Paxos reveals backing for PAX and BUSD stablecoins

US-dollar–pegged stablecoins from Paxos are fully backed by cash and cash equivalents, as well as U.S. Treasury securities. This was stated by the company’s general counsel, Dan Burstein.

There are big differences between regulated #stablecoins that are backed 1:1 by cash & US T-Bills and unregulated «stablecoins» backed by various financial instruments. Understand the nuance from our GC and Chief Compliance Officer Dan Burstein https://t.co/vDkwdIYaFd

— Paxos (@PaxosGlobal) July 21, 2021

Burstein noted that there are only three regulated dollar-backed stablecoins on the market — Paxos Standard (PAX), Binance Dollar (BUSD), and Gemini Dollar (GUSD). The issuer of the first two is Paxos Trust Company.

The company holds a conditional national trust bank license and plans to obtain a clearing agency license. The BUSD stablecoin, issued for the Binance cryptocurrency exchange, has been approved by the New York State Department of Financial Services.

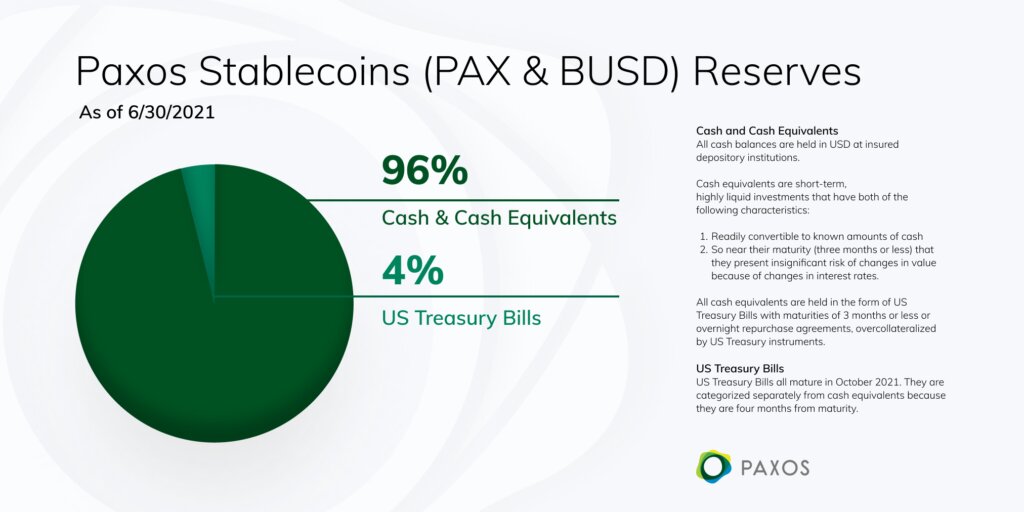

According to the statement, all of Paxos’s cash reserves are held in insured U.S. depository institutions. The cash equivalents consist of “U.S. Treasury securities with maturities of three months or less, or overnight repo agreements, over-collateralized with Treasury instruments.”

The remaining portion of the reserves is also in U.S. Treasury securities, but Paxos has separated them into a separate category because the maturities of these instruments run to four months.

Earlier, Circle disclosed information about the backing of its stablecoin. Cash and cash equivalents made up 61% of USD Coin (USDC) reserves, the remaining coins are backed by bonds and other highly liquid assets.

The issuer of the stablecoin Tether (USDT) disclosed its reserves in the May quarterly report. 76% of the coins are backed by cash and cash equivalents, the rest by bonds, digital assets and other instruments.

In a CNBC interview, Tether’s chief legal officer Stuart Hoegner stated that the company is working on a full financial audit of USDT and results will be published within a few months. According to him, none of the stablecoin issuers has conducted such thorough scrutiny.

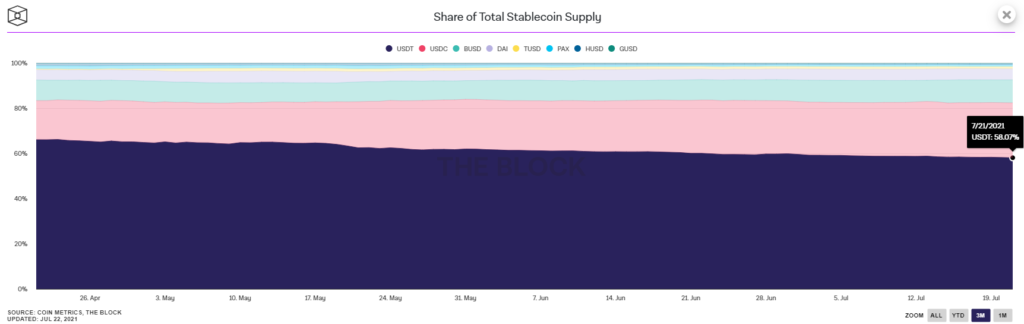

According to The Block, the market value of all stablecoins in circulation stands at $111.38 billion. The market capitalization of PAX reached $905 million, BUSD $11.4 billion, according to CoinGecko. For USDT and USDC, the figures were $61.69 billion and $26.85 billion respectively.

Tether remains the leader in the segment. The stablecoin dominance index sits at around 58%.

As reported, U.S. Treasury Secretary Janet Yellen has called for a swift regulatory framework for stablecoins.

Follow ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!