River: Major US Hedge Funds Embrace Bitcoin ETFs

By the end of the first quarter of 2024, 13 of the 25 largest hedge funds in the United States held bitcoin-based products, according to data from River.

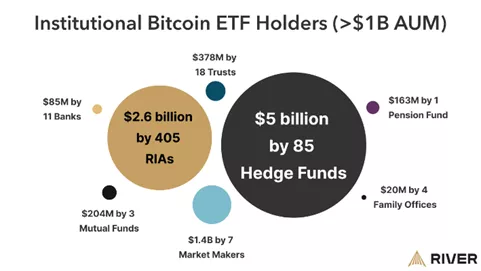

The study reveals that 534 organizations, ranging from hedge funds to pension and insurance companies with assets exceeding $1 billion, have invested part of their funds in BTC-ETFs.

Notably, 11 of the 25 largest registered investment advisors and hundreds of smaller firms have allocated resources to this instrument.

Among hedge funds, Millennium Management stands out, having acquired 27,263 BTC ($1.69 billion). This amount is equivalent to 2.5% of the organization’s total AUM of $67.7 billion.

Other significant players include Schonfeld Strategic Advisors (6,734 BTC) and Point72 Asset Management (1,089 BTC).

Some leading hedge funds, such as Bridgewater Associates, AQR Capital Management, and Balyasny Asset Management, have yet to invest in these instruments.

“With the advent of digital gold ETFs, institutions have run out of reasons to refuse ‘sound’ money,” concluded the experts.

Earlier, the Wisconsin State Investment Board reported investments in bitcoin products amounting to $163 million. By the end of 2023, it managed $156 billion.

Back in May, BlackRock’s head of digital assets, Robert Mitchnick, stated expectations of a new wave of inflows into spot BTC-ETFs driven by institutional participation.

In April, analysts at Bernstein predicted a similar trend.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!