Percent Finance token plunged after $1m of user funds were locked

The DeFi project Percent Finance, a fork of Compound, warned users about a serious issue on the platform. Against this background the price of the PCT token plunged by 87.5%.

Users funds on our platform amounting to ~$1m are stuck in money market smart contracts

Reaching out to @WrappedBTC and @circlepay/@coinbase respective teams to help us make affected USDC/WBTC holders whole

Read Below:https://t.co/63Q1DlyqVv

— Percent Finance (@PercentFinance) November 4, 2020

On Wednesday, November 4, an update to the interest-rate model took place. According to the developers, due to a bug the USDC, WBTC and ETH markets were frozen. The message notes that the issue could lead to permanent locking of user assets.

The amount of funds locked in the contracts is estimated at $966,000 (446,000 USDC, 28 WBTC and 313 ETH). The Percent Finance team has sought help from the issuers of USDC (Circle and Coinbase) and WBTC (BitGo) to unfreeze the funds.

The developers warned that restoring around $125,000 of ETH will probably be impossible. They asked users to repay existing loans and withdraw their cryptocurrency.

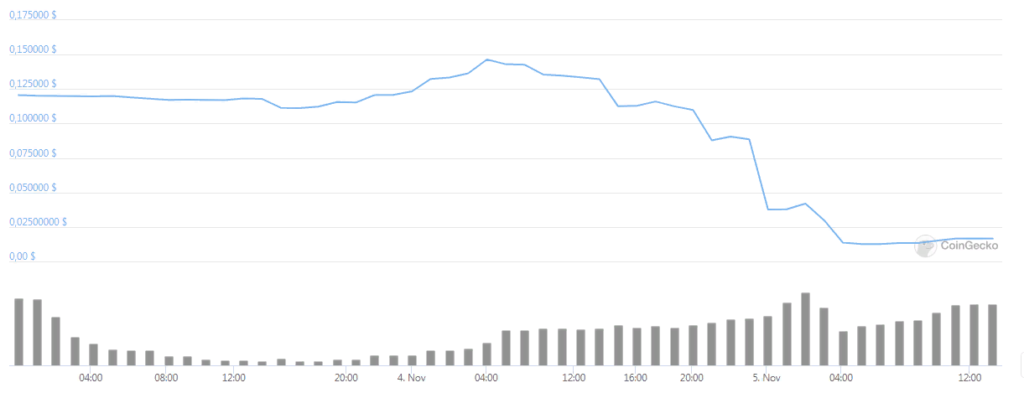

According to CoinGecko, PCT began the fall on November 4 from a high of $0.14. At the time of writing the token is trading at $0.016.

Data: CoinGecko.

As a reminder, on October 30, leading DeFi tokens reached new lows amid waning activity in the sector. Among them was yEarn Finance (YFI), whose price briefly dipped below $9,900.

Subscribe to ForkLog’s YouTube channel!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!