Ripple Ecosystem Introduces Institutional Product and Announces EVM Sidechain

Investment firm Guggenheim Treasury Services has launched digital commercial paper (DCP) on the XRP Ledger (XRPL), according to Bloomberg.

The product consists of tokenized notes issued by fintech startup Zeconomy, backed by U.S. Treasury bonds. It leverages XRPL’s advantages: 24/7 trading, rapid transaction execution, and low fees. As part of the partnership, Ripple is investing $10 million in Guggenheim’s DCP program.

The issuance of the notes is managed by Great Bridge Capital Co., a special purpose vehicle created by Guggenheim to protect investors from bankruptcy risks. Moody’s has awarded the product its highest rating for money market instruments — Prime-1.

The launch on XRPL marks an expansion for Guggenheim, which first introduced DCP on the Ethereum network in September 2024. Since then, approximately $20.5 million in notes have been issued on the blockchain.

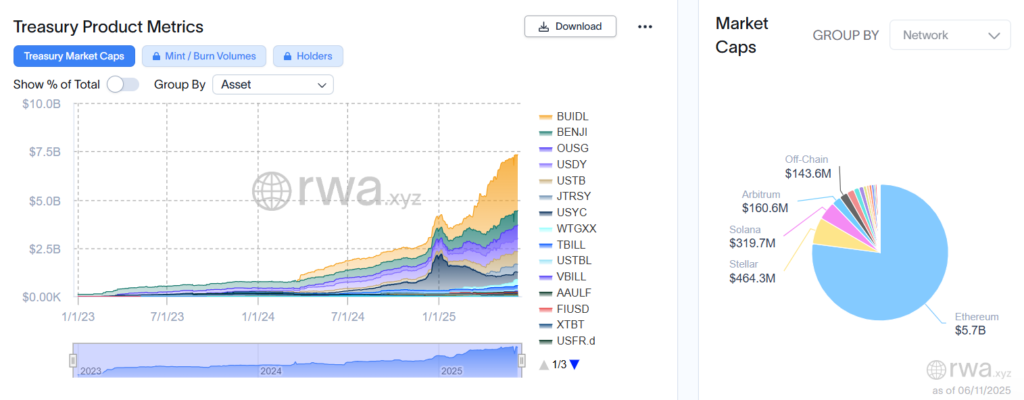

This move reflects the growing interest of institutional players in the RWA market. According to RWA.xyz, $7.24 billion is currently locked in tokenized U.S. Treasury obligations and bonds.

Sidechain Launch

To attract new projects and developers, XRPL will also enhance its technical capabilities. The network is set to launch a sidechain with EVM support in the second quarter of 2025.

The timeline for the sidechain launch was announced by Ripple’s CTO David Schwartz at the Apex 2025 event in Singapore. The information was confirmed by one of the project’s key developers, Peersyst.

? The one and only @JoelKatz and Ripple’s @jazzicoop announced the XRPL EVM is going live Q2 at Apex featuring some DeFi apps like @StrobeFinance @vertex_protocol, @SecurdLabs and @squidrouter building on it ?? pic.twitter.com/EPhz1JcdiA

— Peersyst Technology (@Peersyst) June 11, 2025

The new sidechain will combine XRPL’s low transaction costs with Ethereum’s smart contract functionality. Ripple and Peersyst are developing it using the evmOS software stack.

The sidechain will connect to the main XRP Ledger network via a cross-chain bridge. The Axelar protocol will be used as an exclusive solution to facilitate asset transfers, including wrapped XRP (wXRP), which will serve as the native token for gas payments.

Currently, the sidechain is operational in a test network. Its mainnet launch is expected following further testing and partnerships with validators.

Back in April, alternative asset management firm Teucrium Investment Advisors introduced the first XRP-ETF in the United States.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!