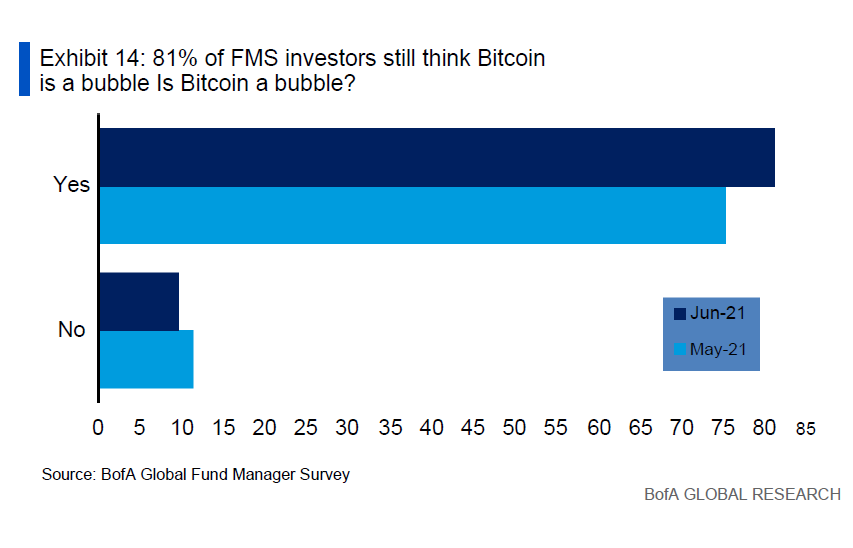

Poll finds majority of fund managers view Bitcoin as a bubble

81% of Bank of America survey respondents said the Bitcoin market was a bubble, despite May’s 35% drop in price. Data reported by Bloomberg.

Last month, 75% of respondents held that view.

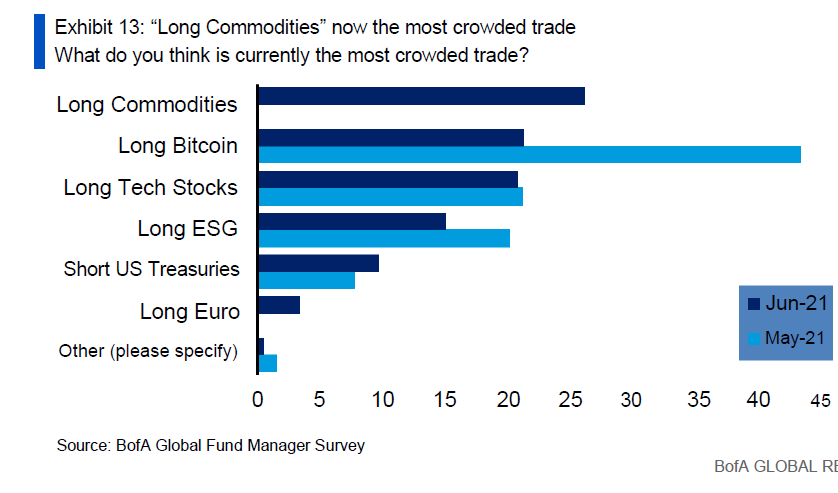

Meanwhile, the survey, which records the views of 207 investors with total assets of $645 billion, found long crypto positions to be the second most in-demand after bets on rising commodity prices.

Among other points from the Bank of America survey:

- 72% of respondents said inflation is temporary;

- 63% expect the Fed to signal a reduction in monetary injections into the economy in August–September;

- 53% of investors are confident that the stock market correction in the next six months will be less than 10%.

Earlier, according to a Goldman Sachs survey of hedge-fund managers conducted in late May, Bitcoin proved to be the least attractive asset for structures oriented toward long positions.

Subscribe to ForkLog news on VK!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!