Researchers identify causes of ZKJ and KOGE crash on Binance Alpha

Polyhedra Network’s ZKJ and 48 Club Token (KOGE), popular on Binance Alpha, suddenly slumped. Researchers spotted signs of a coordinated dump of large holdings by several whales.

What happened?

The chart below shows ZKJ falling by more than 80% within hours.

Before the crash, the token behaved like a quasi-stablecoin, with its price barely budging for an extended period. One plausible reason was strong demand for a relatively liquid asset to pad trading volumes and farm Alpha Points. Those points granted access to airdrops and the TGE of new projects on the platform.

Согласно основателю AP Collective под ником Abhi, operations in ZKJ were marked by “extremely low” slippage. At “peak levels”, turnover in the token was three times ZKsync’s market capitalisation.

A similar pattern played out in the other “alpha-stablecoin”, KOGE, though it fell by a smaller ~54%.

On-chain analysts took note. According to Lookonchain, shortly before the drop various wallets were removing liquidity from pools, swapping KOGE for ZKJ, and then dumping the latter.

2/ Before the $ZKJ crash, many wallets had already started to remove liquidity from $ZKJ and $KOGE, exchanging $KOGE for $ZKJ and dumping $ZKJ. pic.twitter.com/ovSdGahlcs

— Lookonchain (@lookonchain) June 15, 2025

Six wallets sold 5.23m ZKJ.

3/ Six whale wallets sold 5.23M $ZKJ for $9.66M.

0x6aD390b069316ca0877a039AccDC5e02beDe2EBb 0x0781325b3688714065b15C8d9fC0d4827628bdE7″ 0xef78554c8384ad94e874D2b27A21085C45Dfb456 0xb7Ba3Cf568224457814254C826d7104a92169b3E 0x1A29375eE09B38AFAa23BeD65f30C85230E27599… pic.twitter.com/H1N4mT6GUk

— Lookonchain (@lookonchain) June 15, 2025

The sudden liquidity pull and aggressive selling triggered a price slide, which was compounded by mass liquidations of long positions. In particular, six traders were wiped out for sums exceeding $1m.

4/ The liquidity pull and aggressive selling triggered a price drop, causing a wave of liquidations for $ZKJ longs.

Six traders were each liquidated for over $1M.https://t.co/MT0EgNW8ib pic.twitter.com/0Nw8VJG5ZQ

— Lookonchain (@lookonchain) June 15, 2025

At one point, liquidation volume hit $99m, more than 80% of the market total.

5/ In the past 4 hours alone, over $99M in liquidations occurred on $ZKJ — accounting for 81.3% of all crypto liquidations. pic.twitter.com/T827ZBrLnB

— Lookonchain (@lookonchain) June 15, 2025

«Инфлюенсеры и трейдеры активно продвигали ZKJ, называя его “идеальным стейблкоином” для накопления баллов Binance Alpha. Ажиотаж вокруг токена привлек спекулянтов, что сделало его удобной мишенью для злоупотреблений», — пояснил Abhi.

Shortly before the incident Binance announced the option to passively farm points by providing liquidity to PancakeSwap pools using “alpha tokens”. After the events, the leading crypto exchange scrapped the initiative, stressing that such trading volumes no longer count towards Alpha Points.

Abhi noted that in the chase for points the community missed several “red flags”:

- no clear business model or sustainable revenue;

- very low genuine community engagement;

- a lack of “transparent activity” in the ecosystem;

- growth “happened quietly and without explanation, driven mostly by artificial incentives.”

«Затем внезапно произошло скоординированное изъятие ликвидности и распродажа», — подчеркнул эксперт.

He observed that KOGE’s drop stemmed from similar causes:

- highly speculative activity to farm points;

- a lack of fundamentals “made the market vulnerable”;

- a large token unlock coincided with selling, triggering panic and a cascade of liquidations.

KOGE was also “tightly intertwined” with ZKJ via liquidity pools and trading pairs.

Hype wanes

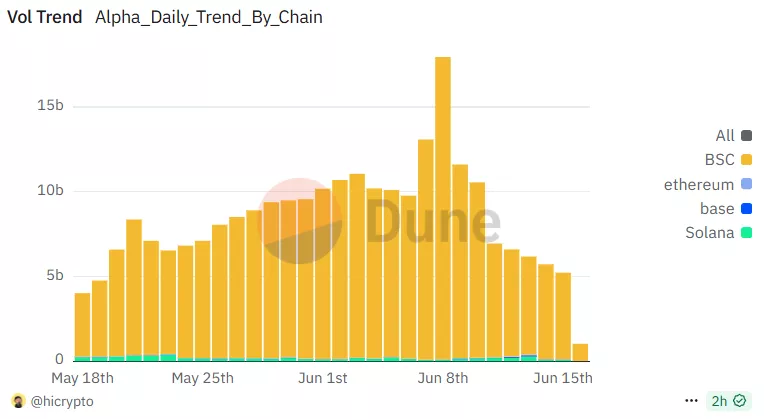

Thanks to gamified point mechanics, Binance Alpha’s daily turnover climbed steadily in early June, peaking above $17bn.

The lion’s share of trading is on BNB Chain. In early May, Binance Wallet developers cut fees by roughly tenfold, which may also have buoyed activity on the platform.

After the peak, trading volumes have been declining. One possible reason is the steadily rising point threshold for airdrops and TGEs, which likely “filtered out” a significant share of users and dampened their motivation.

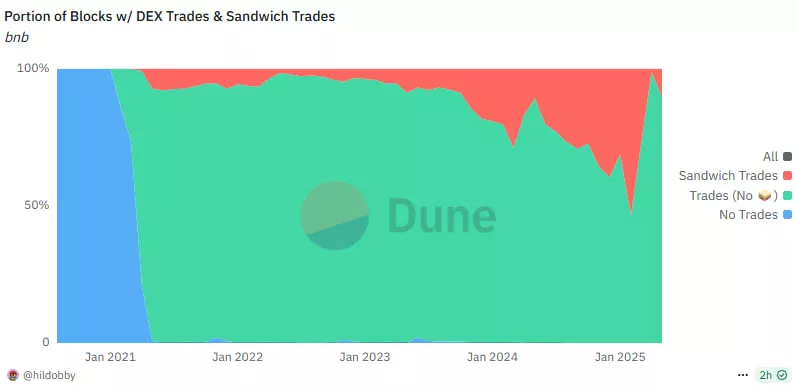

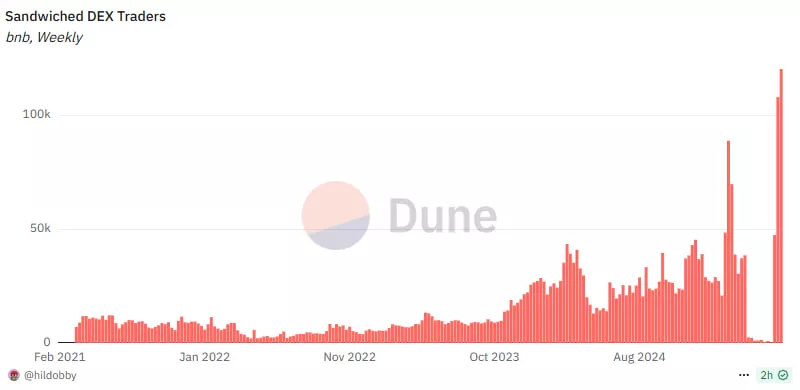

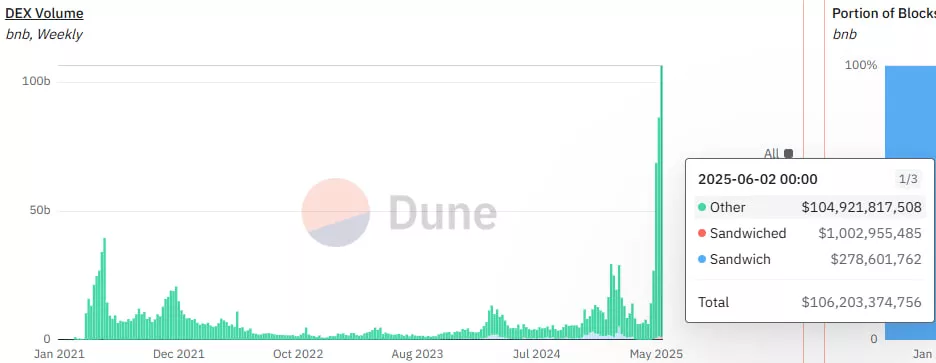

In addition, since mid-May BNB Chain has seen a sharp rise in sandwich attacks, according to the Dune dashboard by user hildobby.

More than 120,000 DEX traders have been affected by such MEV tactics — a record for the ecosystem.

Sandwich-related trading volume has topped $1bn for two consecutive weeks.

Response

Binance representatives “immediately identified significant fluctuations” in ZKJ and KOGE prices, acknowledging active whale participation.

Following the events, the leading crypto exchange scrapped the initiative to farm points by providing PancakeSwap liquidity, stressing that such trading volumes no longer count towards Alpha Points.

The Polyhedra team posted that the project’s fundamentals “remain strong” — both technologically and in terms of community engagement:

«Мы продолжаем развивать проект и движемся согласно плану. Сегодняшнее снижение цены связано с серией аномальных ончейн-транзакций в паре ZKJ/KOGE за короткий промежуток времени.

Наша команда внимательно изучает ситуацию и поделится дополнительной информацией в ближайшее время».

Dear Polyhedra community — we want to emphasize that the fundamentals of Polyhedra remain strong, both in our technology and in the incredible support from our community. We’re continuing to build and push forward as planned.

Today’s price drop was caused by a series of abnormal…— Polyhedra (@PolyhedraZK) June 15, 2025

The 48 Club team behind KOGE did not comment on the sudden drop — they only announced a trading competition.

Binance Alpha launched in December last year. The platform is designed to help users research and invest in early-stage crypto projects.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!