September 2021 in figures: Arbitrum rally, dYdX hype, and Lightning Network revival after El Salvador’s bitcoin legalization

Key

- Bitcoin failed to hold above $50,000, with the price correcting toward a strong support at $40,000.

- Since the London hard fork was activated on the Ethereum network, more than 400,000 ETH have been burned.

- Outflows of Ethereum from centralized platforms in favour of decentralized applications continue.

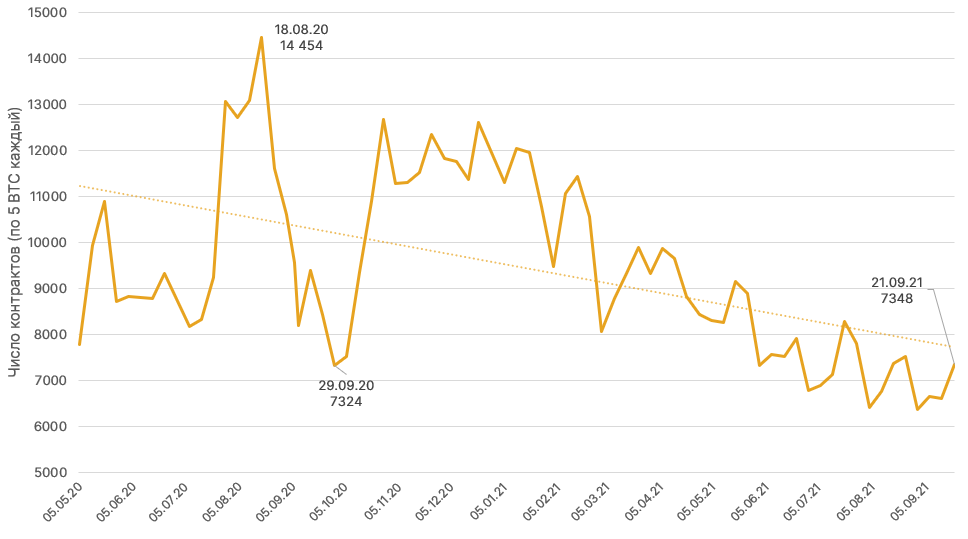

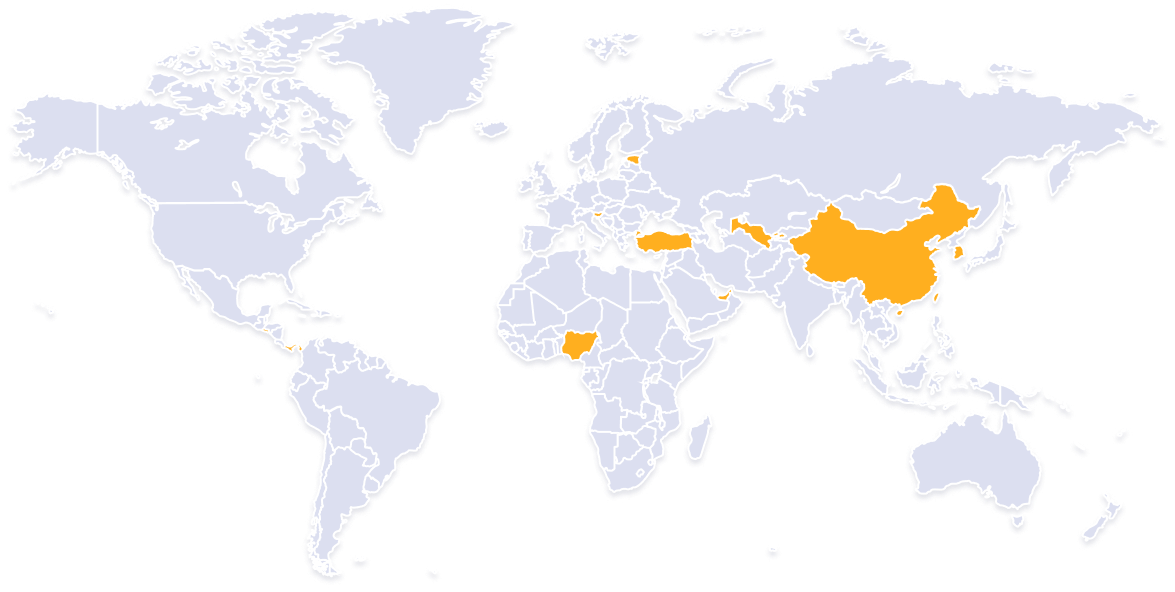

- The Lightning Network is gaining popularity amid Twitter’s donations integration and payments in El Salvador.

- Ethereum miners posted record revenues, with their share of fees exceeding 40%.

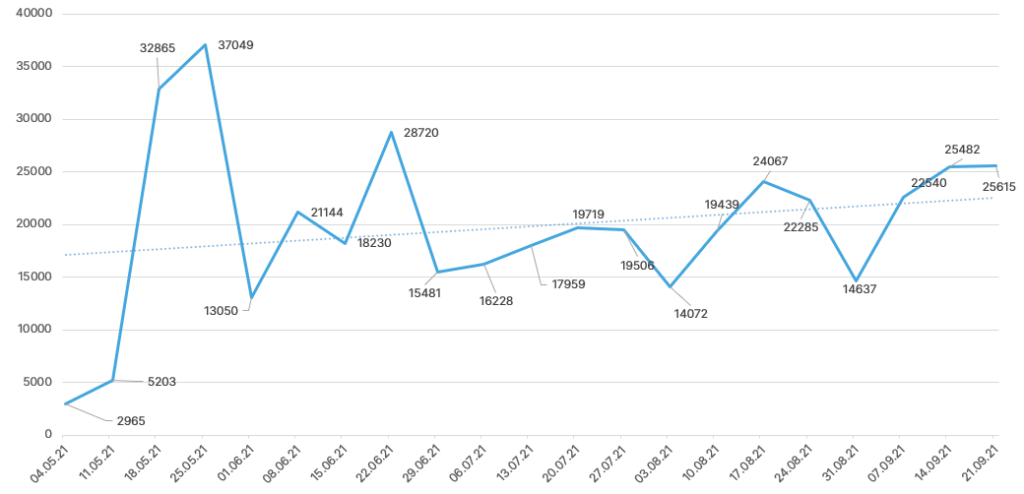

- In the DeFi space, Ethereum Layer-2 solutions such as Arbitrum are gaining traction.

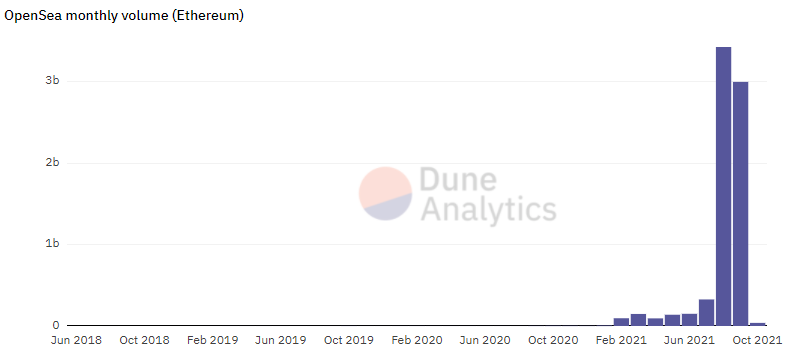

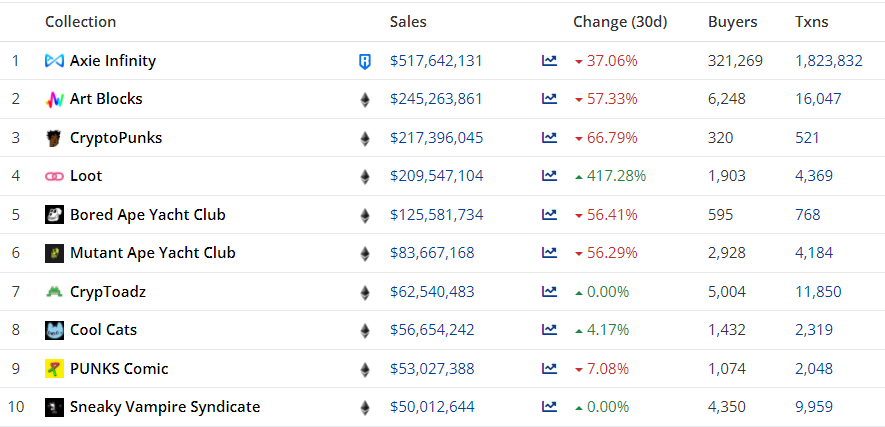

- GameFi tokens corrected, while NFT projects focused on infrastructure development with funding.

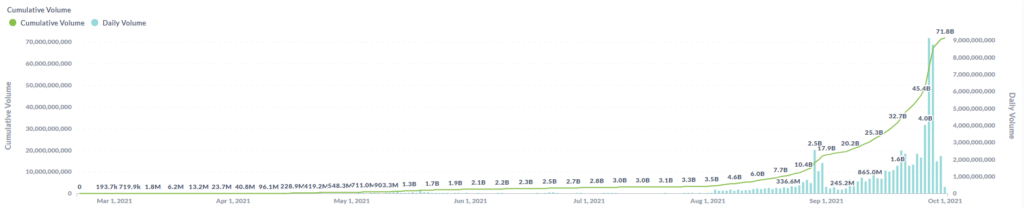

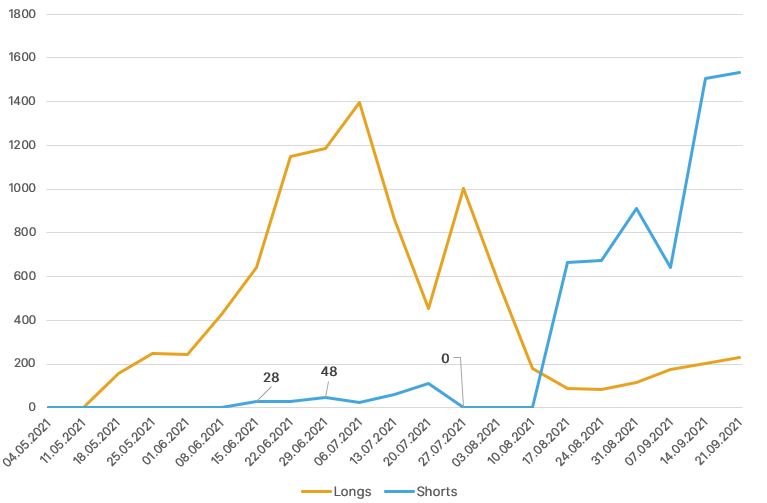

- The decentralised derivatives platform dYdX surpassed centralized exchanges in trading volume.

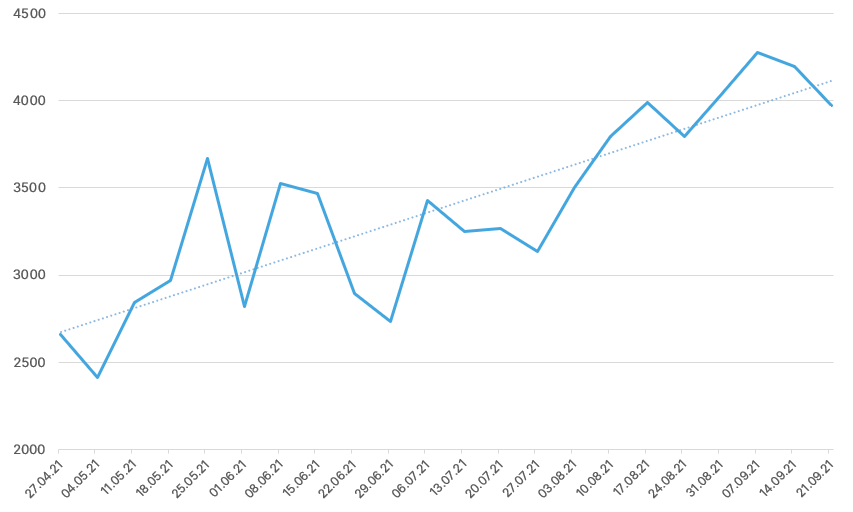

Leading assets dynamics

- In September, bitcoin prices moved in a downtrend. Starting the month around $47,000, the price briefly hit a local high near $53,000, then retraced to below $40,000.

- The psychological level of $40,000, once a resistance, became support.

- For the month, the price fell by 7%.

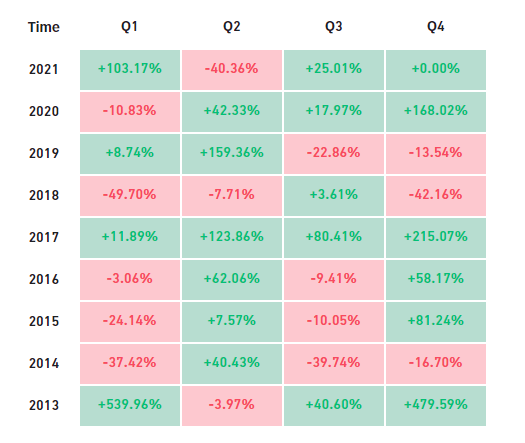

Despite a negative September, in the third quarter Bitcoin rose by 25%. The year-end for the asset historically holds potential for upbeat momentum.

- Ethereum in September closely tracked Bitcoin.

- Starting the month at $3,430, the price briefly set a local high above $4,000, then corrected to around $2,650.

- For the month, Ether fell 12.5%. The quarter for Ethereum ended with a 36% gain.

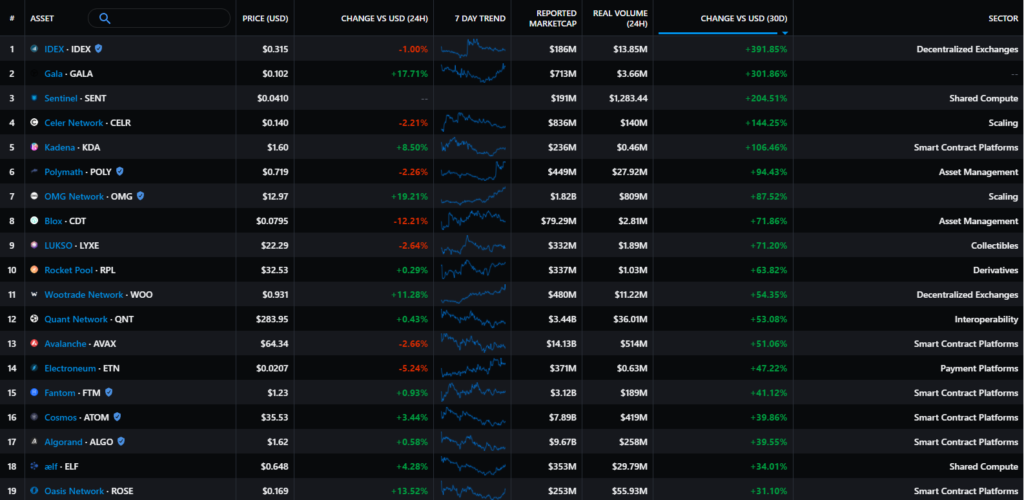

- In September, the best momentum was demonstrated by tokens from decentralised exchanges, smart-contract platforms and scaling solutions.

- Among mid-cap projects, the IDEX token stood out, alongside Gala, a project recently listed on Binance. Avalanche hit a new high and approached the top 10.

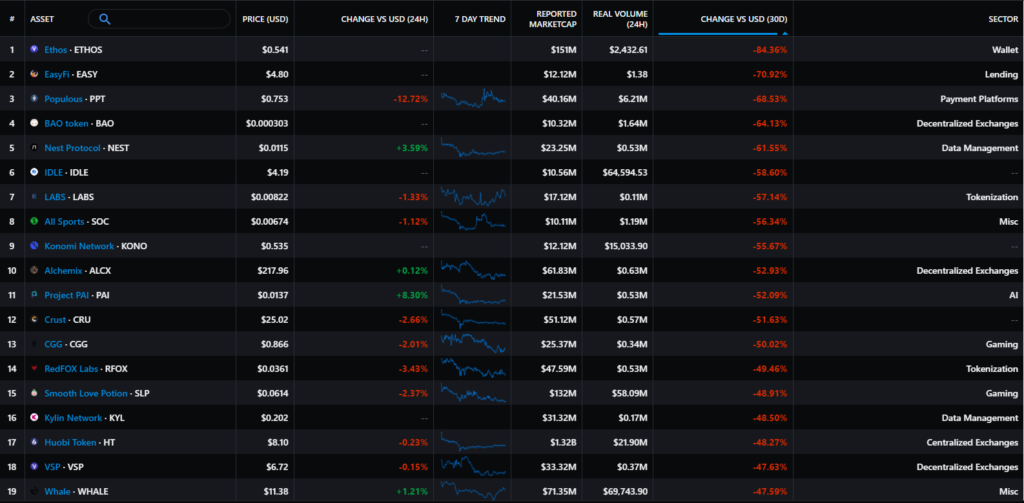

- Among mid-cap losers were Huobi’s native HT token and the Smooth Love Potion (SLP) token from the Axie Infinity blockchain game.

Related crypto-currency listed equities

MicroStrategy (MSTR): -17.3%

Coinbase (COIN): -12.6%

Galaxy Digital (GLXY): -2.6%

Performance of mining-related stocks

Canaan (CAN): -35.5%

Ebang International (EBON): -24.9%

Riot Blockchain (RIOT): -31.3%

Hut 8 (HUT): +4.8%

Marathon Digital (MARA): -23%

Stocks tied to crypto and mining posted negative momentum in September due to a close correlation with Bitcoin. Hut 8 was the exception.

Macroeconomic backdrop

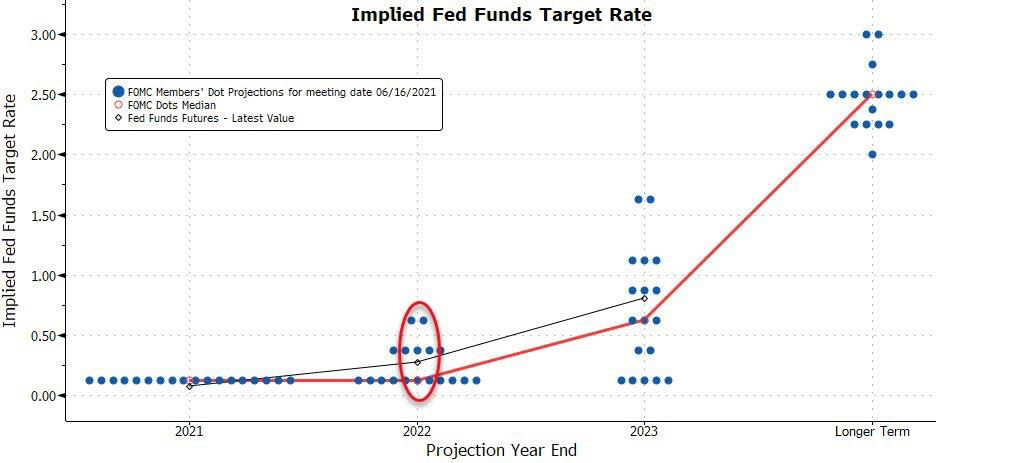

- Following the September 22 FOMC meeting, members presented new projections for key macroeconomic parameters.

- The median projection for the federal funds rate at the end of 2023 stood at 1%, with 2024 expected at just 1.8%;

- Votes for and against the first rate hike in 2022 were evenly split.

- Previous June projections had anticipated the first increase in the key rate in 2023.

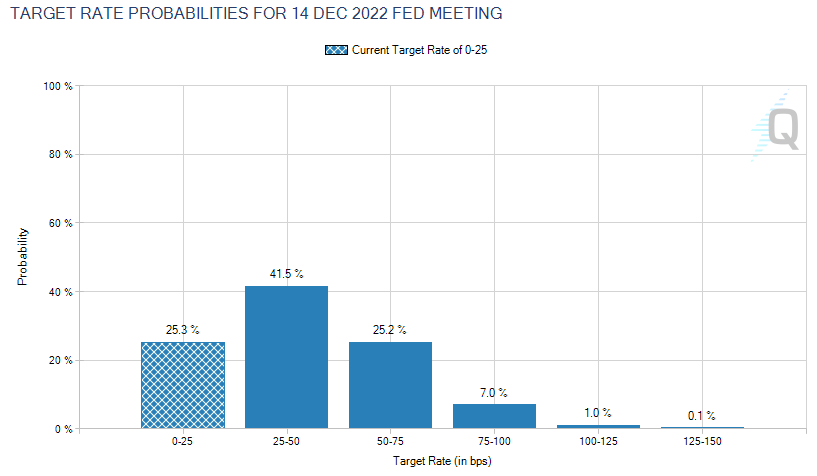

- Futures market priced in more than 75% probability of a first rate hike by the Fed in December 2022. Investors assign a one-in-three chance that the Fed will hike twice by then.

- Before the meeting, the probability of the first hike was around 55%.

- Surges in energy prices due to supply issues boosted inflation expectations and led to a jump in long-term US government bond yields.

- Fed Chair Jerome Powell said that conditions are in place to begin tapering emergency stimulus. The market consensus foresees ending QE at $120bn per month between November 2021 and June 2022.

- The start of the Fed’s return to normal monetary conditions could stress financial markets. Under pressure, cryptoassets could come under pressure if they move in line with risk assets, as seen in March 2020.

Market mood, correlations and volatility

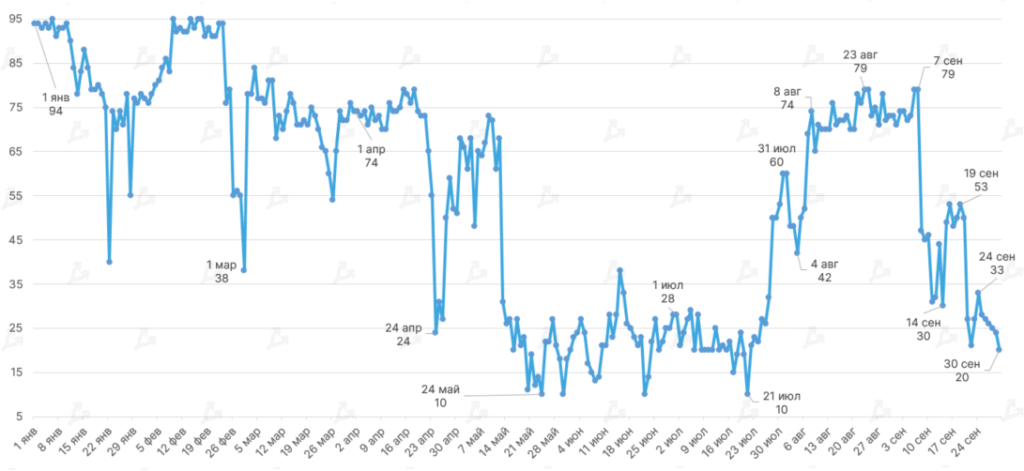

- Unlike August, September saw bearish sentiment dominate — as evidenced by the fear-and-greed index. It started the month at 30, rebounded briefly, but soon slid back into the “fear” zone, signalling rising investor pessimism. By September 30 it stood at 20. The September average was 45.3 (August 68.4); the low was 20, with the most frequent reading at 27.

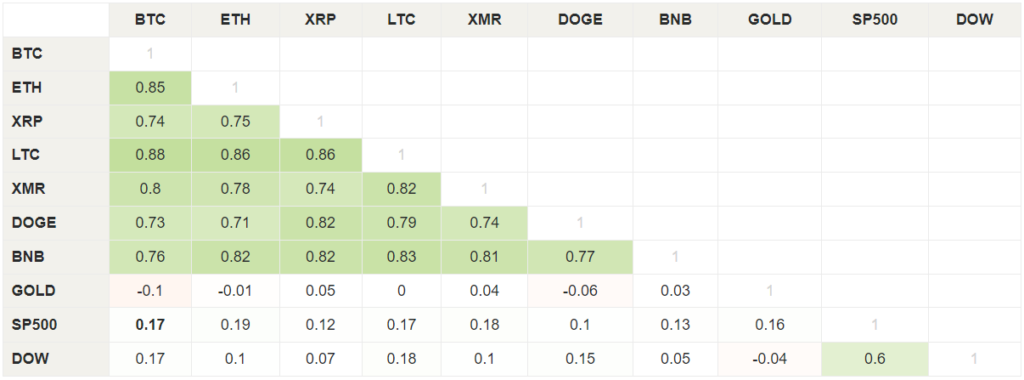

- The price movement of Bitcoin and gold remained diverging, but the negative statistical correlation between the two assets eased for the second consecutive month (-0.1 vs -0.21 in August).

- In September Bitcoin correlated with the S&P 500 and Dow Jones at 0.17, on par with each other.

- This linkage to traditional indices suggests Bitcoin’s sensitivity to the state of the equity market.

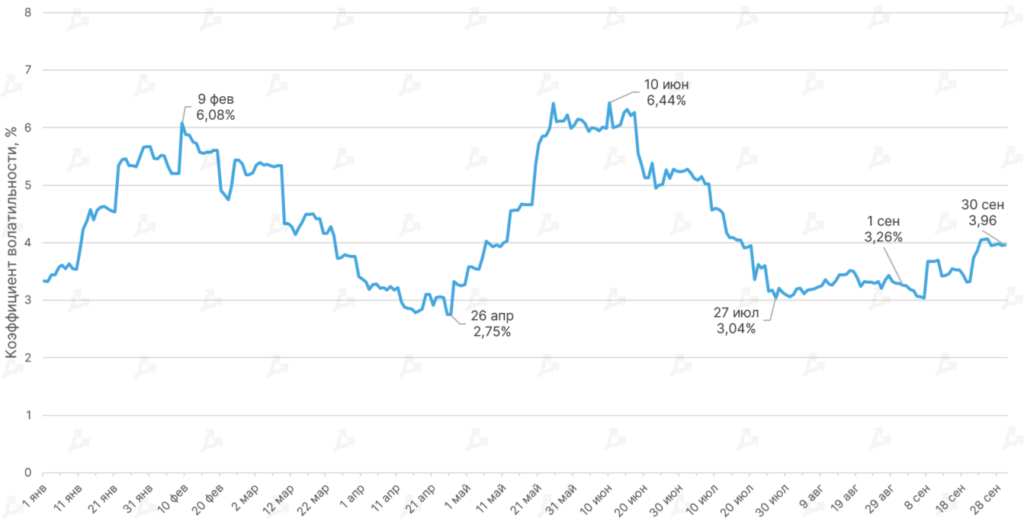

In September, Bitcoin’s historical volatility coefficient ranged from 3.26% to 3.96% as the month ended with a rising trend. Price volatility was notably lower than during prior bull runs.

On-chain data

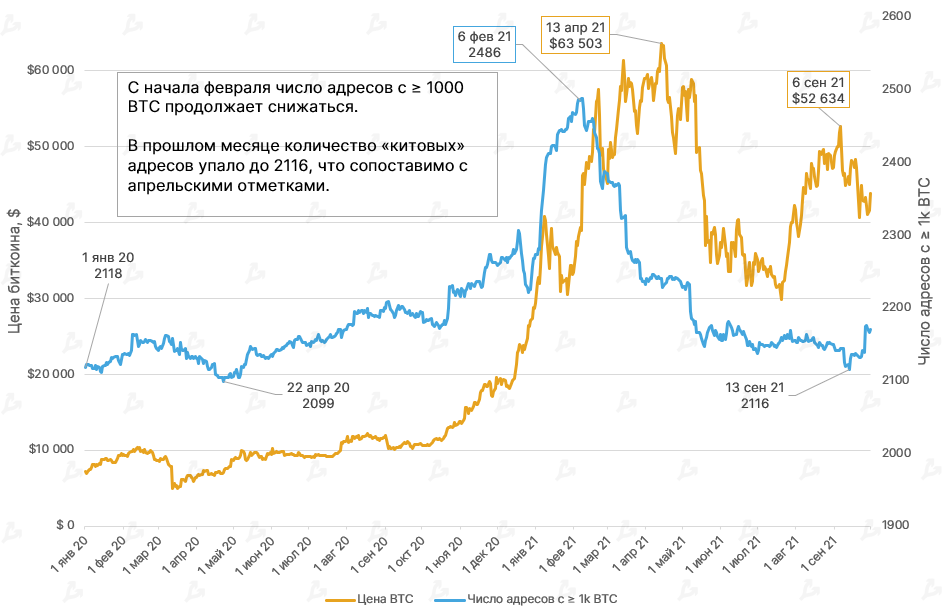

- The number of addresses containing more than 1000 BTC continues to decline after peaking on February 6 at 2,486.

- After a local low on September 13 at 2,116, the metric began to recover. Large players may have used the China-news-driven correction to move BTC to hodlers.

- The current value of 2,171 is 12.6% below the February peak.

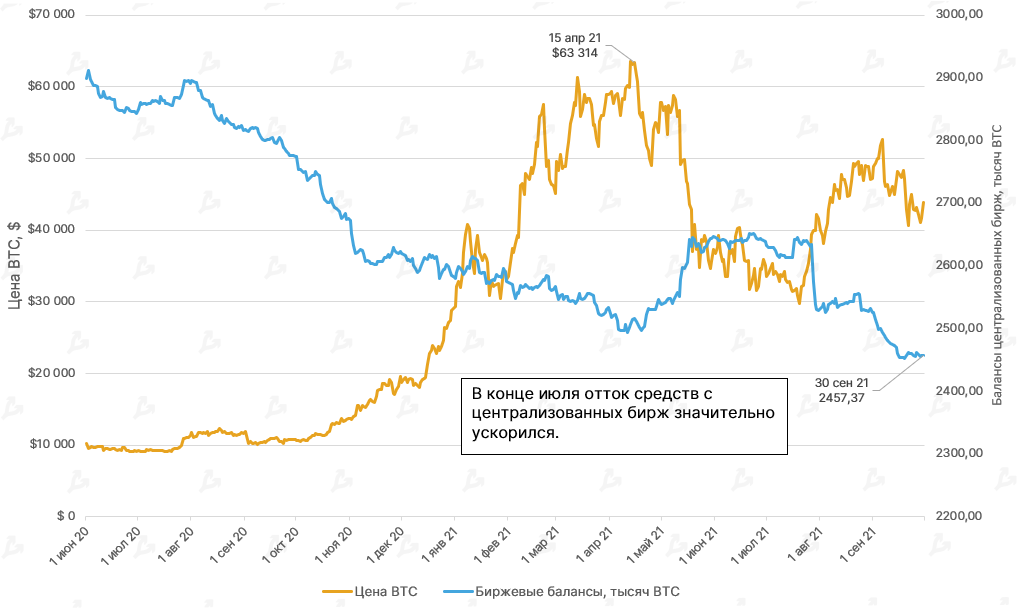

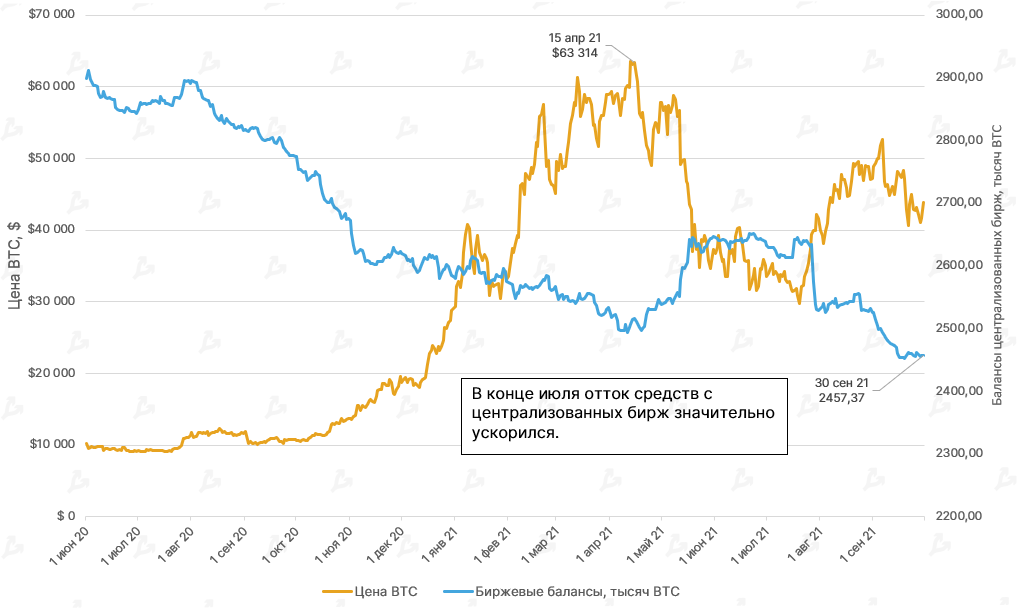

- Bitcoin supply on centralized exchanges fell to levels seen in August 2018.

- Outflows from custodial platforms accelerated over recent months — since July 26, the figure fell by 174,000 BTC (-6.6%).

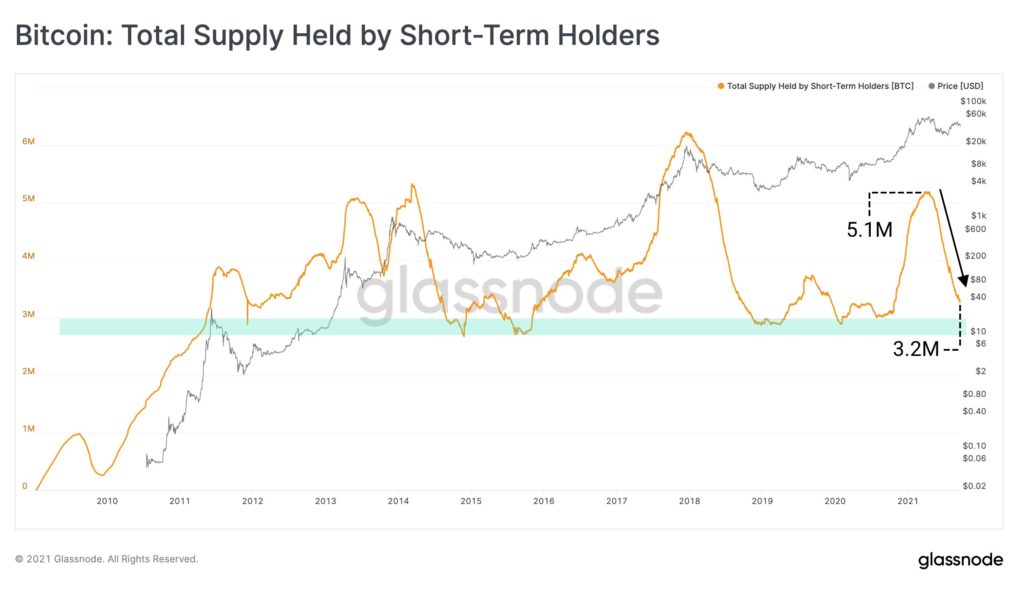

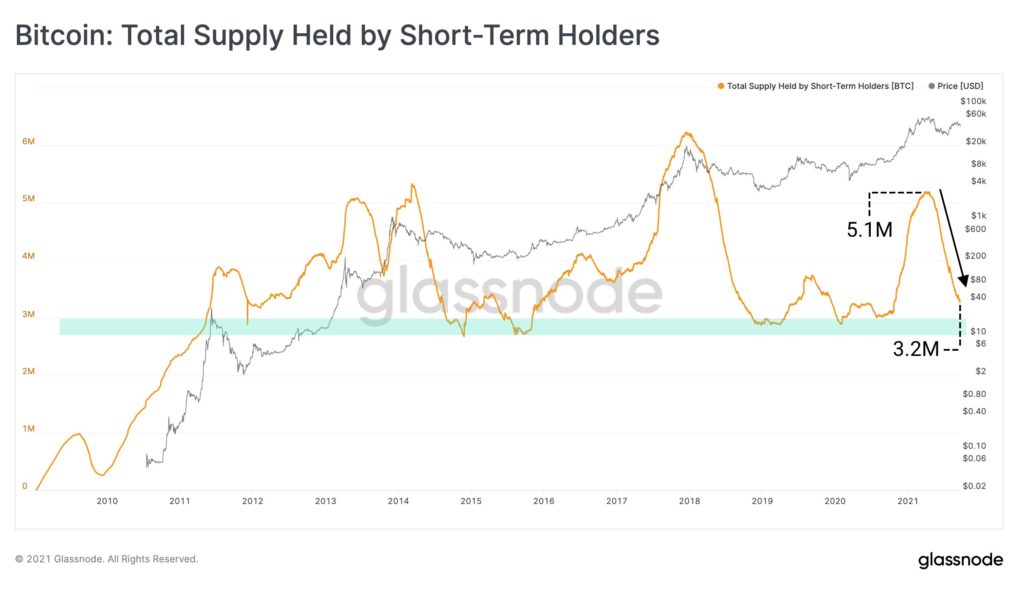

- According to co‑founder of Glassnode Rafael Schultze-Kraff, after Bitcoin price peaked near $65,000, almost 2 million BTC moved from short-term holders to hodlers.

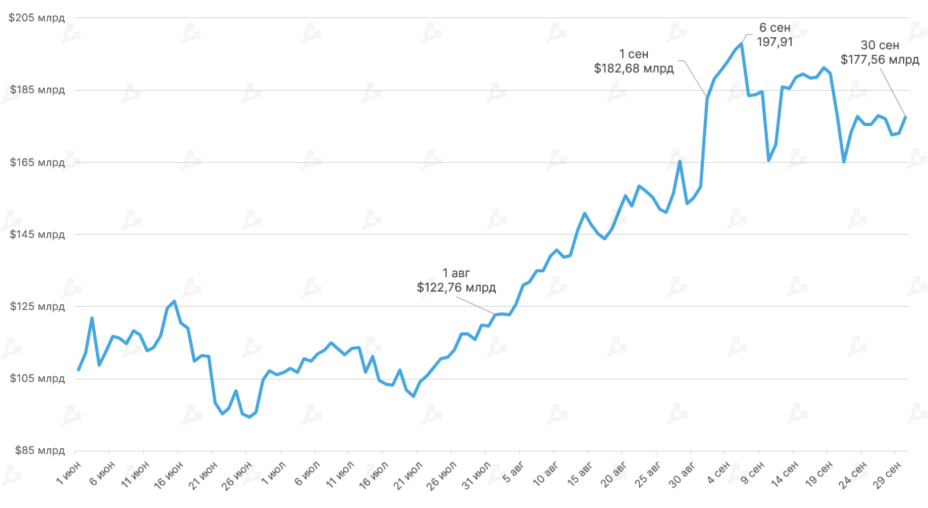

- TVL in DeFi rose slightly versus the prior month; viewing a 30-day window, it fell about 3%.

- Curve Finance led TVL at $14.14 billion, ahead of lending protocol Aave at $13.55 billion.

- Compared to the previous month, September’s TVL in DeFi rose slightly; looking at a 30-day window, it fell by about 3%.

- Curve Finance led TVL at $14.14 billion; its closest competitor, Aave, stood at $13.55 billion.

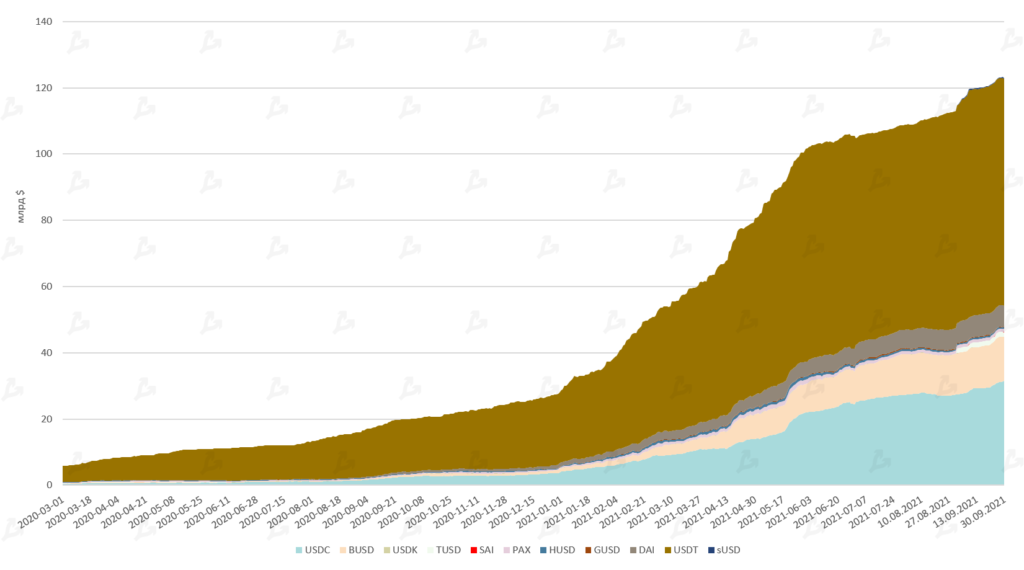

- Ethereum continues to dominate DeFi. Its share rose by nearly $10 billion over the month. Worth more than $120 billion is locked in Ethereum-based apps and wrapped assets — accounting for over 70% of total TVL.

- With Avalanche Foundation launching a DeFi development fund and a private token sale of $230 million, TVL across Avalanche’s native chain surged by 76% to $3.84 billion.

- Solana soared 185% as it overtook Dogecoin and Polkadot by market cap in early September. The surge is attributed to rapid NFT and DeFi growth on Solana.

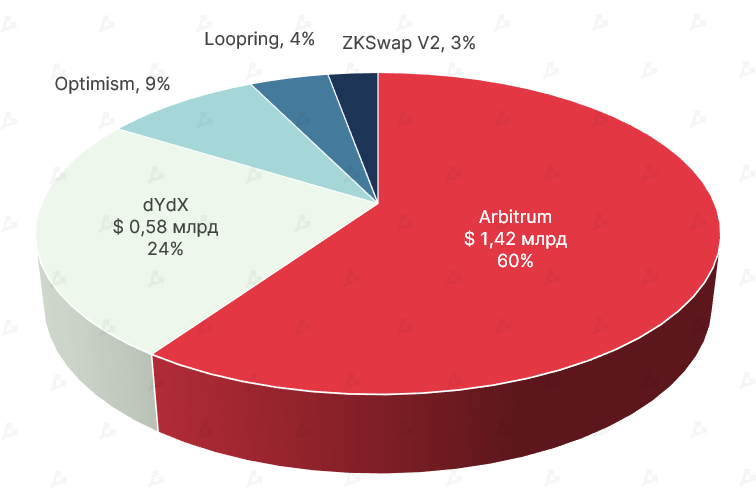

- In the second-layer (L2) space, Arbitrum leads with a TVL of $1.42 billion, well ahead of dYdX, Optimism and others; it commands about 60% of the market.

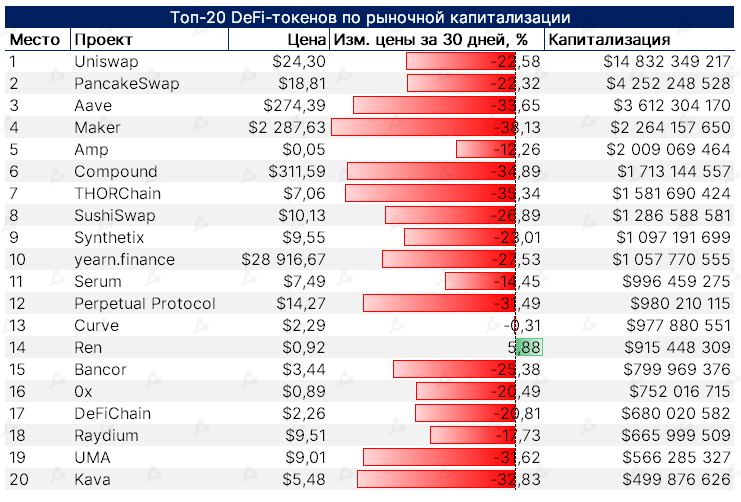

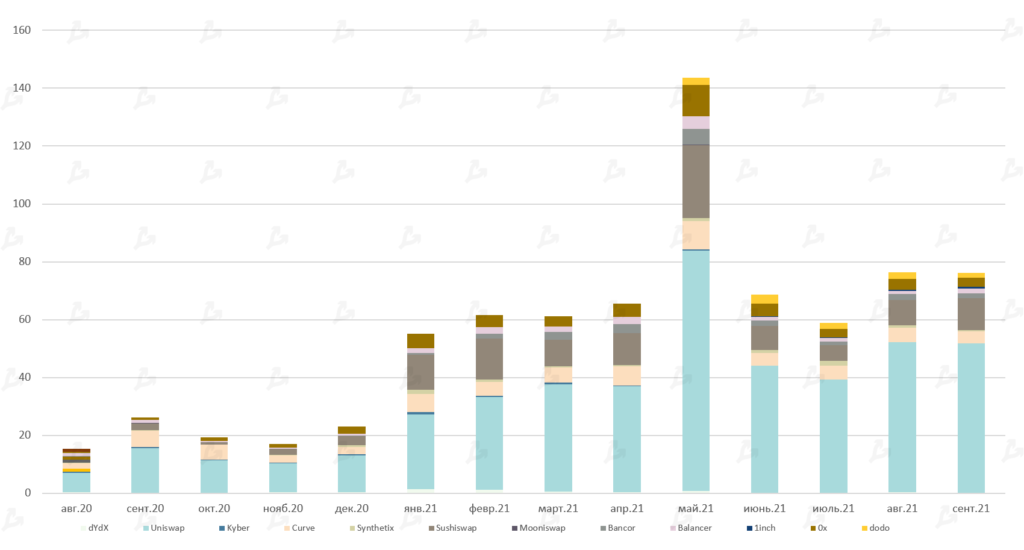

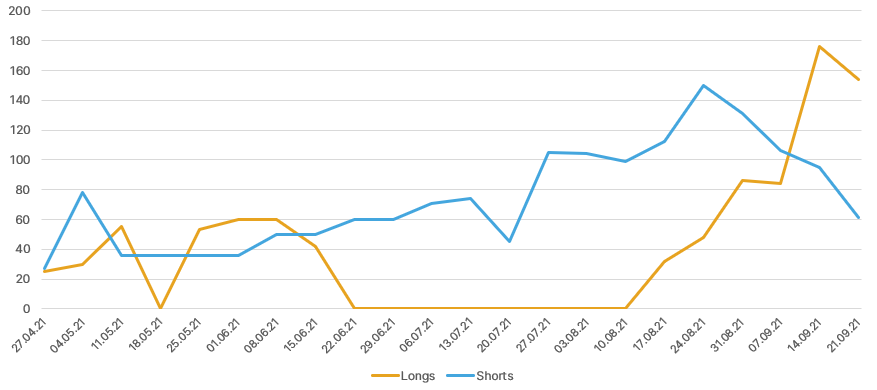

DEX

- In September, decentralized exchanges saw $76 billion in volume.

- Unchanged leaders on the spot market were Uniswap ($51.6bn), SushiSwap ($11bn) and Curve ($4bn).

“This is a completely different era. It is not worth comparing the situation to a bubble. In 2017 the bubble swelled and burst, but over the next three years people built the industry.”Anatoly YakovenkoSOL founder

“This is a completely different era. It is not worth comparing the situation to a bubble. In 2017 the bubble swelled and burst, but over the next three years people built the industry.”Anatoly YakovenkoSOL founder “In the coming years many countries will start to use cryptocurrency as part of monetary policy, either as part of reserves or for settlements with monetary regulators of other countries, or simply, as El Salvador did, make it a national currency.”Charles HoskinsonCo-founder of Cardano

“In the coming years many countries will start to use cryptocurrency as part of monetary policy, either as part of reserves or for settlements with monetary regulators of other countries, or simply, as El Salvador did, make it a national currency.”Charles HoskinsonCo-founder of Cardano “I think, ultimately, if Bitcoin does really succeed, regulators will kill it or try to. And I think they will, because there are opportunities.”Ray DalioFounder of Bridgewater Associates

“I think, ultimately, if Bitcoin does really succeed, regulators will kill it or try to. And I think they will, because there are opportunities.”Ray DalioFounder of Bridgewater Associates “Stablecoins work like chips in a Wild West casino.”Gary GenslerChair, SEC

“Stablecoins work like chips in a Wild West casino.”Gary GenslerChair, SEC