Opinion: Institutional investors push Bitcoin to new highs

Institutional investors are set to push Bitcoin to new highs. This will be aided by a reduction in selling pressure from miners and other major players, according to Ki Young Ju, head of the CryptoQuant analytics service.

$BTC whales seem exhausted to sell. Fewer whales are depositing to exchanges.

I think this bull-run will continue as institutional investors keep buying and Exchange Whale Ratio keeps below 85%.

Chart 👉 https://t.co/TLWRvP7pyZ pic.twitter.com/goUmowVv2e

— Ki Young Ju 주기영 (@ki_young_ju) December 28, 2020

The expert developed the Exchange Whale Ratio indicator. It measures the ratio of Bitcoin volumes sent to exchanges by whales to the analogous metric for retail investors. From December 8 to 22, amid the rally in the leading cryptocurrency, the indicator rose to 90% before dipping below 85%.

According to Ki Young Ju, institutional investors account for 16% of Bitcoin’s realized market cap indicator.

16% of the $BTC realized market cap is now owned by institutional investors.

— Realized Market Cap: $186 billion

— Grayscale AUM: $19 billion

— Institutions AUM: $30 billion (by @BTCtreasuries)Chart 👉 https://t.co/jmwVAzV5K7 https://t.co/ABT284B2jc pic.twitter.com/KfygKFgflH

— Ki Young Ju 주기영 (@ki_young_ju) December 29, 2020

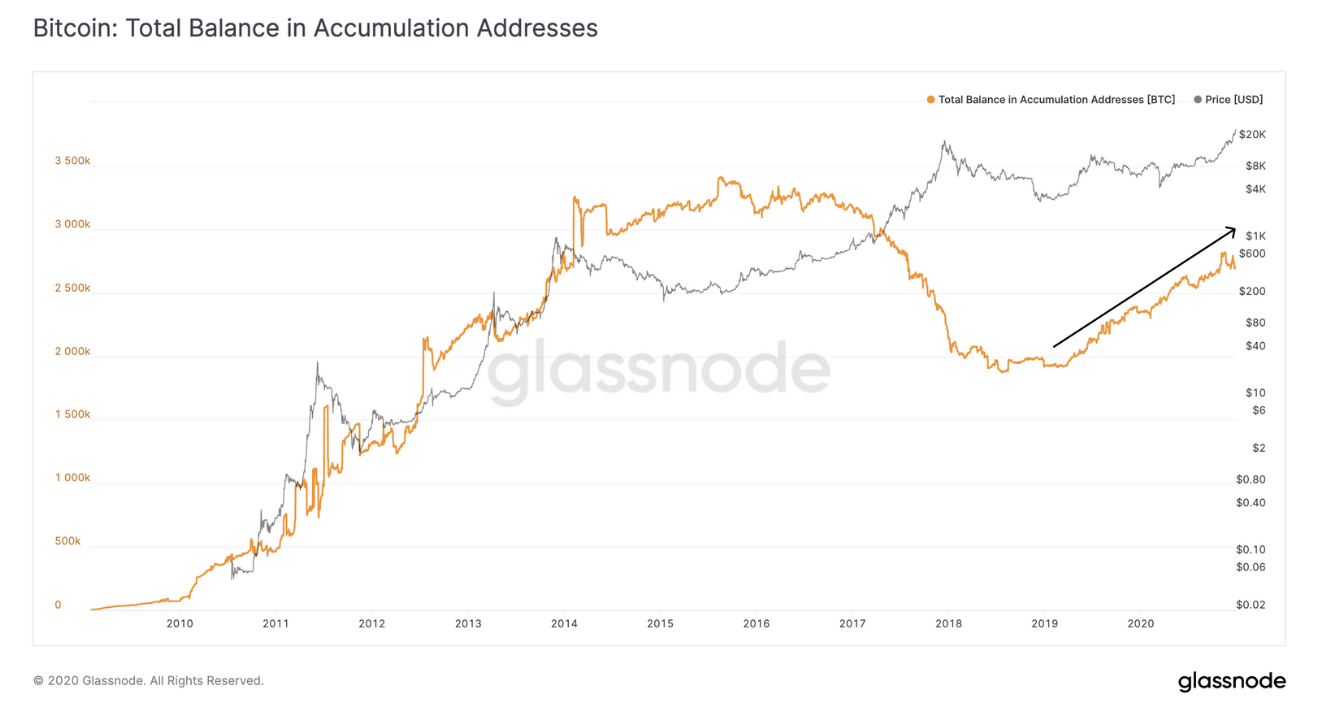

In the latest Glassnode report, long-term holders’ addresses now hold 14.5% of Bitcoin’s total circulating supply. The share has been rising since 2019. Analysts believe this could set the stage for a liquidity crisis.

Data: Glassnode.

In the latest Glassnode report, long-term holders’ addresses now hold 14.5% of Bitcoin’s total circulating supply. The share has been rising since 2019. Analysts believe this could set the stage for a liquidity crisis.

Ранее глава Pantera Capital Дэна Морхэда выразил мнение, что private investor demand drove Bitcoin to new records.

Analyst Mikaël van de Poppe believes that the price of the leading cryptocurrency could reach $40,000. This will require a breakout above the $28,500 resistance.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!