Solana tops $200

Over the past 24 hours Solana has jumped 12.6%, despite potential profit-taking by large holders. Analysts at Lookonchain reported that three whales transferred more than 226,000 SOL to exchanges, worth about $40 million.

Solana rose above $200 for the first time since July.

Whales seem to be selling $SOL.

CMJiHu deposited 96,996 $SOL($17.45M) to exchanges 9 hours ago.

5PjMxa deposited 91,890 $SOL($15.98M) to #Kraken 3 hours ago.

HiN7sS deposited 37,658 $SOL($6.73M) to #Binance 8 hours ago for a profit of $1.63M.https://t.co/SjYyx112xa… pic.twitter.com/6A22shhpe8

— Lookonchain (@lookonchain) August 12, 2025

According to the analysts, the wallet CMJiHu sent 96,996 SOL ($17.45 million), 5PjMxa moved 91,890 SOL ($15.98 million) to Kraken, and HiN7sS deposited 37,658 SOL ($6.73 million) to Binance. The latter locked in a $1.63 million profit.

Even so, Solana has held above $190, signalling strong demand from other market participants. At the time of writing the altcoin traded at $196.42, with a market capitalisation of $106.1 billion.

Solana is now 33% below its all-time high of $293.31. According to CoinGecko, that level was recorded on January 19.

Why Solana is rising

Hong Kong-regulated exchange OSL HK has received approval to open Solana trading to retail investors. From August 11 the SOL/HKD and SOL/USD pairs are available in Flash Trade mode. From August 19 Pro Trade will open with the SOL/USD pair.

Almost simultaneously, the DigiFT project and asset manager CMBI introduced a tokenised version of a money-market fund recognised by regulators in Hong Kong and Singapore. It operates, among others, on the blockchain of the sixth-largest cryptocurrency by market capitalisation.

Another positive factor was the news that Blue Origin, founded by Jeff Bezos, started accepting digital assets for space flights. In addition to bitcoin, Ethereum, USDT and USDC, the firm added support for Solana.

Public companies are also continuing to accumulate SOL. On August 12 DeFi Development Corp. (DDC) reported holding 1.3 million SOL worth about $250 million. In the first two weeks of the month the company bought 4,500 coins.

July? Our most transformative month, hands down. 🚀

We accelerated $SOL accumulation, raised fresh capital, & issued our first SPS guidance — all while Solana extended its dominance across EVERY major metric.

All that and more in our latest recap. 👇https://t.co/bwqfY9ZFBm

— DeFi Dev Corp. (DFDV) (@defidevcorp) August 4, 2025

DDC uses a model akin to Michael Saylor’s strategy. The company’s primary income, however, comes from staking SOL. With a 10% annual yield, it earns about $63,000 a day.

Upexi remains the largest corporate holder of Solana. Earlier the company stated that in July it increased reserves from 735,692 SOL to more than 2 million SOL.

Meanwhile, the exchange Coinbase has revived its Stablecoin Bootstrap Fund to distribute liquidity across DeFi protocols. The fund has already announced financing for two Solana-based projects, indirectly supporting its ecosystem:

- Kamino, which offers lending against SOL collateral;

- Jupiter — one of the largest DEX aggregators.

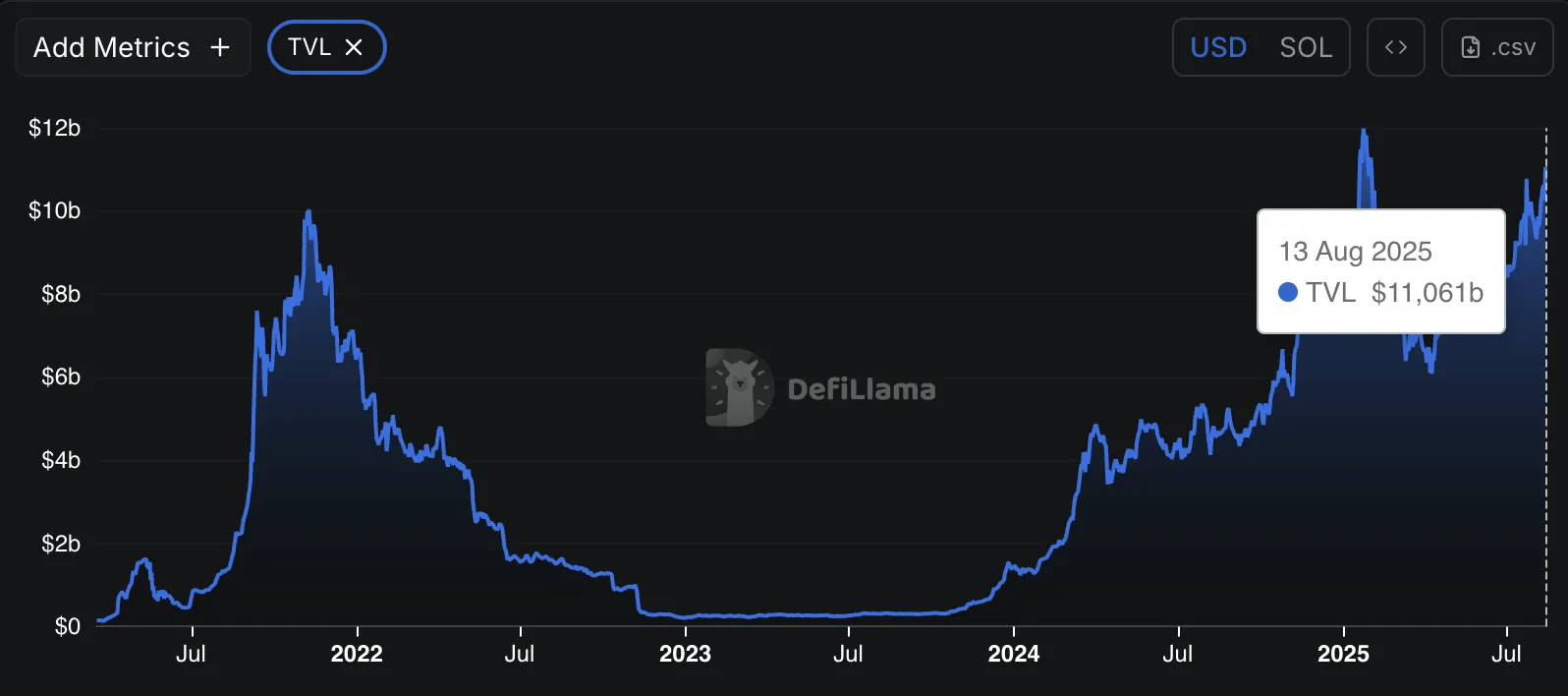

At the time of writing, TVL in Solana-based decentralised protocols exceeds $11 billion. Over the past day the metric has risen by 7.8%.

In July, trading volumes in Solana futures on CME rose by 252%.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!