Satoshi-Era Miners Cease Bitcoin Sales

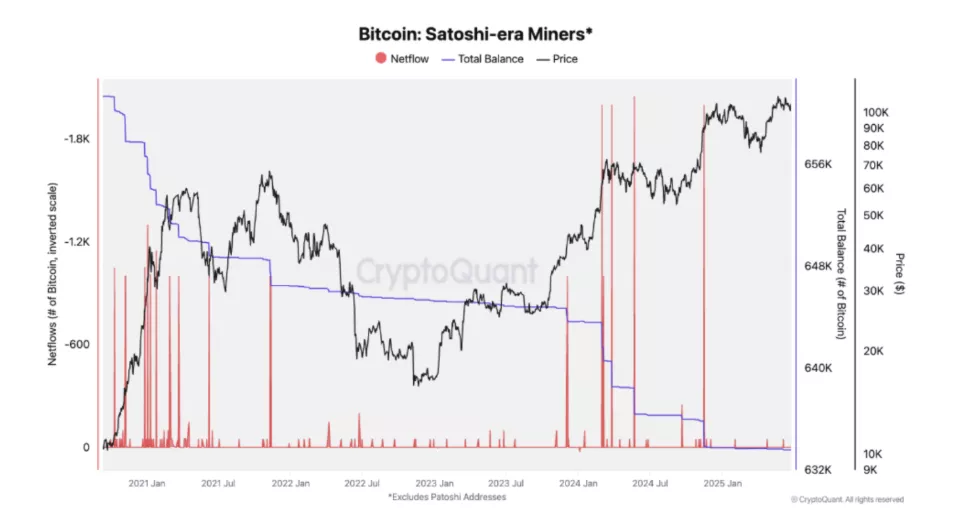

Miners of the first cryptocurrency have increased their reserves by 4000 BTC since April, despite declining revenues. Simultaneously, participants from the “Satoshi era” have shifted to accumulation, according to a report by CryptoQuant.

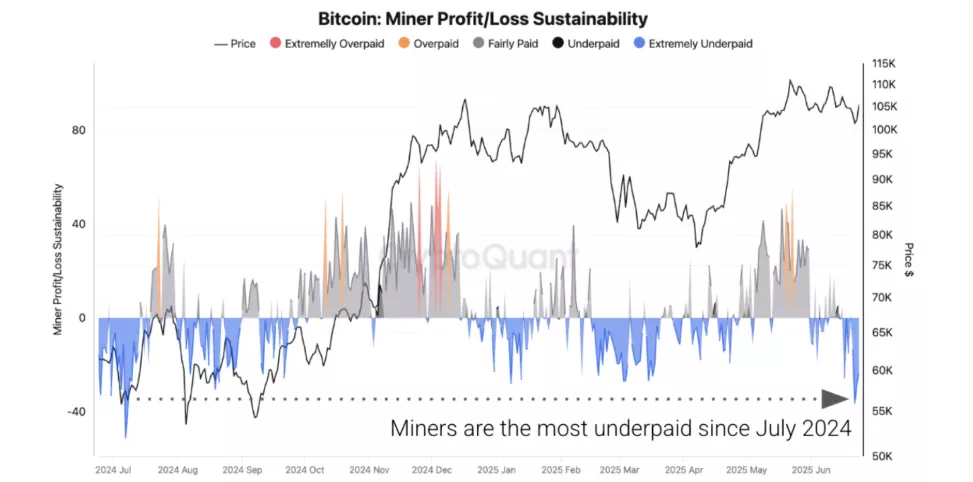

Analysts noted that miners’ daily revenue has fallen to $34 million — the lowest level since April 20, 2025. The reason is a decrease in transaction fees and the recent decline in Bitcoin’s price. Over the past 10 days, the network’s hash rate has decreased by 3.5%.

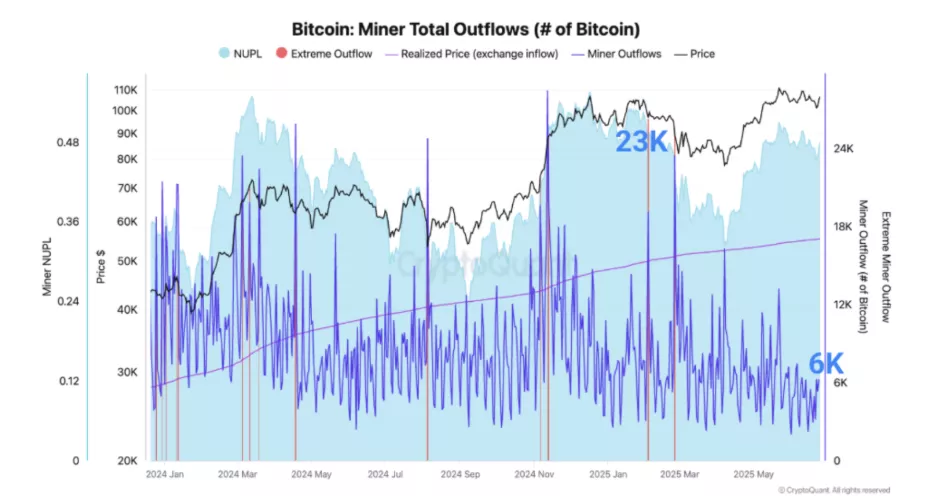

However, miners are in no hurry to sell digital gold. The outflow of coins from their wallets has dropped from a peak of 23,000 BTC per day in February 2025 to about 6,000 BTC. Direct transfers of bitcoins from miners to exchanges also remain low.

CryptoQuant suggested that the trend of asset retention among miners is linked to a high operating margin — around 48%.

Wallet owners with balances from 100 to 1000 BTC have increased their holdings by 4000 BTC since April. They now hold 65,000 BTC — the highest level since November last year.

Satoshi-era miners have minimized sales. In 2025, they sold only 150 BTC. By comparison, in 2024, the figure was nearly 10,000 BTC.

Historically, “old” miners sold coins after a strong price increase, “indicating a possible market peak.”

Since the beginning of June, miners of the first cryptocurrency have earned about $7 million from fees — just 0.97% of the total revenue of $722.8 million.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!