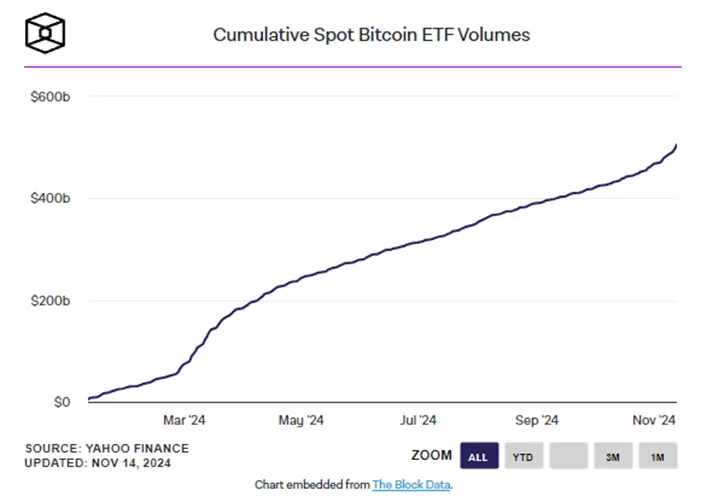

Spot Bitcoin ETFs Surpass $500 Billion in Trading Volume

Since the approval of spot Bitcoin ETFs in January, their trading volume reached $505.4 billion by November 13, according to The Block.

The $100 billion mark was surpassed by March and $200 billion by April, when Bitcoin reached its ATH of $74,000 for the first time this year.

Subsequently, the growth trajectory slowed somewhat as the price consolidated between $50,000 and $70,000 over the next seven months.

Activity picked up again after reaching new all-time highs following the election victory of cryptocurrency advocate Donald Trump in the United States.

Increased interest in BlackRock’s IBIT accelerated the milestone of $500 billion. On November 13, the product’s trading volume hit a new record of $5.37 billion.

“IBIT’s trading volume reached $5 billion for the first time ever. Only three ETFs and eight stocks were more active today. Up to $13 billion over three days this week. Its peers are also seeing increased volume, but on a smaller scale. FBTC achieved $1 billion, the highest since March,” commented Bloomberg analyst Eric Balchunas.

I thought things were cooling off, but no, $IBIT just saw $5b in volume today for first time ever. Only 3 ETFs and 8 stocks saw more action today. Up to $13b in 3 days this week. Its peers seeing heightened volume too but smaller scale. $FBTC did $1b, biggest day since March. pic.twitter.com/9SQP5oPsMM

— Eric Balchunas (@EricBalchunas) November 13, 2024

Total turnover across all instruments on November 13 reached $8.07 billion — the fourth-largest result since launch and the highest since the previous peak in March.

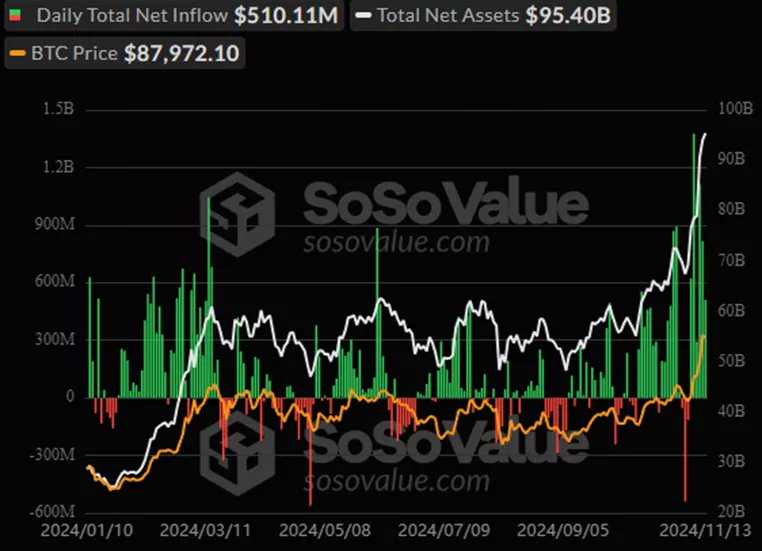

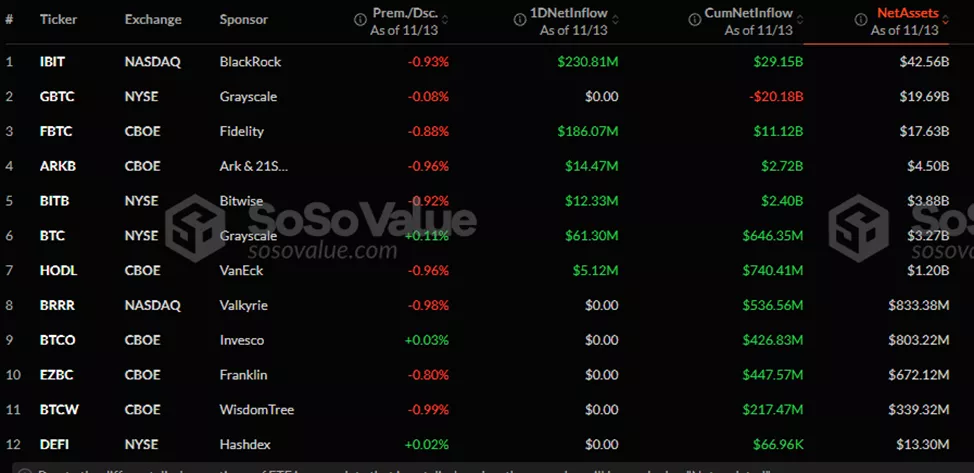

Inflows amounted to $510.11 million, with $230.9 million attributed to IBIT and $186.1 million to Fidelity’s FBTC.

Cumulative inflows since the approval of BTC-ETFs in January have increased to $28.2 billion, including $4.7 billion following Trump’s victory.

The AUM of the products rose to $95.4 billion, with IBIT accounting for $42.6 billion.

“IBIT surpassed the $40 billion mark (just two weeks after reaching $30 billion) in a record 211 days. The fund broke the previous record of 1,253 days held by IEMG. It is now in the top 1% of all ETFs by assets, and at 10 months old, it is larger than all 2,800 ETFs launched in the past ten years,” calculated Balchunas.

JUGGERNAUT: $IBIT has hit the $40b asset mark (a mere two wks after hitting $30b) in a record 211 days, annihilating prev record of 1,253 days held by $IEMG. It’s now in Top 1% of all ETFs by assets and at 10mo old it is bigger than all 2,800 ETFs launched in the past TEN years. pic.twitter.com/WTATlpShUq

— Eric Balchunas (@EricBalchunas) November 13, 2024

Daniel Chung, co-founder of Syncracy Capital, has predicted the launch of a SOL-ETF in the first quarter of 2025 following Donald Trump’s victory in the U.S. presidential election.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!