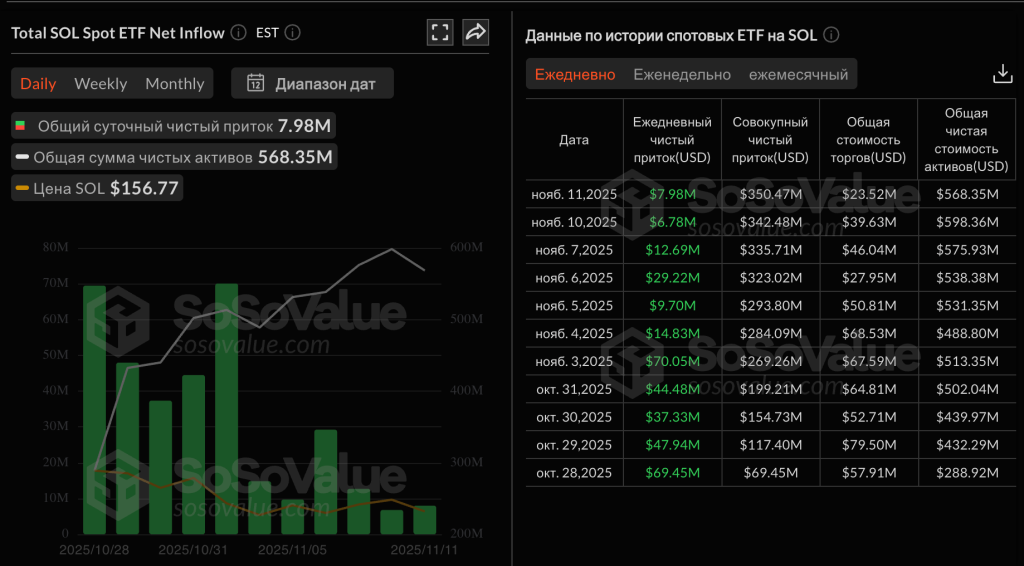

Solana ETFs Attract Over $350 Million in 11 Days

Solana ETFs attracted $7.9M on Nov 11, marking 11 days of inflows.

As of the trading session on November 11, spot exchange-traded funds based on Solana attracted $7.9 million. This marks the 11th consecutive day of positive inflows.

The majority of the inflows were directed towards GSOL from Grayscale, amounting to $5.9 million, while BSOL from Bitwise accounted for $2 million.

The total trading volume reached $23 million.

Since the launch of these instruments in late October, investors have poured $350.4 million into them. The funds manage assets worth $568.3 million, representing 0.6% of Solana’s total supply.

Unexpected Results

Nick Rook, Director of LVRG Research, told The Block that the steady inflow into spot ETFs based on the altcoin was a surprise to the market. The results significantly exceeded initial conservative forecasts.

He noted that many experts were initially skeptical about the potential institutional demand for the instrument.

Rook emphasized that investors view Solana exchange-traded funds as a high-yield addition to positions in Bitcoin and Ethereum. These market participants consciously accept increased volatility, hoping for higher returns.

“In the long run, sustained inflows into ETFs should provide long-term support for the SOL price by tightening supply dynamics and attracting institutional capital,” the expert added.

So far, the positive dynamics of the instruments have not significantly impacted the altcoin’s price. At the time of writing, the asset is trading around $156, having decreased by 5% over the past day.

Senior analyst at etf.com, Sumit Roy, stated that the inflows into spot Solana ETFs appear “logical,” given the coin’s market capitalization of $90 billion.

“The coin has a dedicated community of supporters, possibly the strongest after Bitcoin and Ethereum,” he noted in a conversation with Decrypt.

In his view, the appeal was also enhanced by the staking feature included in the instruments. Roy suggested that Solana-based exchange-traded funds could accumulate at least 5% of the asset’s market value.

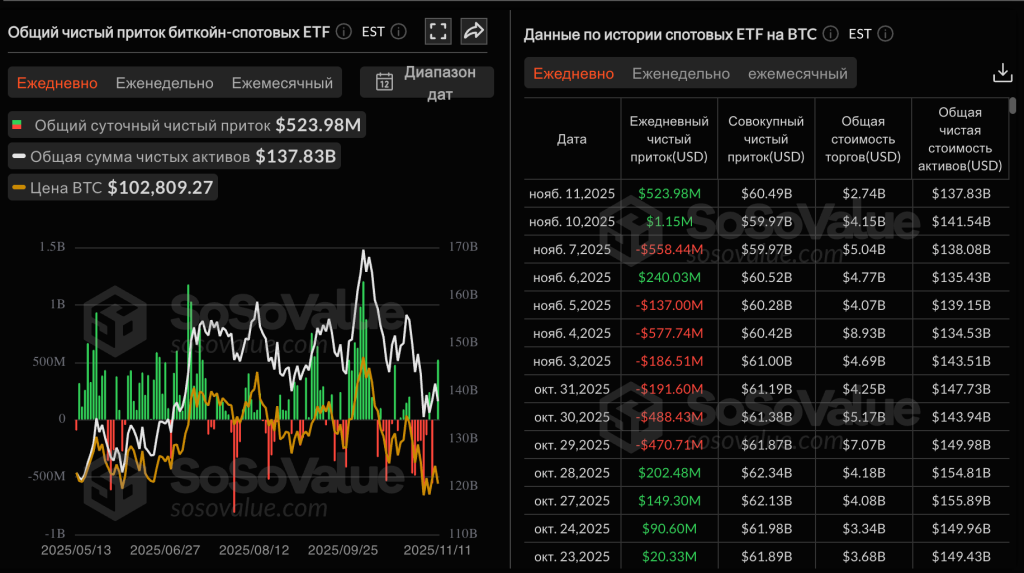

Bitcoin and Ethereum ETFs

Instruments based on the first cryptocurrency attracted $523 million, bringing the total net inflow to $60.4 billion.

The largest share went to IBIT from BlackRock — $224 million. FBTC from Fidelity and ARKB from Ark & 21Shares received $165 million and $102 million, respectively.

Bitcoin ETFs currently manage assets worth $137.8 billion, representing 6.6% of the total issuance of digital gold.

Exchange-traded funds based on Ethereum recorded an outflow of $107 million. ETH from Grayscale lost $75 million, while ETHA from BlackRock saw a $19 million outflow.

Earlier in November, the American provider of post-trade, clearing, and settlement services in the financial market, DTCC, added five spot ETFs based on XRP to its list.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!