Report: Celsius Lost $390 Million of Customer Funds in DeFi and NFT Investments

Lending platform Celsius deployed about $534 million of customer funds under “high-risk leveraged cryptocurrency trading strategies” via KeyFi. According to Arkham analysts, this resulted in a $390 million loss.

Coverage of the Celsius crisis thus far has been superficial and anecdotal.

Using on-chain and off-chain data and analytics, Arkham has revealed a more comprehensive picture of Celsius’ activity. 1/14

— Arkham (@ArkhamIntel) July 8, 2022

According to the Arkham report, from August 2020 to April 2021 Celsius moved digital assets worth $534 million to an address linked to KeyFi. The latter deployed most of these funds in various DeFi protocols and invested $6.3 million in NFTs.

If one considers Chainalysis’s December 2020 audit report, at a given moment KeyFi controlled 10% of Celsius’s assets under management ($330 million of $3.3 billion).

From September 2020 to September 2021, KeyFi returned assets to Celsius worth $1.14 billion — a USD-denominated profit of 113%. Analysts noted that, given market conditions during that period, the platform would have earned more had it simply held the funds on its balance sheet.

“During the period of Celsius’s cooperation with 0xB1 [the KeyFi address], the price of bitcoin rose from $11,000 to $60,000, more than 400%. Ethereum, another significant asset entrusted to 0xB1, rose 900% — from $400 to $4000. If Celsius had kept these assets for itself instead of sending them to the counterparty, their value would have been $1.49 billion — $350 million more than was returned”,

Earlier, KeyFi’s chief Jason Stone said that his company filed a lawsuit against Celsius. The latter was accused of breach of contract, market manipulation, mismanagement and organizing a Ponzi scheme.

Arkham stated that the lending platform spent more than $300 million to purchase its own CEL token to meet obligations to users who earned yield in that asset. To do so, the company used centralized exchanges such as FTX and Liquid.

Founder and CEO Celsius Alex Mashinsky, in turn, regularly sold large sums of CEL — the total value of tokens he liquidated reached 44 million, according to the report.

Mashinsky predominantly used DEX such as Uniswap and Airswap, though he also sold on the same centralized platforms where Celsius acquired the tokens.

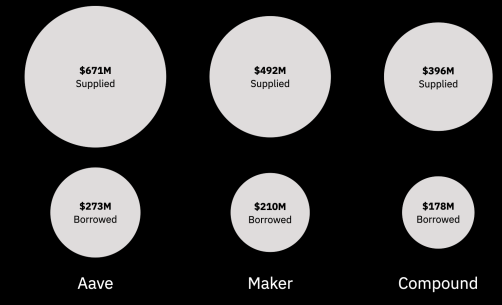

Analysts emphasised that Celsius was one of the largest players in DeFi. The platform deployed much of its funds in three protocols — Compound, Aave and MakerDAO.

For example, the company accounted for 2.5% of all coins involved in Ethereum staking, and 10% of the supply of synthetic stETH tokens.

In July, Celsius closed a MakerDAO vault and withdrew 23,962 WBTC from the protocol. A few hours later the platform transferred over $500 million in WBTC to the FTX exchange.

Follow ForkLog’s bitcoin news on our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!