Opinion: The Stock-to-Flow Model Signals Bitcoin Price to Reach $85,000

The popular Stock-to-Flow (S2F) model and on-chain indicators point to the end of the correction and a rise in Bitcoin to $85,000 by year-end. Observations were shared by DecenTrader analysts.

Market update from @PositiveCrypto : https://t.co/o3l4Wsz5Wq

— Decentrader (@decentrader) June 11, 2021

Experts analyzed the dynamics of a number of on-chain indicators and found similarities with events in December 2018 and March 2020, when the groundwork for a shift to an uptrend was laid.

The price of the leading cryptocurrency remains within the corridor between the 200-day moving average and the $32,000 level. Analysts say that the market still feels uncertain after the May crash due to concerns about intensified regulatory pressure from US authorities.

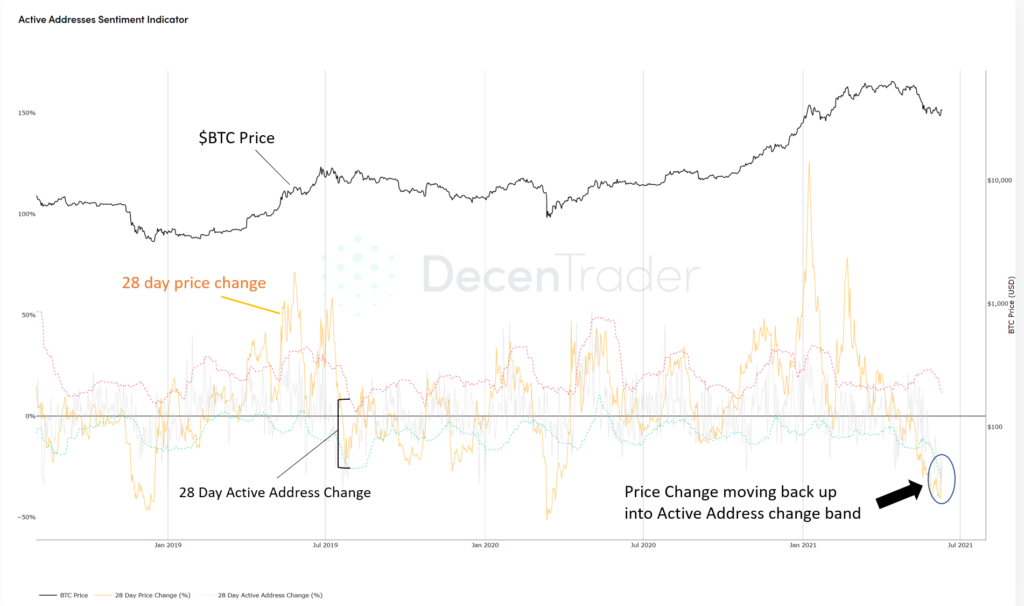

Active Addresses Sentiment Indicator (active-address sentiment indicator) pointed to excessive selling and a potential reversal, specialists noted. The metric measures overbought/oversold conditions relative to user activity.

Analysts presented a chart showing the 28-day moving average of the price of digital gold returning to the corridor of this same indicator, built on the dynamics of active Bitcoin addresses. Previously, such a pattern served as a signal of growth in the following weeks.

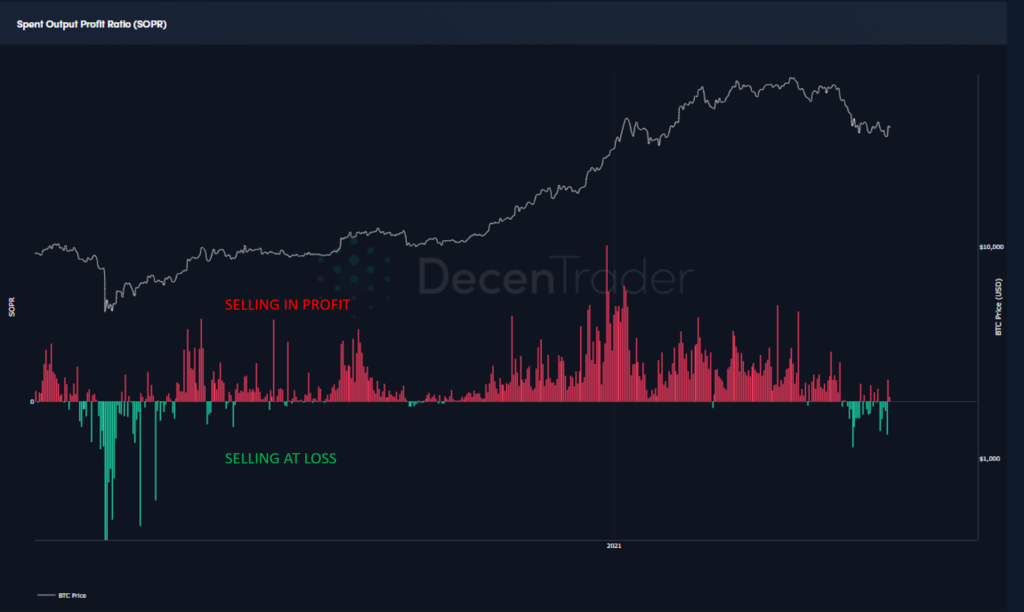

Similar price-growth signals were seen in the SOPR (Spent Output Profit Ratio). In the past few days, profits-driven selling has dominated, which was observed during May.

DecenTrader expressed confidence that over the coming months the price will return to the trajectory line expected by the S2F model. In other words, by the end of the year the value of digital gold will reach a new high of $85,000.

“This time buyers may not stage the same rally. Nothing fundamental has changed. The model works, it’s just that the news backdrop around Bitcoin has turned negative”, — analysts explained.

On the chart they provided there is a divergence between the current price of Bitcoin and the S2F-predicted price. Orange arrows mark four historical instances when this divergence reached current levels.

$288,000 remains a realistic benchmark. I would be very surprised if the price does not return to the trend line, — wrote the creator of the PlanB model.

$288K still in play. It would really surprise me if #bitcoin would not touch the black S2FX model line this phase. Regardless of current volatility, yellow green and blue dots will be (much) higher than red orange dots. pic.twitter.com/np26ypO96X

— PlanB (@100trillionUSD) June 12, 2021

Analyst Michaël van de Poppe noted that in the S2F model Bitcoin undervaluation has reached its maximum in the past decade. He did not rule out that the crowd would ignore this and wait for a drop to $20,000.

Stock-To-Flow Deflection on #Bitcoin shows it’s the most undervalued in the past 10 years at the current prices.

But, people will wait for $20,000 to come. pic.twitter.com/SbSYAZ5YEL

— Michaël van de Poppe (@CryptoMichNL) June 14, 2021

On June 14, Bitcoin rose 12% after Elon Musk’s tweets about resuming Tesla’s sales of the leading cryptocurrency.

Earlier ForkLog experts stated that there were no grounds to regard May’s correction as a sustained bearish trend.

Subscribe to ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!