Peter Schiff admits error in his Bitcoin forecast

The uncompromising Bitcoin critic Peter Schiff admitted his mistake in his July forecast of Bitcoin’s collapse. At the time he predicted it would occur against the backdrop of gold approaching an all-time high.

In response to a reminder from one of his followers, the ‘Gold Bug’ explained that he was right about gold, but wrong about Bitcoin. He attributed this to the influence of Grayscale Investments’ advertising campaign, which hinted at the Federal Reserve’s printing press running at full tilt in times of crisis.

I was right on #gold, but wrong on #Bitcoin. The latter did managed to get through resistance and rally up to $12K, thanks in large part to a ride on gold’s coattails and a massive TV advertising buy by Grayscale. By falling back to $10K Bitcoin quickly returned to a bear market.

— Peter Schiff (@PeterSchiff) September 6, 2020

The reminder to Schiff about his erroneous forecast was prompted by his new statements regarding Bitcoin’s prospects.

In a discussion with Gemini co-founder Tyler Winklevoss, he said he expects a breach of the $10,000 support level. A pullback to this level, the Bitcoin critic sees as the start of a new bear cycle.

#Bitcoin can just as easily be consolidating before the next breakdown. Consolidations after sharp moves typically continue the move that proceeds them. The more the 10K support level is tested the weaker it gets. Markets rarely give investors that many chances to buy the bottom.

— Peter Schiff (@PeterSchiff) September 6, 2020

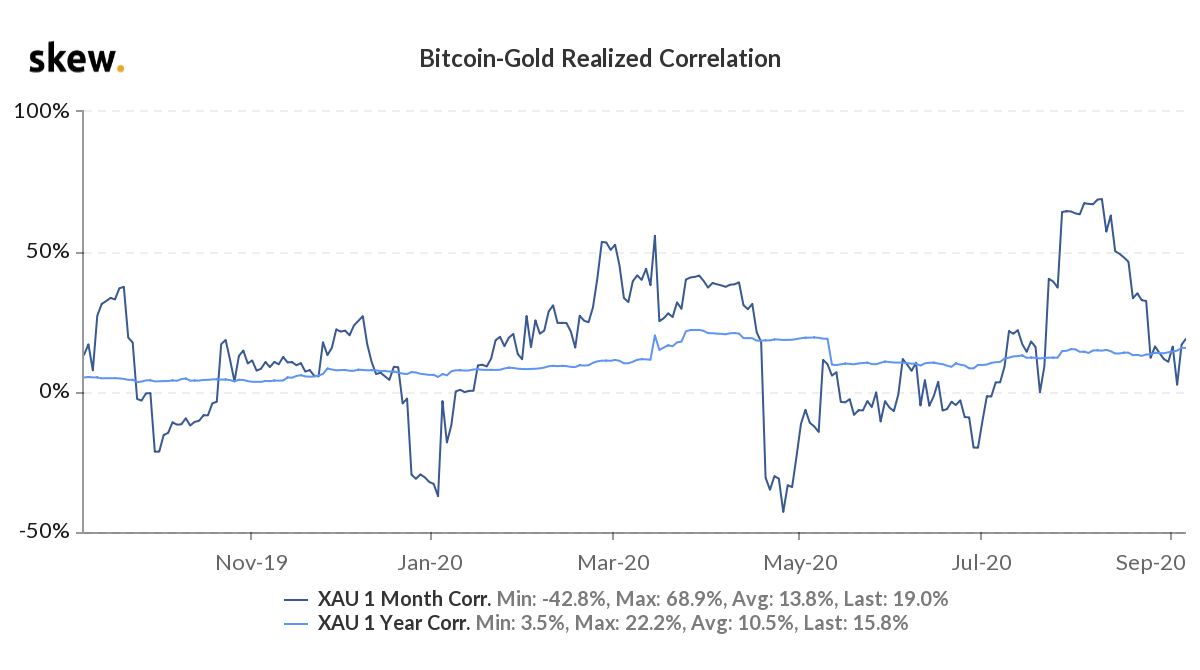

Explaining why the July forecast proved unsound, Schiff also mentioned the increased correlation between gold and Bitcoin.

According to analytics firm Skew, on August 7 the monthly realized correlation between the two assets reached a maximum of 68.9%. By September 4 this ratio had fallen to 19%.

Realized correlation of gold and Bitcoin. Source: Skew.

Another well-known trader and technical analyst Peter Brandt said he had liquidated all bitcoins and other assets shortly before the deterioration in sentiment across global markets.

Earlier, co-founder of 10T Holdings and Gold Bullion International Dan Tapiero expressed confidence that a possible continuation of the stock-market correction would not affect the resilience of gold and Bitcoin.

Follow ForkLog on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!