Possible default by a Chinese developer rattled markets, weighing on Bitcoin

The risk of default by one of China’s largest construction companies, Evergrande, which has accumulated debt of 2 trillion yuan ($309 billion), on September 20 provoked panic in financial markets. Bitcoin fell by 9%.

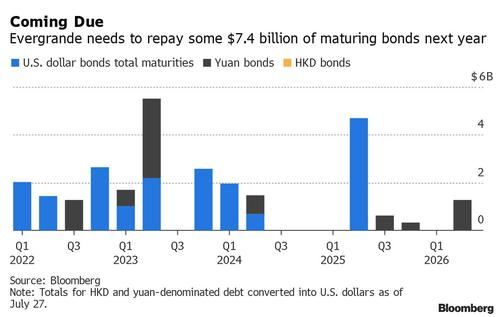

According to Bloomberg, by the end of 2021 Evergrande is due to pay $669 million in coupons and to have $7.4 billion in obligations due in 2022.

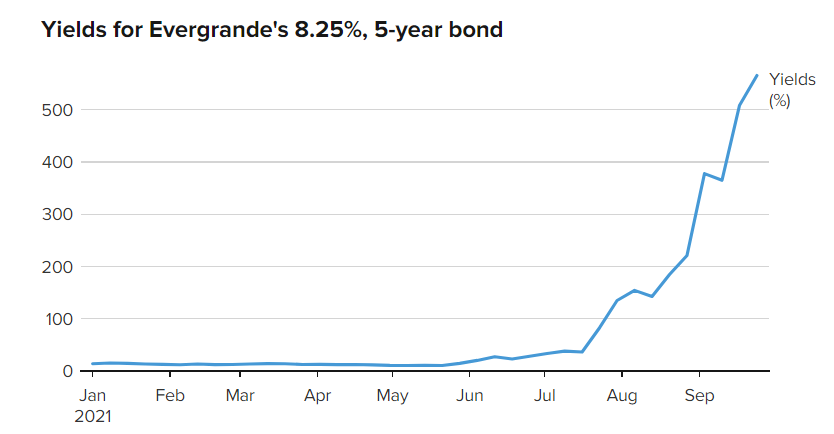

The yield on Evergrande’s five-year bonds maturing in March 2022 reached 560%, after starting the year at under 10%.

Earlier the developer warned of a possible restructuring of payments on September 23. A similar decision by Evergrande applied to those obligations maturing on September 20. The issuer has 30 days to settle its debt with investors.

Evergrande’s portfolio comprises around 800 projects. Construction on more than half of them is currently suspended due to problems with obligations to staff and suppliers.

The group includes 200 offshore and 2,000 Chinese legal entities, including a bank and an investment company. Debt of 2 trillion yuan is equivalent to about 2% of the country’s GDP. The company’s equity stands at about $3.9 billion against debt of about $300 billion.

The head of the company said Evergrande would weather the difficulties.

S&P warned of the potential default by the developer and questioned Chinese government intervention in the situation unless the risks become systemic. Fitch Ratings colleagues hold a similar view.

The market’s painful reaction on September 20 (the S&P 500 closed down 1.7%, demand for U.S. Treasuries and the dollar rose) is explained by fears of spreading Evergrande’s problems to the broader real estate market, new defaults, and a slowdown of the world’s second-largest economy.

Many drew parallels with the collapse of Lehman Brothers, which sparked the 2008 financial crisis.

“Evergrande is just the tip of the iceberg,” said Louis Tse, managing director of Hong Kong broker Wealthy Securities, in an interview with Financial Times.

Five-year credit default swaps in China rose sharply at the start of the week.

It’s starting pic.twitter.com/i1CUSgsYc1

— zerohedge (@zerohedge) September 20, 2021

Evergrande bonds are held in portfolios of well-known Western funds, including Fidelity Asian High-Yield Fund, UBS (Lux) BS Asian High Yield (USD), HSBC Global Investment Funds — Asia High Yield Bond XC, Pimco GIS Asia High Yield Bond Fund, Blackrock BGF Asian High Yield Bond Fund and Allianz Dynamic Asian High Yield Bond.

Inflation concerns are heightening, prompting major central banks to signal a tapering of monetary stimulus. Global investors do not rule this out at the Fed meeting on September 22.

Tether Limited confirmed that it does not hold Evergrande securities as collateral for the stablecoin USDT.

“Tether has not issued Evergrande securities and never has. The vast majority of the commercial paper held belongs to issuers rated A-2 and above [Evergrande is rated CCC],” The Block said in a statement.

Technical analyst Peter Brandt noted the formation of a bearish Head and Shoulders pattern on the Ethereum chart.

“There is a potential H&S, regardless of whether it completes, fails or morphs. I am not a hater.”

I am NOT saying I believe it and I am saying I am not shorting it — but like it or not if you own $ETH you will have to deal with it. This possible H&S exists, whether it is completed, fails or morphs, it exists. I am NOT a hater. pic.twitter.com/PG50GwaZkI

— Peter Brandt (@PeterLBrandt) September 20, 2021

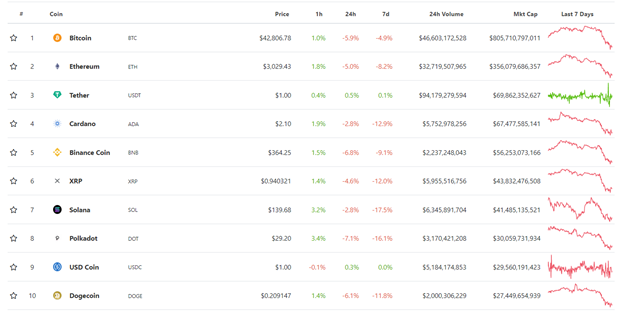

At the time of writing, Ethereum traded back above the suspected neck line and the psychological $3,000 level. Over the past 24 hours the asset has fallen 5%, according to CoinGecko.

The depth of declines in the top-10 cryptocurrencies excluding stablecoins ranges from 2.8% to 7.1%. On the previous day, losses had reached double-digit values.

Earlier JPMorgan strategist Nikolaos Panigirtzoglou said that Ethereum’s fair price based on on-chain activity is $1500.

Analysts at Delphi Digital suggested that ahead of the September 24 options expiry the market is expected to see higher volatility.

Subscribe to ForkLog news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!