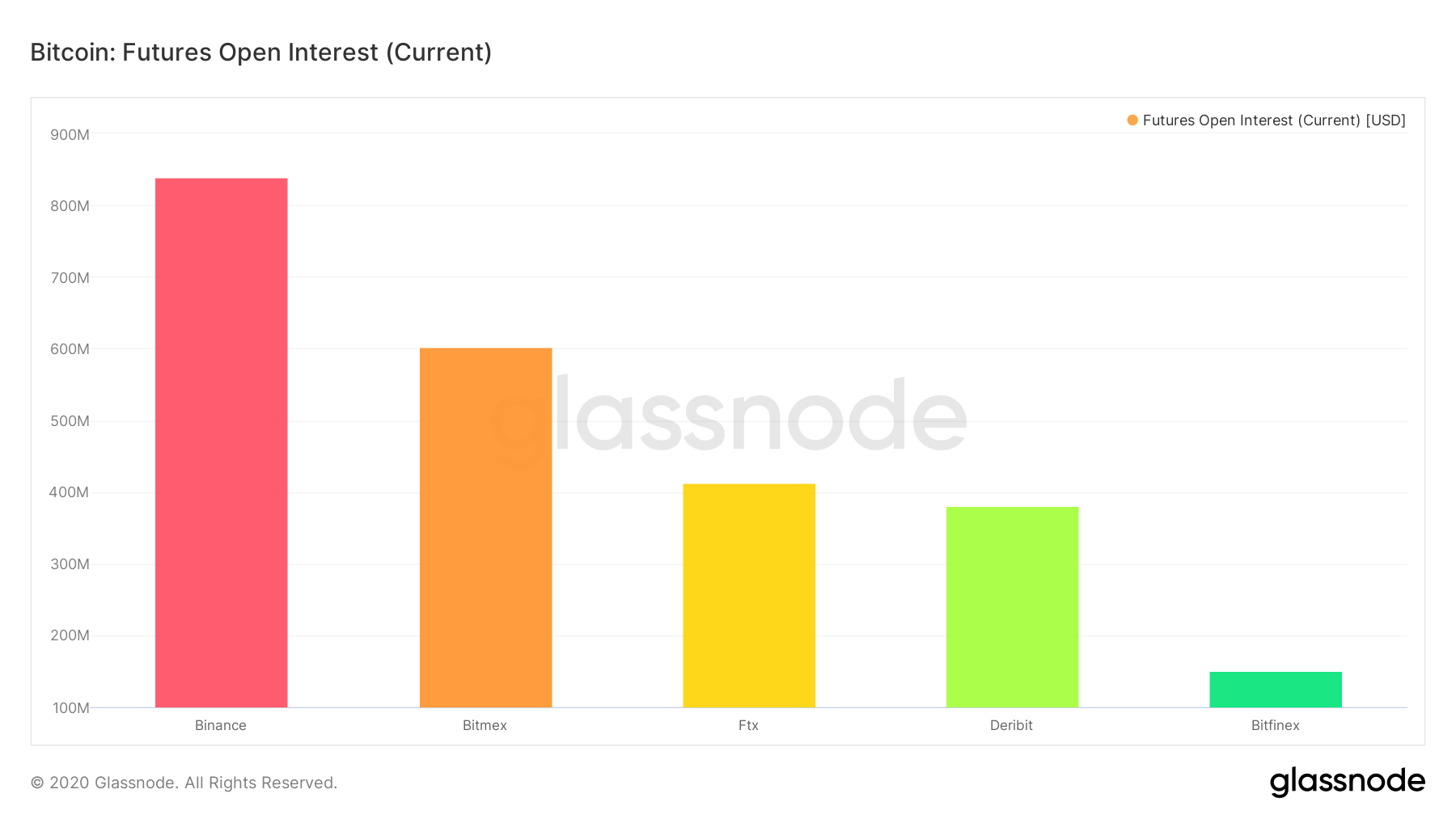

The largest OI is on the Binance exchange; it is followed by BitMEX and FTX.

Source: Glassnode.

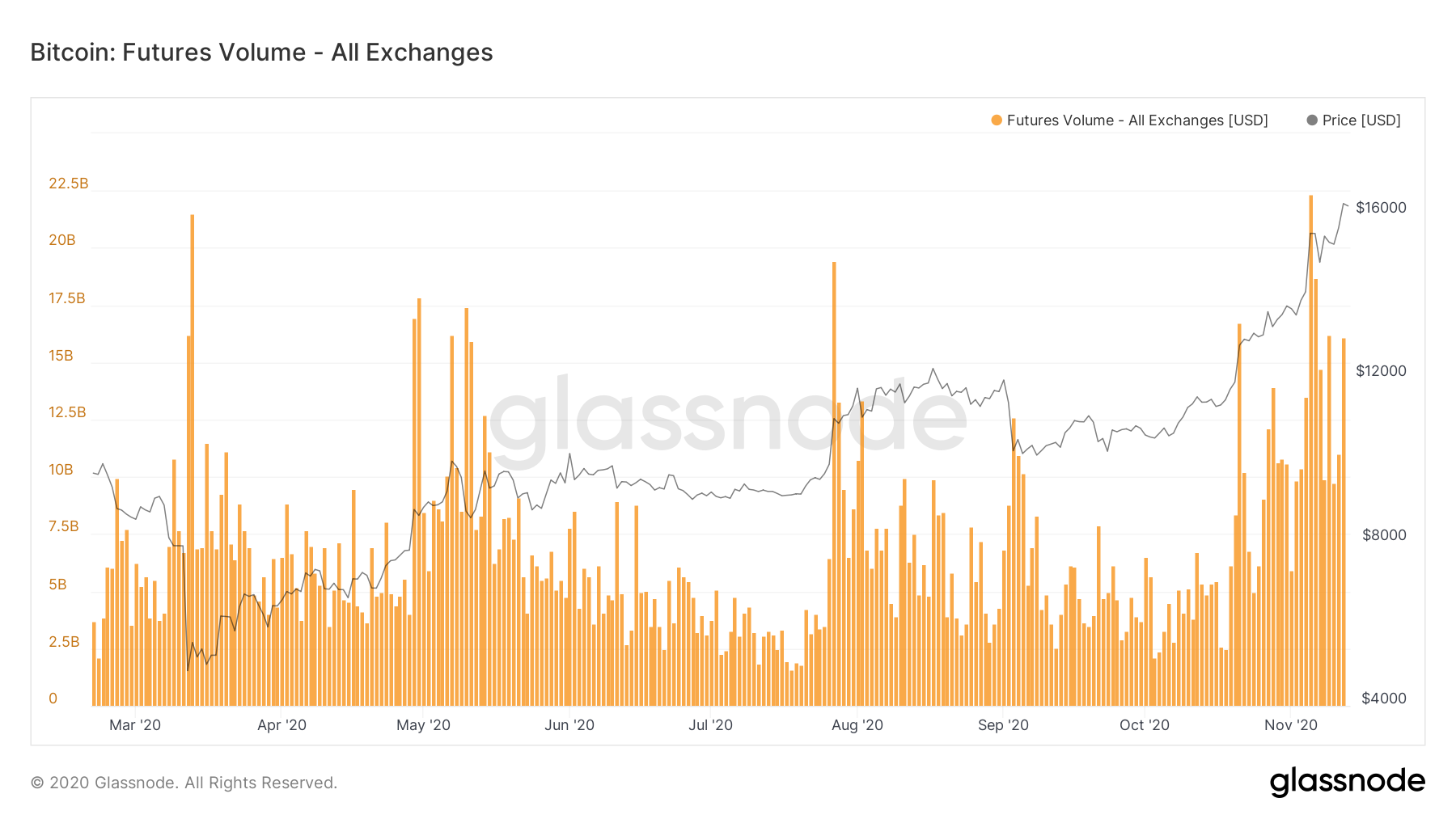

Aggregate trading volume on futures exchanges is also rising to new highs.

Source: Glassnode.

A significant uptick is also seen in the Bitcoin options market — aggregate OI here has also reached an all-time high.

What a beauty! $BTC Options OI chart by @skew! pic.twitter.com/LCvV1HRziX

— Deribit (@DeribitExchange) November 13, 2020

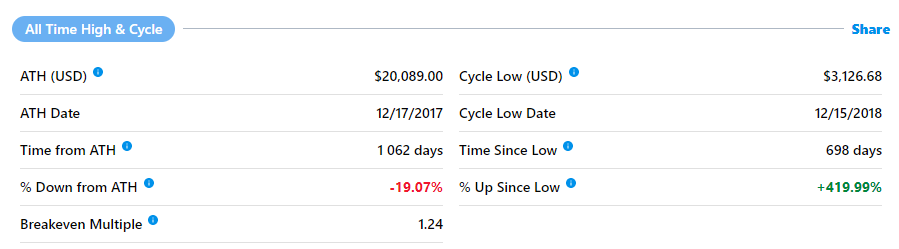

Bitcoin’s current price is only about 19% below its all-time high recorded 1,062 days ago, on December 17, 2017, at $20,089.

Source: Messari.

From a bear-market bottom just above $3,000, Bitcoin rose by 420%.

Earlier, about the record trading volume of physically settled Bitcoin futures reported by the regulated Bakkt exchange.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!